ACCUBUILD TIME CLOCK

•ENHANCEMENT - New Audit Setting added for AB Time Clock [PMID Ref No 12997]

A new audit feature has been added to the AccuBuild TimeClock application that will track the number of clock in / clock out entries for each employee for a given set of work hours that are uploaded during the close day process. The purpose of this feature is to determine how many times each user clocked in and out in order to determine if any breaks (lunch etc.) were recorded during the work session. This new audit count setting will be stored in the user's time clock record(s) using the MiscInteger3 field in the PMPersonnel table. For example, if this field is set to 2, then the user only clocked in and out one time for the day which would indicate that no breaks were recorded on the TimeClock App. If the number is set to 4, that would indicate that the user logged one break - clock in for the day, clock out for the break, clock back in after the break, and clock out at the end of the day.

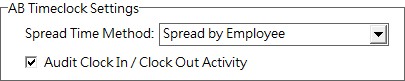

The new feature MUST be enabled in the AccuBuild Mobile Setting Screen on the Mobile / Cloud Settings Tab in the AB Timeclock Settings Group. Check the box entitled Audit Clock In / Clock Out Activity to enable this feature and uncheck the box to disable the feature:

The mobile stored procedure library has been updated to support this new setting with the following mobile stored procedures:

•abm_TimeCardLookupControlSettings (existing stored procedure)

•abm_DailyReportTimeCardRecord_WithCount_Write (new stored procedure)

ACCOUNTS PAYABLE

•ENHANCEMENT - New Comdata Setting Changes for FTP Connections [PMID Ref No 14236]

The settings for Comdata have been updated for future Account Code and FTP Site Address changes. AccuBuild now supports both the current legacy settings as well as the future settings. These settings will only need to be changed when Comdata notifies the customer that they need to be set up for a new account code. Until you are contacted by Comdata, you will continue to use your current settings.

Current (Legacy) Settings - The current FTP Settings are as follows:

•FTP Site Address: ftp.iconnectdata.com

•Port Number: 10021

New Settings - The new FTP Settings are as follows:

•Account Code: The new account codes that use the new FTP Server will contain a dash “-” in the second position of the code such as “1-ACC”. If the new account code format is used then when the Set Defaults button is clicked, the new FTP Site Address and Port will be updated automatically.

•FTP Site Address: transfer.comdata.com

•Port Number: 50023

ACCOUNTS RECEIVABLE

•Correction - Misc AR Invoices - Recurring Entries [PMID Ref No 13163]

The recurring entries for Miscellaneous A/R Invoices had an issue whereby the blue fields in the grid could not be updated (modified) when the Advanced Settings option ReoccurringARInvoicesAllUDFs was enabled. This option allows for additional vendor UDF fields to be included in the recurring grid for more advanced filtering options. This feature has been corrected and the blue fields will be now be able to be modified when this option is enabled.

•ENHANCEMENT - New Advanced Setting for AR Collection Notes Feature [PMID Ref No 13720]

The Client Center (Client List Screen) has been updated with new functionality to create historical collection notes on customer receivable invoices. The collection notes will be maintained in a new free table located in the company folder called ARCollectionNotes. This new feature must be enabled under the System Admin > Configuration > Accounting Tab > Advanced Settings Properties and the ARCollectionNotes table will be created automatically when the Client List (Center) Screen is opened. The outline below explains how to enable and use this new feature:

oEnable New Setting: Open the Advanced Setting Screen using the Advanced Property Settings Button on the Configuration Properties Screen - File | System Administrator | Configuration menu. Enable the new setting entitled EnableARCollectionNotesTracking using the Add Advanced Company Setting Button as shown:

oCreating / Viewing Collection Notes: The collection notes are created in the Client / Customer List (Center) Screen:

▪Select the desired customer from the customer grid on the left side of the screen.

▪Select the Customer Tab located at the top right side of the screen.

