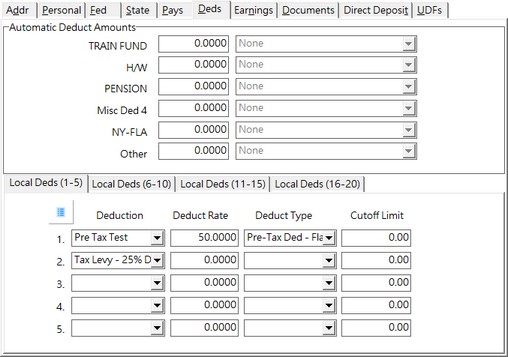

The Automatic Deduction Amounts section of this tab displays the six deduction categories that have been defined on the Misc Pays / Ded Tab of the Payroll Properties Screen. These six categories can be used in conjunction with up to twenty Local Deduction Codes for each employee. Although originally designed for setting up various local payroll tax rates, the local deduction codes are now the preferred method of setting up most deductions because the local deductions offer more set up options including annual cutoff limits as well as more detailed reporting with the Employee Local Deduction Report. Note: Pre-tax issues such as 401K plans and Cafeteria plans must be set up as a local deduction if the contribution is based on either an hourly rate or a percentage-of-gross wages.

Remember: If a company is union or pays prevailing wage, then the first three automatic deduction fields should be reserved for union or prevailing wage deductions only. If a valid union code has been entered for an employee, then the first three deduction fields will be automatically updated by the system with the information as set up in the union table.

Note: When a miscellaneous pay is set up as a withheld amount, then the corresponding miscellaneous deduct field should be reserved to hold the withheld amount. For example, if the miscellaneous pay #2 field is set up to be paid as a percentage of gross wages and withheld, then the miscellaneous deduct #2 field should be set up with the description of the withheld amount. Do not enter the withheld percentage nor the deduct type as the amount will be automatically posted to this deduct accumulator.

When a deduction is set up in this section of the screen, the system will automatically withhold the amount from the employee's paycheck. Each of the six Automatic Deduct Amount fields has a field that defines how the deduction amount will be calculated. There are currently five different deduction types available.

| 1. | Hourly – The deduction amount will be computed at the hourly rate for each hour entered on the timecard screen for the employee |

| 2. | % of Gross - The deduction will be calculated as a percentage of gross pay for each timecard transaction entered for the employee. Enter the percentage as a whole number (5 % would be entered as "5.000"). |

| 3. | Flat Amount – The dollar amount entered will be deducted from each paycheck produced for the employee. This type of deduction will be calculated ONCE for each check regardless of the number of Pay transactions entered on the time card screen. |

| 5. | Pre-Tax Deduction Amount - This is a flat amount deduction that reduces the amount of 'subject to' wages for all payroll taxes and is not subject to any tax calculations. The employee's gross wage is left unchanged, however the wages subject to FWH, FICA, FUTA, SWH, SDI, SUI and ETT are all reduced by this amount. |

•If your pre-tax deduction must be a percentage of gross, then you must set up your deduction using the Local Deduction Codes.

For most companies, setting up deductions as local deductions is the preferred method because there is more flexibility in setting up the deductions. Automatic Deduction Amounts (as noted above) only allow for a total of six employee deductions whereas the Local Deduction Codes allow up to twenty deductions per employee.

Local deductions are first created with default values (template) and then linked to the Employee Information Screen with specific rate information.

Due to the fact that employees can have multiple deductions of the same type with varying cutoff limits, such as child support or tax levies, it is important to keep each deduction separate with a different local deduction code (Child Support 1, Child Support 2, etc.).

As of Version 9.5.0.2, there is a new setting in the Local Deduction Codes screen that you can designate whether a cutoff limit should be recalculated at the beginning of the year. If the LDC is set to 'Reducing Balance' and if the Payroll Cutoff Date is changed in the Company Configuration Screen, a test will be performed to see if the year is being moved forward to a new calendar year and if so, the employee local deduction cutoff limits will be updated automatically. NOTE: This process is only done one time for each Calendar Year so if you need to re-open a year for W-2 Adjustments etc, the rolled balances are preserved. The LDC balances are maintained in a new local deduction audit table called “LocalDedCutoffHistory” and the 'Payroll Deductions Cutoff Limits - Year End Log' report will recap the employees that were updated with new cutoff limits. The report will include the Open Cutoff Balance before any changes were made, the Yearly Activity (deduction total) for the year being rolled, and the Year End Balance which will be the new cutoff balance in the employee file. If the computed balance for the new calendar year is zero (amount is paid in full), the deduction will be flagged as “Paid in Full” automatically. This setting allows for the local deduction information to be left remaining on the employee file without the need to clear the local deduction code from the employee file. You may also manually set the deduction to "Paid In Full" if you know that a deduction limit has already been reached during the year.

IMPORTANT NOTE: Keep in mind that the historical records of the time card deductions is kept online until records are purged through the Historical File Maintenance option which means that, in best practices, a local deduction code with a cutoff limit that has been paid in full for one employee should not be used again for the same employee. For example, if an employee has an employee loan in 2015 and has paid the levy in full in 2016, the same LDC should not be used for a new employee loan in 2017. While AB bases the deduction on the cutoff limit for the current calendar year, the historical reporting may be confusing if the report covers multiple years using the same LDC.

Employee Deductions and Multi-State Payroll

If you have an employee that works in multiple states during one pay period, AccuBuild will calculate all flat amount employee deductions just once for the check. However, deductions that are based on a % of gross, % of disposable income or hourly will be automatically added to the time card screen with each Pay transaction.

A percentage of disposable income deduction will be calculated based on the disposable income for each state. For example, if an employee works 30 hours in California and 10 hours in Arizona and has a 20% of disposable income garnishment, then the system will display two separate screens for the calculation of the garnishment. The first screen will show the total gross wage for California with the tax calculations applicable to those earnings and will then show the disposable wage calculation based on those amounts. The next screen will show the gross wages, taxes, and disposable wage applicable to the Arizona wages. The two separate calculations of the deduction will equal the total amount that should be deducted from the check if it were calculated based on the check totals.