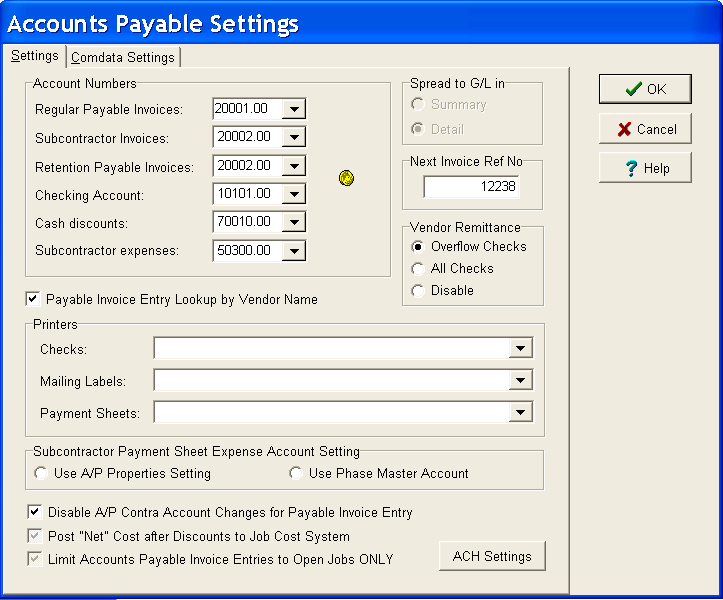

The Account Numbers section of the screen represents the default general ledger accounts that will be used whenever information is processed through the Payables system. Be sure to check with your company's accountant if you are not sure which accounts to use.

| Regular Payable Invoices |

| This field represents the accrued liability account for regular (non-subcontractor payment sheets) that are entered in the Payables system. |

| Subcontractor Invoices |

| This field represents the accrued liability account for the current portion of all Subcontractor Payment Sheets generated in AccuBuild. Whenever these payment sheets are generated, AccuBuild automatically creates a pair of payable invoices for each subcontract on a given job. One invoice represents the current amount due (the gross amount less the retention withheld) and the other invoice represents the retention withheld. The current amount due is credited to the Subcontractor Invoices account. The retention withheld is credited to the Retention Payable Invoices account. |

| Check Account |

| This field represents the default 'cash-in-bank' general ledger account to be used for non-payroll cash disbursements. This account will be displayed automatically whenever payments are processed through the Payables system; however, a different checking account may be selected as needed for each batch of checks during the Schedule Payments option. |

| Cash Discounts |

| This account will be updated with the total cash discounts associated with each batch of payable checks that are processed through the system. |

| Subcontractor Expenses |

| This field represents the default expense account for all Subcontractor Payment Sheets. The system will use this single expense account to post the gross amount of all Subcontractor Payment Sheets if the 'Use A/.P Properties Setting' option is chosen at the bottom of the screen. Select 'Use Phase Master Account' if the payment sheets should be posted to multiple expense accounts as linked to the job cost phases in the Phase Master. |

The Printers section of the screen sets up the default printers for the following print functions:

| Checks |

| Select the default printer for printing accounts payable checks. |

| Mailing Labels |

| When printing checks through the Schedule Payments option, AccuBuild will prompt you to print mailing labels. The mailing labels are printed on 2" x 4" labels (20 to a page) and two labels will be generated for each check. The first label is the mailing label and the second label summarizes the check information that can then be attached to vendor's invoice for reference. |

| Payment Sheets |

| Select the default printer for printing subcontractor payment sheets. |

The Spread to GL in section of the screen shows that the Ledger system is updated from the Payables system with detailed transactions whenever any payable invoices (accrual basis only) or cash disbursements are processed. This setting cannot be changed.

Next Invoice Ref No

This field simply keeps track of the system's internal reference number for each accounts payable invoice entry. In addition to the vendor's invoice number, AccuBuild logs an internal reference number for each entry associated with the vendor's invoice number. In cases were one invoice may be posted to several different jobs and phases, each partial entry of the one invoice will receive its own unique internal reference number. With rare exception, the Next Invoice Ref No field should not be changed.

Use Advance Grid Screen for Scheduling Payments

This option changes the functionality of the Schedule Payments screen so that you can click on any column in the grid to sort the invoice information. Group the data by moving any column into the gray area above the columns. Click on any column and type in a value, such as an invoice number, to dynamically scroll thru the column to find the matching value. Unlike other grid screens in the system, these columns do not contain individual filtering capability. Basic filtering for a specific job, vendor, invoice date, etc can still be performed at the top of the screen.

Disable A/P Contra Account Changes for Payable Invoice Entry

Use this option to prevent a user from changing the contra account when entering payable invoices. This will ensure that the credit side of the invoice entry will post to the accounts payable liability account displayed on the Payables Properties or Order Properties screens. This should help prevent new users from posting entries incorrectly.

Post 'Net' Cost after Discounts to Job Cost System

Use this option to allow cash discounts to be credited to the job cost instead of the traditional Cash Discounts account per the accepted accounting standard. Please check with your CPA before enabling this new setting as the normal standard is to track cash discounts under a separate account and NOT allow them to be credited to the jobs.

When this setting is enabled, the posting process for A/P checks including automatic, hand-written, and voided checks will include an additional set of transactions in the job cost and general ledger historical files which will credit the job cost amounts and debit the cash discount amounts. These additional transactions will contain a description that begins with the word 'Discount' to help identify them. Note: This setting only affects vendor invoices that contain discounts which are coded to a job.

Limit Accounts Payable Invoice Entries to Open Jobs ONLY

When this option is enabled, and the job field is chosen on an invoice entry screen, then the system will only display the list of current jobs or allow only a current job number to be entered into the field. This setting will affect all a/p entries including Subcontractor Payment Sheets, a/p handwritten checks that expense items on the fly, and Purchase Order / Subcontract Order forms.