▪Click the Lookup Customer Activity Button to display the customer transactions. The open receivable invoices are displayed on the top half of the screen and the paid receipts are displayed on the bottom half of the screen. Both of these grids can be used to create and view collection notes.

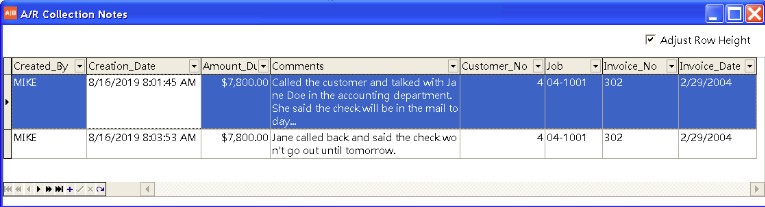

▪Select the desired invoice record from either grid and then double-click with the mouse to open up the collection notes screen which allows you to view any historical notes as well as create new notes:

❑Each collection note record will contain the invoice information including the Customer Number, Invoice Number, Job Number, Invoice Date and the current Amount Due (Open Balance) of the invoice when the collection note was created. Each time a new collection note is created, the user name of the user creating the note is logged along with the date/time stamp when the note was created.

❑Click on any column heading to sort the grid in order by the column and use the drop down arrow to filter the grid.

❑Click the Add (blue plus) Button at the bottom left side of the screen to add a new collection note record. All of the fields are updated automatically with the current invoice information and the only field that can be changed is the Comments field where you will enter your collection notes:

![]()

❑Click the Save (green check mark) Button to save your collection notes entry. Note: If the Comments field is left blank, a message will be displayed and the new record will be deleted. Only records with valid (non blank) comments will be saved.

❑Click the Cancel (red x) Button to cancel the new record.

▪You may close the screen when you are done with each entry, OR you can leave the screen open and simply repeat the process with other customers or other invoices for the current customer. Each time the invoice grid is double clicked, the collection notes screen will be refreshed for the newly selected invoice.

▪If you attempt to close the Client List (Center) Screen while the Collection Notes screen is still open, the system will force you to close the Collection Notes screen before exiting.

oAdding Collection Notes to an existing MAR Report: Our Professional Services team is available for Tailored Report Solutions if you would like to incorporate these collection notes into an existing MAR Report. Please contact AccuBuild Support for more details and a price quote.

▪Sample Report Change - Class 553 - A/R Aging Schedule - Customer Order:

The A/R Aging Schedule by Customer Order could be modified to support a drill down feature on each invoice to show any collection notes by adding a new data pipe to the report for the ARCollectionNotes table and creating a drill down subreport. The custom SQL script changes for creating this table are shown below:

try

Drop Table <<URP:ARCollectionNotes>>;

catch all

end;

select a.na_no,a.inv_no,b.*

into <<URP:ARCollectionNotes>>

from <<URP:ReconstructedDetail>> a

left outer join "<<COFREE>>ARCollectionNotes" b on a.Na_no = b.customer_no and a.Inv_no = b.invoice_no

where b.customer_no is not null;

Important Note: <<COFREE>> tables need to be enclosed in double quote marks

ORDERS

•Correction - PO Invoice Reversal [PMID Ref No 13292]

The reversal process for a Purchase Order Invoice that included amounts for shipping charges was not including the shipping amount in the reversal process. This issue has been corrected.

PAYROLL

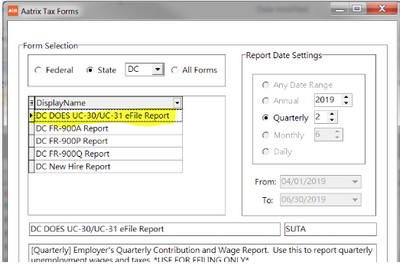

•UPDATED - Aatrix Tax Form System Tables Updated

The system tables in the AccuBuild DATA Folder were updated to correspond with the latest changes from Aatrix for tax form processing which mainly involves new record changes to support the Family Leave Act changes for Washington, Massachusetts, and DC:

