If your company is located in the state of New Mexico or if your employees work in New Mexico, then be sure to follow these instructions in order to properly set up the payroll system.

| 1. | Payroll Integrity Tests - If New Mexico does not show up on the State Payroll Tax Information screen, then select the Payroll > Integrity Tests > All Tests option to add New Mexico (State code 35) to the company costates.adt table. |

| 2. | Payroll Properties – New Mexico employees are subject to a $2 flat amount payroll deduction which is paid into the Workers Compensation Administration Fund. This deduction is taken once per quarter and is applicable to all employees working the last day of the quarter. AccuBuild can automatically create these deductions for you but you must click on the W/Comp Deduct Enabled option (located on the State Payroll Tax Information screen) prior to beginning the timecard entries that should include this deduction. You must also remember to turn this option off before you enter timecard entries for the next pay period. Note: Employers must match the employee contribution for the Workers Compensation Administration Fund but AccuBuild will not make this accrual for you. |

| 3. | Enter Employee Beginning Balances - To establish existing year-to-date totals for New Mexico employees, use the SDI tax field to hold the Workers Compensation Administration Fund contribution when entering the handwritten check in the Payroll system. |

New Mexico - State Withholding

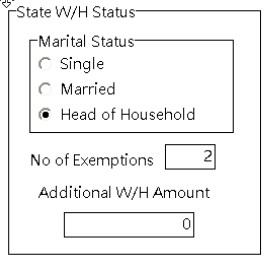

[Version 10.2] - The state withholding settings have been updated for the New Mexico State Withholding controls in order to support the 'Head of Household' Status for payroll tax calculations. New Mexico state withholding tax calculations for the 2020 tax year will now support withholding tables for Head of Household Status: