The Department Codes option is used to create and maintain a list of up to 999 department codes. Department codes are optional in most cases but they offer a multitude of choices for fine tuning your accounting system.

Reasons to Use Department Codes

•Expanded Payroll Reporting - If no department codes are used, then the time card entries will be grouped together as a single group on this report. Department codes give you flexibility to group your entries by cost center even if they post to the same expense account in the general ledger.

•Expanded General Ledger Reporting - If no department codes are used, then the time card entries will be posted to the general ledger based on two default account settings:

oJob Related Time Card Entries

oNon Job Related Time Card Entries

The default account settings are found on the Payroll > Properties > Ledger Interface Tab. Department codes allow you to assign different account numbers for each department code as necessary for income statement purposes.

•Equipment Operators and Mechanics - If you own the Equipment system, then time card entries may be used to allocate an additional cost of operating the equipment to each job. In order to use this feature, a department code must be created for equipment operators and linked to each of their time card entries. Equipment mechanics must also have their own department code in order for their time to be allocated to a piece of equipment and logged as maintenance in the equipment file.

•Payroll Burden Calculation - You may optionally elect to change how the burden amounts are calculated and posted to the job cost system for each department code:

oActual Burden Only - By default, the payroll burden attached to each time card entry will be based on actual rates of four key items:

▪Employer Payroll Taxes (FICA, FUTA, State Unemployment Ins, Employment Training Tax (California only)

▪Workers Comp Insurance

▪General Liability Insurance

▪Union Benefits

oDepartment Percentage Burden Only - This feature will allow you to expense labor burden as a fixed percentage rate of gross pay for “cost plus” type projects where the labor burden allowance is based on a fixed rate instead of the actual labor burden. The actual burden is still computed and expensed, however the percentage burden is the only amount that will be job costed.

oBoth - This option will also allow you to calculate a percentage of gross pay as burden in addition to the actual burden amounts in order to allocate overhead expenses to the jobs.

Department Code Business Rules

Whenever a time card is entered with a department code, the accounting system will look to the department code for the default job cost phase, workers compensation code, general ledger expense accounts, and payroll burden calculation method. If the workers comp code field is blank, then the system will look to the employee's file for this information. Note: If a job number is entered on the time card entry, and the job has a default workers comp code, then the workers comp code found in the job file will be used to update the time card entry screen even if the employee file and/or the department file contains a default workers comp code.

| 1. | Go to Payroll > Controls > Department Codes. Click Add to create a new code. Select Save to record your entries or select Cancel to erase your entries. Information on an existing code can be changed at any time by selecting Edit. Department codes can be deleted but you must first remove any link to an employee or union code. |

| 2. | Enter the new department information as follows: |

•Dept Code and Description - The department code field is numeric only and will accept numbers 1 through 999. The description field may contain up to 35 characters.

•General Ledger (G/L) Accounts - The general ledger expense accounts (gross wages and burden) give you more flexibility in reporting payroll costs on the income statement. For example, Corporate Officer Salaries may be reported separately from General Office Salaries on the financial statement by using different accounts with each department. Time card entries not associated with a department code will be posted to the default accounts as set up on the Ledger Interface Tab of the Payroll - Properties option.

Keep in mind that job related time card entries should be posted to general ledger accounts that have been set up with a type of 'Job Cost Account' in the Chart of Accounts. An option titled 'Enforce Direct Job Cost Rules' in the System Administrator > Configuration > Accounting screen should be enabled so that the job cost reports and the 'Job Cost Account' types in the general ledger remain in balance with each other.

If you will be using a % of gross wages to calculate your payroll burden (see below), then be sure to set the Actual Labor Burden Account field to an overhead expense account because the actual burden will not be included on the jobs.

| Note: If you have not purchased the General Ledger System, then leave the account fields blank. Detailed compensation reports by department are still available to you to assist in analyzing your payroll expenditures. |

• Job Cost Controls - Linking a job cost phase to the department code is another way to ensure that time card entries are posted to the correct cost center in the job cost reports. If the department code is not related to a job, then skip the Default Job Cost Phase field.