•RBScript.ADT

•AatrixTaxTypes.ADT

•AatrixTaxTypes_Ver10004_Rev1.ADT - Backup copy of previous version of AatrixTaxTypes

•Correction - FICA Employer Burden Error Message

When an employee reaches the $200,000 Medicare Wage limit and begins paying the Additional Medicare Wages, the system was displaying an out of balance message for the employer portion of the FICA Tax Amount which indicated that the two payroll batch tables were out of balance for the FICA Amount when in fact the two tables were in balance. The error message was wrong and the amounts were actually being computed correctly. The system will no longer report this situation incorrectly.

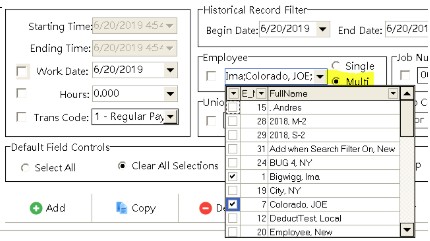

•Correction - TimeCard Worksheet Screen - Multi Employee Add Function [PMID Ref No 13272]

When the Add Button was used with the Multi Employee option where multiple employees are added at one time, the default settings for the employee for union codes, department codes etc. were all being set to the same value instead of being based on the employee default settings. This issue has been corrected and now the employee defaults will be pulled from the employee master record. In addition, if the employee works in multiple states and the default state for the employee is checked, then the employee's default state will be used.

•ENHANCEMENT - Employee Center - Master List Lookup Changes [PMID Ref No 10478 - 321.37]

The Employee List (Center) Screen has been updated with new functionality for all of the master list lookup buttons (Union Codes, Department Codes etc.). When the lookup lists are accessed, the employee screen will be disabled until the lookup screen is closed. Once a lookup list screen is closed, the employee list will be updated with any changes from the lookup list screen and the user can continue with the current employee record changes. Previously, the current employee changes were canceled when a lookup button was clicked.

If the lookup list is open and the Close (X) Button is used to close the employee screen, a check will be made to make sure any lookup master screens are closed BEFORE the employee screen will be allowed to close.

•Correction - TimeCard Worksheet Screen - Multi Employee Add Function [PMID Ref No 13272]

When the Add Button was used with the Multi Employee option where multiple employees are added at one time, the default settings for the employee for union codes, department codes etc. were all being set to the same value instead of being based on the employee default settings. This issue has been corrected and now the employee defaults will be pulled from the employee master record. In addition, if the employee works in multiple states and the default state for the employee is checked, then the employee's default state will be used.

•ENHANCEMENT - New Advanced Setting for TimeCard Worksheet Business Rules Process [PMID Ref No 14020]

The TimeCard Worksheet Screen now contains a new Rules Button as shown below which is used to execute the custom SQL script for the company business rules:

To be able to utilize this new feature, the new 'EnableTCWorksheetBusinessRulesBtn' option must be enabled in File > System Administrator > Configuration > Advanced Settings. The Rules button on the Time Card Worksheet Screen requires a custom set of SQL Script to be designed for each company which defines the business rules to be executed. This new framework allows for specific processes to be applied to the timecard entries for updating existing records and / or adding new timecard entries for such things as field changes, identifying overtime calculations etc. Refer to the documentation link above for complete information on this new feature.

•ENHANCEMENT - Family Leave Act [PMID Ref No 13033]

Three states have implemented new laws for handling Family Leave for employees which include the District of Columbia (DC), Massachusetts, and Washington. The set up for handling the Family Leave amounts will be handled on the Payroll > Properties > Tax Rates > State Tax Settings Screen.

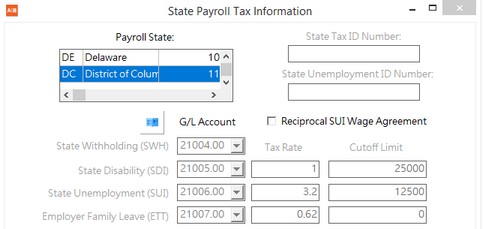

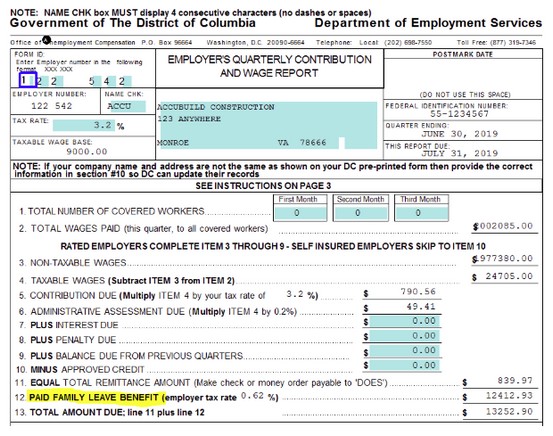

•District of Columbia - The Family Leave tax is paid by the employer only and therefore will be accrued as a payroll tax burden. The ETT Tax in AccuBuild will be used to track the Family Leave amount which should be set up as shown in the following screen:

|

Employer Family Leave (ETT) - The accrued Family Leave amount will be tracked under the ETT Tax field in the PRCHECKS table:

•G/L Account - A new G/L Account should be set up to track the family leave amount.

•Tax Rate - The initial tax rate is 0.62 % for 2019, however you will need to verify this rate and update as needed according to DC Tax regulations.

•Cutoff Limit - Currently there is no cutoff limit and this tax applies to all employee gross wages. Leave this field set to zero.

The Family Leave Tax Amounts will be included in the Aatrix Tax Form for the DC Quarterly Reporting (DC DOES UC-30):

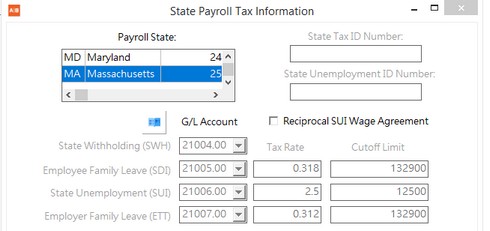

•Massachusetts - The Family Leave tax is paid by both the employee and the employer with the employee portion being handled with the SDI accumulator and the employer portion being handled with the ETT accumulator as shown:

| Employee Family Leave (SDI) - The employee Family Leave amount will be withheld from the employee’s pay amount and tracked under the SDI Tax field in the PRCHECKS table: |

•G/L Account - A new G/L Account should be set up to track the family leave amount for the employee.

•Tax Rate - The initial tax rate is 0.318 % for 2019, however you will need to verify this rate and update as needed according to Massachusetts Tax regulations.

•Cutoff Limit - Currently the cutoff limit is based on the social security cutoff limit and this field will need to be updated as necessary according Massachusetts Tax regulations.

Employer Family Leave (ETT) - The accrued Family Leave amount will be tracked under the ETT Tax field in the PRCHECKS table:

•G/L Account - A new G/L Account should be set up to track the family leave amount for the employer.

•Tax Rate - The initial tax rate is 0.312 % for 2019, however you will need to verify this rate and update as needed according to Massachusetts Tax regulations.

•Cutoff Limit - Currently the cutoff limit is based on the social security cutoff limit and this field will need to be updated as necessary according Massachusetts Tax regulations.

