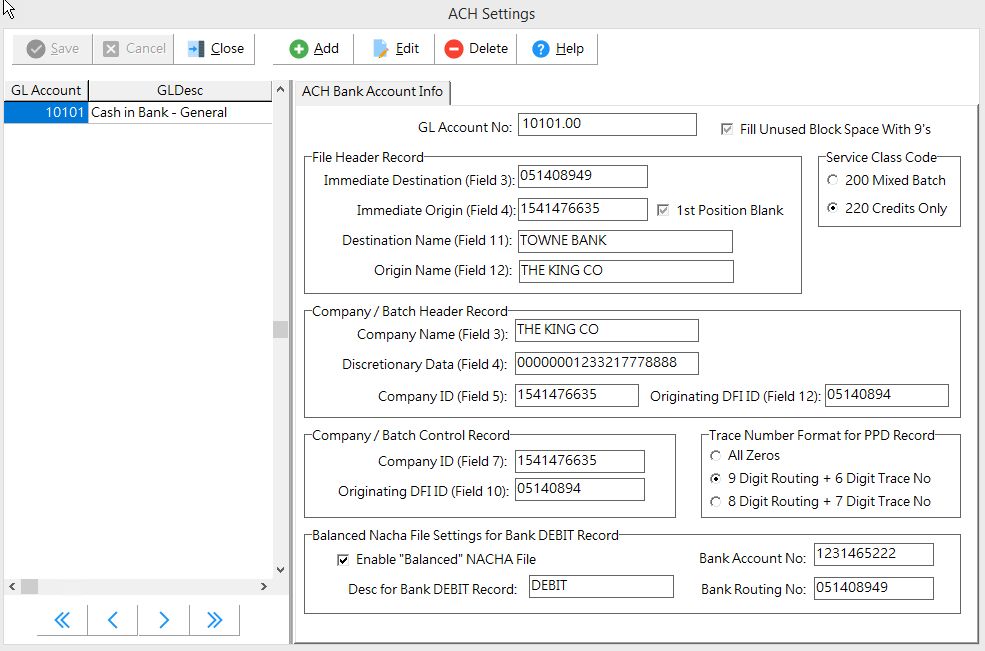

In order to use the Vendor ACH Payment feature in AccuBuild, you must provide the following information for each bank account that will be used for ACH Vendor Statements.

These bank account setting fields are maintained in the ACH Settings Screen which can be accessed from the Payable Properties Screen using the ACH Settings Button. Use the Add Button to set up a new bank account for ACH Processing, Use the Edit Button to edit an existing bank account record, and used the Delete Key to remove a bank account from the ACH Process. The fields required for each bank account records are outlined below:

•GL Account No :- This field represents the general ledger account in the Chart of Accounts for representing the Bank Account to be set up. Select an account from the drop down list. NOTE: Each ACH Bank Record must contain a unique G/L Account Number. An error will be displayed if you try to add the same account more than once.

•Fill Unused Block Space with 9’s :- The ACH Specification states that the blocking factor for the file is 10 records per block and if the last block in the file does not contain 10 records, then all unused record space needs to be filled with the value '9'. This is NOT required by all banks and if your bank DOES require this, then be sure to check this box.

•File Header Record Settings

oImmediate Destination - This is Field 3 of the File Header Record and represents the 9 digit number that identifies your bank as the destination of your ACH Payment file information. Your bank will provide this information. (Usually the Bank Routing Number ).

oImmediate Origin - This is Field 4 of the File Header Record and represents the 10 digit number assigned to your company by your bank. Your bank will provide this information. (Usually your Bank Account Number ; may also be your 9 digit Federal Tax ID Number preceded with 1 ).

o1st Position Blank - Check this box to put a blank character as the first character of the Immediate Origin field which overrides the first digit of this field followed by the remaining 9 digits of this field.

oDestination Name - This is Field 11 of the File Header Record and indicates the name of your bank . Your bank will provide this information.

oOrigin Name - This is Field 12 of the File Header Record and holds your company's name up to 23 characters.

•Company / Batch Header Record Settings

oCompany Name - This is Field 3 of the Company / Batch Header Record and represents your company's name up to 16 characters as it will appear on the payee's bank account statements.

oDiscretionary Data - This is Field 4 of the Company / Batch Header Record and may be required by your bank (refer to your bank's ACH specifications). If your bank requires this field, you will need to fill in the entire field for a length of 20 characters. If your bank does NOT require this field, then leave it blank. This field will be set to a blank value by default and for any existing bank accounts that already exist on the ACH settings tab. (Version 10.2.0.3 Red)

oCompany ID - This is Field 5 of the Company / Batch Header Record and represents the 10 digit number assigned to your company by your bank. Your bank will provide this information. Note : AccuBuild does not support multiple batches in the same ACH File so this field will always be the same as Field 4 of the File Header Record .

oOriginating DFI ID - This is Field 12 of the Company / Batch Header Record and represents the 8 digit Originating DFI Identification Number. Your bank will provide this information. (Usually the Bank Routing Number without the last digit .)

•Company / Batch Control Record Settings

oCompany ID - This is Field 7 of the Company / Batch Control Record and will be identical to Field 5 of the Company / Batch Header Record. This field is read-only and will be filled in automatically.

oOriginating DFI ID - This is Field 10 of the Company / Batch Control Record and will be identical to Field 12 of the Company / Batch Header Record. This field is read-only and will be filled in automatically .

•Service Class Code :- The Service Class Code setting has been added to override the default class code of "200" in the batch control records. Setting this field to "220" may be required by some banks to indicate that the file only contains "Credit" entries and NO Debit entries.

•Trace Number Format for PPD Record :- Some bank require a unique 15 digit 'trace' number be assigned to each vendor record in each batch which is similar to a check number. Choose from the following options:

oAll Zeros (Default Setting)

o9 Digit Routing Plus 6 Digit Trace Number

o8 Digit Routing Plus 7 Digit Trace Number

•Notes - Bank Specifications :- The banks listed below use the following options:

oInland Community Bank, Ca. - Use the 9 digit company phone number for Fields 4, 5 & 7; Trace number format = All Zeros.