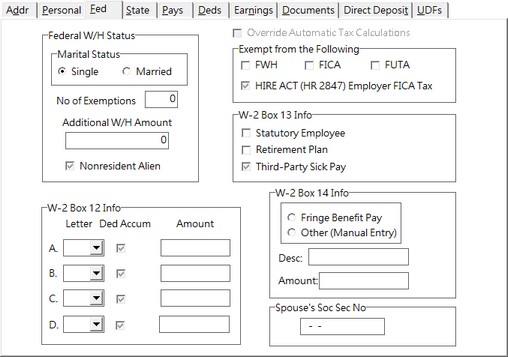

The Federal Tab contains fields for the employee's federal withholding information and various W-2 box information.

Federal Withholding Status

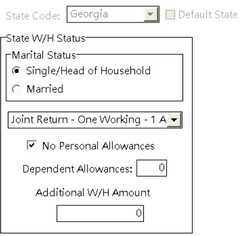

Federal W/H Status - As of 2020, a new W-4 Setting field has been added which allows you to choose the new 2020 W-4 or later format for new hires or the 2019 W-4 or earlier formats for existing employees. The 2020 W-4 format is designed to help employees more accurately calculate their federal withholding tax amounts.

IMPORTANT NOTE: You do NOT have to use the new W-4 settings for 2020 and may continue to use the current employee settings from 2019 or previous years. In other words, if you do nothing to change an employee's W-4 setting, AccuBuild will continue to compute the federal withholding taxes as normal for 2020. However, if an employee fills out the new 2020 W-4, you can make the change for the employee on an individual basis and Accubuild will calculate the federal withholding taxes using the new 2020 W-4 Settings. The latest update from the IRS regarding this form is that employees will be required to fill out the new 2020 W-4 by October 1, 2020.

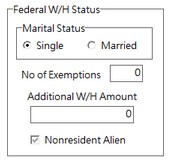

•2019 W-4 or earlier: This is the default option and has been used for federal withholding calculations for all years prior to 2020. For existing employees, this setting may appear as blank which also represents the default setting so that no changes are necessary if you choose to continue with the '2019 W-4 or earlier' version. There are no field changes for this option as the fields are the same as they have always been.

Enter the employee's federal withholding information as stated on the Employee's Withholding Allowance Certificate (Form W-4). The Additional W/H Amount field contains the amount the employee may elect to have withheld from their paycheck in addition to the amount calculated by the withholding tax tables.

Nonresident Alien - Effective January 1, 2010, employers must implement a new withholding guideline for nonresident aliens. The new guideline is designed to offset withholding reductions for the Making Work Pay Credit already built into the federal withholding tables. Refer to IRS Publication 15 for more information.

•2020 W-4 or later: Please review the 2020 W-4 Instructions from the IRS for details on each of the fields and how they are used in the federal withholding tax calculations. Note: If you change the W-4 Setting, you will need to click on another field on the screen before the Federal W/H Status group box changes based on the new setting. The new Federal Withholding Tax tables for 2020 will now handle both methods of tax calculations based on each employees individual W-4 Setting. These new settings will only be applicable if you receive a new 2020 W-4 form or a revised 2019 W-4 form from an employee, otherwise you can continue into 2020 without making any changes to the employee settings.

oMarital Status: In addition to the Single and Married options, and new Head of household option has been added for the 2020 W-4.

o2. Multiple Jobs or Spouse Works: Check this box if it is checked under step 2c of the W-4 Form. NOTE: Make sure the checkmark is dark black as a dimmed checkmark is the same as a blank checkmark:

o3. Dependents Amount: Enter the Dependents Amount Total (if any) under step 3 of the W-4 Form.

o4a. Other Income Amount: Enter the Other Income Amount (if any) under step 4a of the W-4 Form.

o4b. Deductions Amount: Enter the Deductions Amount (if any) under step 4b of the W-4 Form.

o4c. Extra Withholding: Enter the Extra Withholding Amount for each pay period (if any) under step 4c of the W-4 Form. This field works the same as the Additional W/H Amount field from the 2019 or earlier W-4.

oNonresident Alien: This field is not part of the W-4 fields but is included with the Federal W/H Status group box in order to be compatible with the 2019 or earlier field group box.

Exempt from the Following

An employee may be set up to be fully exempt from federal withholding (FWH), social security and Medicare taxes (FICA) or federal unemployment insurance (FUTA). Once an employee is set up to be exempt from any of the federal taxes, AccuBuild will ignore the selected taxes when calculating future paychecks for the employee. These exemption fields can be changed back at any time to a non-exempt status by disabling the options. Once the exemption is removed, AccuBuild will then begin calculating tax for all future payroll checks.

Note: Be sure to check with your company's CPA before marking any employee as exempt from any tax.

HIRE Act (HR 2847) Employer FICA Tax - The 2010 HIRE Act will exempt employer's portion for Social Security Tax for qualified Employees on wages PAID from March 19, 2010 through December 31, 2010. If you have an employee(s) who qualifies under this Act, be sure to check this box to allow the system to accurately calculate your companies portion of the FICA tax. The exempt tax must be reported in Box 12 of the 2010 W-2s. Be sure to read the documentation in the FAQ section of the payroll manual for complete information on this issue.

Override Automatic Tax Calculations

This option will display a screen during payroll check processing to may be used to manually adjust employee and employer tax amounts including the wage amounts that are subject to each tax. In addition, the number of payroll periods per year for each payroll check can be adjusted for those employees who might have a different pay schedule than the system default.

| FICA - Medicare: As of 1/1/2013, an additional medicare tax is due on any amount paid over $200,000 to a single employee. This additional tax is deducted from the employee and is NOT matched by the employer as are the medicare taxes on the first $200,000. When overriding the automatic tax calculations, the additional tax and the related subject wages must be entered in separate fields than the 'normal' tax and wages. |

| · | Normal Medicare (Tax Amount and Subject To Wages) – These fields represent the normal medicare amount ONLY and does NOT include any of the Additional Medicare Tax. (ie. $10,000 x 1.45%) |

| · | Additional Medicare (Tax Amount and Subject To Wages) – These fields represent the additional medicare amount ONLY and does NOT include any of the normal medicare tax. (ie. $10,000 x 0.9%) |

W-2 Box 12 Info

Be sure to review the Internal Revenue Service publication for Form W-2 before completing the following W-2 box information:

| This section of the screen allows you to assign up to four miscellaneous deduction accumulators to print in Box 12 of the W-2s. Each item must print with the proper code as defined by the IRS. Items that will appear in Box 12 should be assigned to their own deduction accumulator on the Payroll > Properties > Misc Pays > Deds Tab. For example, if your company has a 401K plan and a 125 Cafeteria Plan, each plan should be set up with its own deduction accumulator (check stub description). |

| To set up a deduction item to automatically print in Box 12 of the W2, click the Ded Accum box and select the associated deduction accumulator. AccuBuild will then calculate the amount from the employee's file when generating the W-2s. Alternatively, the total deduction amount may be manually entered in the Amount field as long as the Ded Accum box is not checked. |

| Box 12 has the new option 'CC' for 2010 W-2s which is used to report the exempt FICA wages under the 2010 HIRE ACT. When option 'CC' is selected for any of the Box 12 Fields (A-D), the system will calculate the FICA wages for all payroll checks that were written within the qualified period which runs from 03/19/2010 through 12/21/2010 and update the Box 12 amount automatically. The display of this amount on this screen is for reference purposes only and the amount will be recalculated when W-2s are created. If you make changes to the historical check records AFTER setting the Box 12 to 'CC', you can drop down the Box 12 Letter control and close it back up to refresh the displayed amount on this screen. |

Box 12 has a new option 'DD' for 2011 W-2s to report the 'Cost of Employer Sponsored Health Coverage'. This controls the RW record and the RT Record in the magnetic media filing.

Box 12 has a new option 'EE' for 2011 W-2s to report the 'Designated Roth Contributions under a governmental section 457(b) plan'. This controls the RO record and the RU Record in the magnetic media filing.

W-2 Box 13 Info

Check all boxes that apply:

Statutory Employee - Statutory employees are workers who are independent contractors under the common-law rules but are treated by statute as employees. Check this box for statutory employees whose earnings are subject to social security and Medicare taxes but not subject to Federal income tax withholding. Do not check this box for common-law employees.

Retirement Plan - Check this box if the employee is an active participant in a qualified retirement plan. Do not check this box for contributions made to a nonqualified or section 457 plan.

Third-Party Sick Pay - Check this box only if you are a third-party sick pay payer filing a Form W-2 for an insured's employee or are an employer reporting sick pay payments made by a third party.

W-2 Box 14 Info

Use Box 14 to report a fringe benefit or any other information that you want to give to your employee.

Fringe Benefit - A fringe benefit is a form of pay for the performance of services. For example, you provide an employee with a fringe benefit when you allow the employee to use a company owned vehicle to commute to and from work. The lease value of a vehicle provided to your employee and reported in box 1 must be reported here or on a separate statement to your employee.

Other (Manual Entry) - Enter a description and amount of the item.

Spouse's Social Security Number