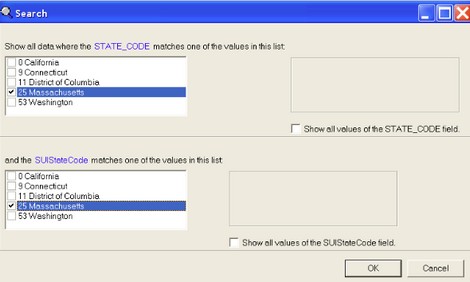

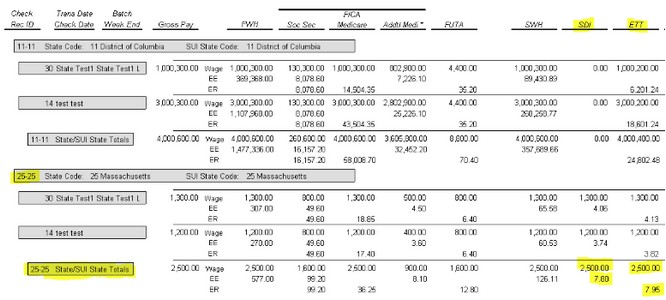

At this time, the state of Massachusetts has not released any official form for reporting the Family Leave Tax Amounts and therefore the Aatrix Tax Form generator in AccuBuild does not provide a form yet. The AccuBuild MAR Library Report has been updated with two new Subject Earnings Reports that can be used to obtain the Family Leave totals for the SDI (employee deduction) and ETT (employer portion) totals for Massachusetts. This report is different from the other Subject Earning Reports in that the report grouping are based on the combined STATE_CODE and SUISTATECODE fields for each payroll check record so that both state codes are included in each group. For multi-state payroll situations, this new grouping method will make sure that separate groups are created when the state code and the SUI State code are NOT the same which occurs when employees have state earnings in another state but need to report state unemployment earnings to their home state.

•Subject Earnings - StateSUICombo Group - Summary - Trans Date

•Subject Earnings - StateSUICombo Group - Detail - Trans Date

Both of these reports have a built in filter for selecting the desired State Codes and SUI State Codes so that you can run the report just for Massachusetts if needed:

The Summary Report will provide totals for each State / SUI Combo Group along with subtotals for each employee within the Group. The Detail Report will include details for each employee check that make up the employee totals. The Subject Wages are reported on the Wage line for both the Employee (SDI) and the Employer (ETT) Subject Wages. The Employee Withheld Amount (SDI) is reported on the EE Line and the Employer Burden Amount (ETT) is reported on the ER Line.

Hint: You may want to run this report as a MAR Data View as well so that you can filter the data and/or export the data to excel as needed.

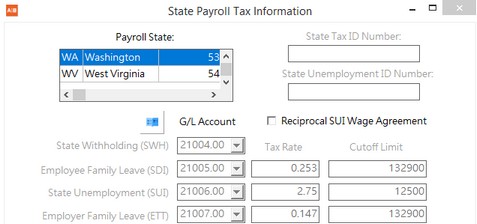

•Washington - The Family Leave tax is paid by both the employee and the employer with the employee portion being handled with the SDI accumulator and the employer portion being handled with the ETT accumulator as shown:

Employee Family Leave (SDI) - The employee Family Leave amount will be withheld from the employee’s pay amount and tracked under the SDI Tax field in the PRCHECKS table:

•G/L Account - A new G/L Account should be set up to track the family leave amount for the employee.

•Tax Rate - The initial tax rate is 0.253 % for 2019, however you will need to verify this rate and update as needed according to Washington Tax regulations.

•Cutoff Limit - Currently the cutoff limit is based on the social security cutoff limit and this field will need to be updated as necessary according Washington Tax regulations.

Employer Family Leave (ETT) - The accrued Family Leave amount will be tracked under the ETT Tax field in the PRCHECKS table:

•G/L Account - A new G/L Account should be set up to track the family leave amount for the employer.

•Tax Rate - The initial tax rate is 0.147 % for 2019, however you will need to verify this rate and update as needed according to Washington Tax regulations.

•Cutoff Limit - Currently the cutoff limit is based on the social security cutoff limit and this field will need to be updated as necessary according Washington Tax regulations.

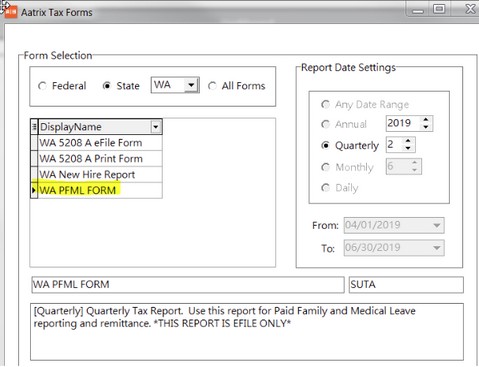

The Family Leave Tax Amounts will be included in the Aatrix Tax Form for the WA PFML Form:

•Other States - Family Leave is already supported in AB in four other states using various taxing methods as outlined below:

•California - Family Leave is included in the SDI Rate ( Payroll > Properties > Tax Rates > State Tax Settings Screen). No additional set up is required for reporting at this time.

•New York - Family Leave is handed through a local deduction code that the AB customer must set up and the amount is reported annually on the employee W-2. Refer to the Payroll FAQ Section for specific state setup notes. http://support.accubuildcloud.com/abhelp/newyork-payrolltaxissues.htm

•New Jersey - Family Leave is handed through a local deduction code that the AB customer must set up and is reported on quarterly returns in Aatrix for form NJ-927/WR-30.

•Rhode Island - Family Leave is handled via the SDI Tax field on the Payroll > Properties > Tax Rates > State Tax Settings Screen and reported on quarterly returns in Aatrix on form TX-17 under the TDI Taxable Wages section.

PROJECT MANAGEMENT

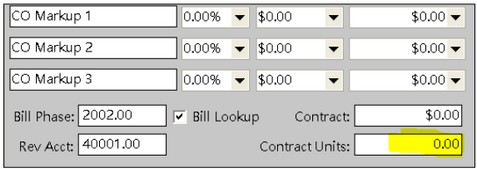

•Correction - The COR Breakdown Screen Allows Zero in Contract Units [PMID Ref No 13821]

oThe COR Breakdown Screen was not allowing the Contract Units field to be set to zero, but was instead forcing the field to be set to 1. The screen has been updated to now check for the billing type on the job and only force the field to 1 if the job format is set to Unit Billings or Unit Billing / Retn. If the job is NOT set up for unit billings, then the system will now allow this field to be set to zero.

SYSTEM ADMINISTRATOR

•ENHANCEMENT - New Advanced Setting for AR Collection Notes Feature [PMID Ref No 13720]

oEnableARCollectionNotesTracking - The Client List (Center) Screen has been updated with new functionality to create historical collection notes on customer receivable invoices.

•ENHANCEMENT - New Advanced Setting for TimeCard Worksheet Business Rules Process [PMID Ref No 14020]

oEnableTCWorksheetBusinessRulesBtn - The TimeCard Worksheet Screen has been updated with new functionality to apply business rules to the time card entries based on a tailored set of SQL Script which is unique for each company. This new framework allows for specific processes to be applied to the timecard entries for updating existing records and / or adding new timecard entries for such things as field changes, identifying overtime calculations etc. Please refer to the link above for complete information.

•DOCUMENTATION UPDATE - Crystal Reports Error Update on Error 7200: NativeError = 2122 - Table or alias not found

This error is caused when there are too many companies set up in an AccuBuild Installation to support the older crystal report drivers for the Advantage Database Server. The ADS.INI file in the AccuBuild Program Directory contains a section entitled [Crystal] which contains an entry called UseBDECompatibleOJ. This entry contains a list of company database connections that are accessed by the Crystal Reports Engine. This company list is limited to 256 characters so any companies that are listed past the first 256 characters cannot be found by the Crystal Engine and need to be moved into the 256 character range in order to run correctly.

Each Company Entry will take approximately 11 characters so the crystal report support will be limited to roughly 23 companies. A temporary solution is to remove this line UseBDECompatibleOJ completely in the ADS.INI file and then close and reopen the AccuBuild Program which will start the list over.

