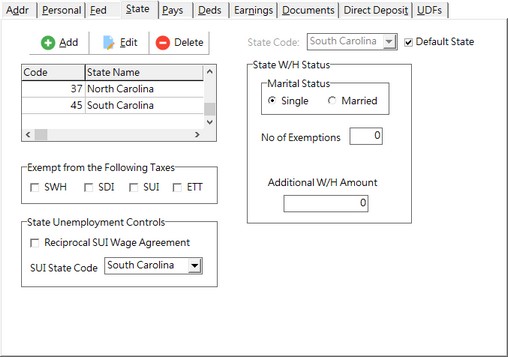

The Payroll > Employees > State Tab contains fields for the employee's state withholding information.

Multi-State or Single State Payroll

Multi-State Payroll - If you own the multi-state payroll option, then you must add each state code and withholding information on the employee screen for each state in which the employee will work. Each state in the list has a numeric number associated with it, and the lowest state code number found in the employee's file will be the default state code used when entering time cards. To prevent the wrong state code from being used, set up each current job with the appropriate state code on the Job Cost > Update Jobs > Payroll Tab. The employee's file MUST contain the same state code as the job's payroll state code in order for an employee's time to be charged to that job.

Single State Payroll - If you own the single state payroll option, then the State Code on the employee screen will default to the state code selected on the Payroll > Properties > Tax Rates Tab. Note: Each job does not have to be set up with a payroll state code in a single state payroll environment.

State Withholding Status

This section of the screen will change depending on the state selected but basically consists of the following items:

•Marital Status - Select 'Married', 'Single' or 'Head of Household'. Choose 'Single' if employee has selected 'Married, but withhold at higher Single rate' on his/her W-4 Form.

•No of Exemptions - Enter the number of exemptions as noted on Form W-4 Employee's Withholding Allowance Certificate. Note: Set this number to a high number such as 25 an alternate way of marking an employee as exempt from taxes (as noted below).

•Additional Withheld Amount - Enter an amount to be withheld in addition to the calculated state withholding amount.

Exempt from the Following Taxes

An employee may be set up to be fully exempt from state withholding (SWH), state disability insurance (SDI), state unemployment insurance (SUI) or employment training tax (ETT) . Once an employee is set up to be exempt from any of the state taxes, AccuBuild will ignore the selected taxes when calculating future paychecks for the employee. These exemption fields can be changed back at any time to a non-exempt status by disabling the options. Once the exemption is removed, AccuBuild will then begin calculating tax for all future payroll checks.

Note: Be sure to check with your company's CPA before marking any employee as exempt from any tax.

State Unemployment Controls

This section allows for the default SUI State Code and the Reciprocal SUI Wage Agreement to be changed for a selected employee. The system will default these fields based on the state that is defined on the Payroll > Properties > Tax Rates Tab.

The reciprocal checkbox only applies when the State Code for SWH tax (top of screen) is different from the SUI State code at bottom of screen (Employee List). All SUI Cutoff limits are based on the SUI State Code for all earnings and are accumulated in the SubjSUIWages field. If the box is checked, then SUI Wages for that state code will be combined with SUI Wages from another state code to arrive at the cutoff limit faster and this would be the normal setting. If the box is unchecked, then each state's earnings will be based on the single state and not combined with other state earnings even if the SUI State Codes are the same.

Note: Some states, such as California, have an Employee Training Tax that is related to the State Unemployment Insurance tax. Therefore, the ETT component will accrue in the same manner as the SUI if the SUI Reciprocal Agreement is enabled.

Reciprocal Example:

$4,000 earnings for California; State Code = California, SUI State Code = Arizona (reciprocal checked)

$4,000 earnings for Arizona; State Code = Arizona, SUI State Code = Arizona

Arizona SUI Cutoff Limit = $7,000

SUI Wages for California = $0

SUI Wages for Arizona = $7,000

NON Reciprocal Example:

$4,000 earnings for California; State Code = California, SUI State Code = Arizona (reciprocal NOT checked)

$4,000 earnings for Arizona; State Code = Arizona, SUI State Code = Arizona

Arizona SUI Cutoff Limit = $7,000

SUI Wages for California = $0

SUI Wages for Arizona = $8,000 - Without reciprocal agreement, earnings in each state (state code) much reach the cutoff limit so in this case, the SUI Wages for Arizona could reach $14,000 ($7,000 each state) before the cutoff is reached.

Default State Code

If the new Default State feature is applied to an employee, then the Business Rules for all new time entries, from any entry point (Enter/Update Time Card entries, Time Card worksheet and Mobile) will be as follows:

1.Use the State as indicated in a Labor Distribution Code. If none exists, then

2.Use the State as indicated on the Job Cost > Update Jobs > Payroll Tab. If none exists, then

3.Use the Default State as indicated on the Employee > State Tab

●To Set Up the Default State Code:

○Payroll > Employees > State Tab

○Select Edit at the top of the screen

○Highlight the desired State in the grid

○Select Edit on the State Tab

○Check the box labeled “Default State”

○Select Save.