•Equipment Cost Controls - A department code may also be linked to a transaction type that will control how the payroll updates the various systems when the timecard entry is linked to an equipment code. (If your software package does not include the Equipment system, then these options may be ignored.)

oNon Applicable - Entries will not be posted to the Equipment system even if the timecard entry is linked to an equipment code.

oEquipment Maintenance & Repairs - This will create two records (transaction type 10) in the Equipment system, representing gross pay and payroll burden amounts, on each piece of equipment that has been linked to the timecard entries. These entries are not typically linked to a job/phase code. If the entry cannot be coded to a specific piece of equipment due to the nature of the maintenance performed, then simply skip the equipment field. This expense can be allocated to the various pieces of equipment later if the general ledger accounts associated with the department code have been set up as indirect equipment cost type accounts.

oEquipment Rental - In House - This will create a record (transaction type 21) in the Equipment system with a description of 'Rent - (Equip Desc)' using the in-house rental rate without an operator. This entry will use the associated debit and credit accounts, along with the associated job cost phase, that are found in the equipment category fields for In-house Rentals. This entry will also update the hours meter on the equipment. This entry will also create additional job cost and general ledger records with the description 'Rent - (Equip Desc)' for the equipment rental amounts (employee hours multiplied by the rental rate).

oEquipment Rental - Outside (3rd Party) - This entry is identical to the Equipment Rental - In House transaction except that it uses the outside (3rd Party) rental rates without an operator. This entry will create a record in the Equipment system with a transaction type of 26.

•Default Workers Comp Insurance Code - Each department code may be optionally linked to a workers comp code. Please refer to the documentation on the system rules for workers comp codes located in the Frequently Asked Questions section of the Payroll Manual.

•Payroll Burden Controls:

oActual - The actual calculation of payroll burden will be used. This may include the employer payroll taxes (FICA, FUTA, SUI, ETT), workers compensation insurance, general liability insurance, and union benefits. This is the default setting and will be used if another burden method is not selected. If the actual calculations are used, then the entry will debit the account listed in the Actual Labor Burden Account field at the top of the screen. The credit portion of the entry will be determined by the liability fields found on the Payroll > Properties > Ledger Interface screen.

oDepartment Percentage Burden Only - This feature will allow you to expense labor burden as a fixed percentage rate of gross pay for “cost plus” type projects where the labor burden allowance is based on a fixed rate instead of the actual labor burden. The actual burden is still computed and expensed, however the percentage burden is the only amount that will be expensed to the job.

oBoth - This option will also allow you to calculate a percentage of gross pay as burden in addition to the actual burden amounts in order to allocate overhead expenses to the jobs.

oIf you select Percentage or Both, then you will need to fill in the following fields:

▪Burden Percentage – Enter the department burden percentage. For example, 7.25% would be entered as 7.25.

▪Percentage Burden Debit Account – Enter the general ledger expense account to be used for the percentage burden amount.

▪Percentage Burden Credit Account – Enter the general ledger credit account to be used for the percentage burden amount. Remember that the percentage burden is an estimated burden amount and not an actual expense so we suggest that you set up an overhead account specifically for the credit portion of this entry (ie. 'Indirect Labor Burden Applied to Jobs'). This will help you to isolate the entries that are being made for the burden for any reporting period.

oJob Cost Actual Labor Burden – This is a read only field and is used to indicate when the actual labor burden amounts will be expensed to the jobs.

| Note: If you have a need to change the labor burden methods from project to project based on owner requirements, you can set up multiple department codes with various burden calculation methods and then use the Labor Distribution Codes to assign department codes to specific cost phases on specific jobs. Please refer to the information on Labor Distribution Codes for more information. |