•ENHANCEMENT - New features and processes for the SQL Dictionary Comparison Utility [PMID Ref No 14815]

oThe SQL Dictionary Comparison Utility has been updated with additional comparison routines for the database fields and indexes in order to discover additional differences between the live database tables and the database definitions.

Compare Dictionaries Button: Two new sections will now be included in the Results Window for providing more details for any differences during the database comparisons:

▪FIELDS: The new FIELDS section will identify specific field attribute differences which include the following list (Note: The Red Fields are NOT tested):

❑Field_Type

❑Field_Length

❑Field_Decimal - Not Tested

❑Field_Min_Value

❑Field_Max_Value

❑Field_Can_Be_Null - Not Tested

❑Field_Default_Value

❑Field_Options

Although in most cases, there should be no differences discovered, these additional comparisons are necessary to identify any special settings for specific companies that may be a result of a tailored solution. The most important attribute in the above list is the Field_Type which SHOULD always match the database definitions. For example, an integer field type and an autoinc field type are both integer type fields, however, the autoinc field will NEVER allow a duplicate value which is a very important distinction that the AccuBuild Program depends on.

When the database fields are compared, three temporary tables are created in the user folder which contain the field settings for the live company and the database definitions, along with a third table for the database differences:

❑__ABDictionaryFieldInfo.ADT - Database Definitions

❑__ABCompanyFieldInfo.ADT - Live Company Definitions

❑__ABFieldErrors.ADT - Database Field Differences

▪INDEXES: The new INDEXES section will identify specific index attribute differences which include the following list:

❑Index_File_Name

❑Index_Expression

❑Index_Options

❑Index_Key_Length

There should be no differences discovered for the index files with the Index_Expression and the Index_Options being the most important attributes. For example, the employee list file (PERSONAL) contains an index on the employee number field (E_NO) which is contained in the Index_Expression. However, the Index_Options contains a UNIQUE Setting that prevents duplicate employee numbers from being added to the employee list.

When the database indexes are compared, three temporary tables are created in the user folder which contain the index settings for the live company and the database definitions, along with a third table for the database differences:

❑__ABDictionaryIndexInfo.ADT - Database Definitions

❑__ABCompanyIndexInfo.ADT - Live Company Definitions

❑__ABIndexErrors.ADT - Database Field Differences

Update Indexes Button: The process for Updating Missing Index files has been updated to support field functions in the index expressions. For example, with some indexes that use a field with alphanumeric data, such as a Vendor Invoice Number, the UPPER expression is used on the index which eliminates any duplicate invoice issues by comparing the invoice numbers without concern for upper or lower case letters.

In previous versions of AccuBuild, these types of indexes were causing errors and the indexes could not be rebuilt using this button. These types of errors are now corrected in this version. In addition, new Update Indexes Buttons have been added for the User Database and the Global Database Sections:

Technical Notes for AccuBuild Support Technicians: This database comparison utility should be run when you first open the AccuBuild Program so that you can avoid issues with tables that are already opened in your AccuBuild Session. If tables are in use during the Update Indexes process, you will encounter a 7008 error when trying to create missing indexes as shown below. This will usually be due to the table being opened by AccuBuild Program and the required index cannot be created. You will want to run the Execute Procedure from ARC when there are no other users in AccuBuild. Copy the EXECUTE PROCEDURE Code from the Results Text Box by highlighting the text and then pressing CTRL-C to copy the text and paste it into a notepad file which you can then access once ARC is opened: Even if the error code is generated, you will have all of the code you need to create the proper index(s) for the table. One you have successfully created the tables in ARC, you can open AccuBuild and re-run the comparison utility to make sure the index errors are corrected. See the following sample of the 7008 error code:

EXECUTE PROCEDURE sp_CreateIndex90( 'BATCHLST','BATCHLST.adi','PRIMARY','BatchType;Source','',2051,512,'' );

poQuery: Error 7200: AQE Error: State = HY000; NativeError = 7008; [iAnywhere Solutions][Advantage SQL][ASA] Error 7008: The specified table, memo file, or index file was unable to be opened.