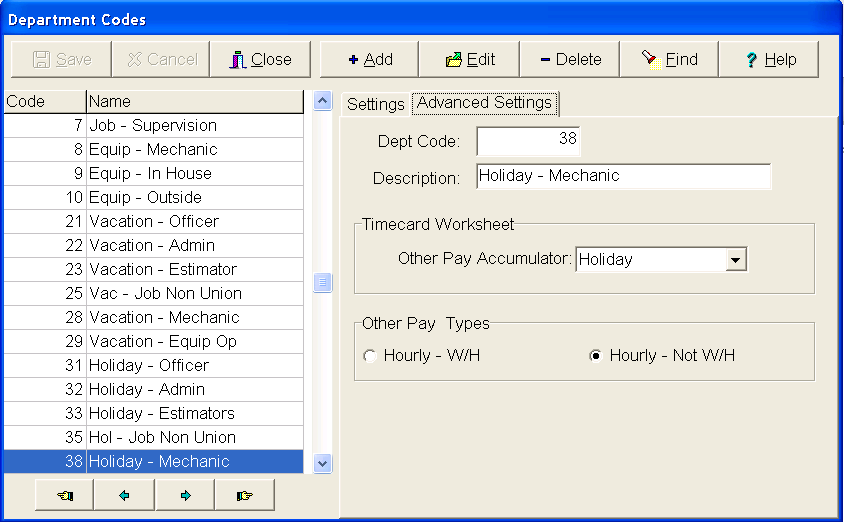

3.Enter Advanced Settings as follows:

Update the Department Codes List with new department code entries that will be used to control the Other Pay transaction types. These department codes are set up as normal but will include an additional set of fields on the Advanced Settings Tab as outlined below:

oDept Code & Description: These are read only fields that are used to show which department code is currently selected.

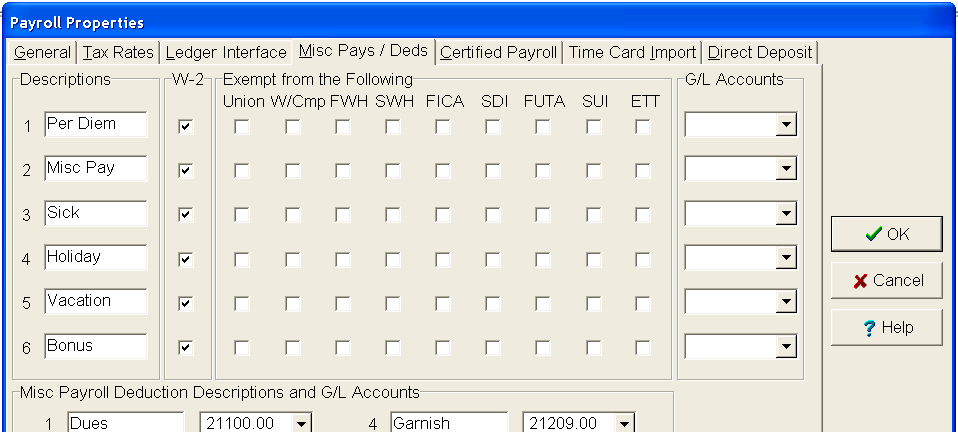

oOther Pay Accumulator: This field is used to assign the other pay accumulator that will be used for the pay transaction.The Other Pay transactions are defined on the Misc Pays / Deds Tab of the Payroll Properties Screen. Select one of the pay options from the drop down list.

oOther Pay Types: These additional settings help to define how the other pay is processed for the payroll check calculations:

•Hourly - W/H: This option represents the hourly and withheld setting. With this option, the pay amount is included as pay on the employee check, and then also withheld as a deduction. These are typically referred to as In and Out Pay types where the amount shows up as a pay amount on the payroll check and is then deducted from the net amount of the payroll check.

•Hourly - Not W/H: This option represents the hourly and NOT withheld setting and is typically how the other pay transactions are set up. The amount of the other pay is included in the pay amount on the payroll check and NOT withheld from the net amount of the check.

oTransaction Type Settings: The Department Code Advanced Settings are stored in the Department Master Table using the associated time card transaction type for other pays. The various transaction type settings are listed below and are stored in the INTEGER1 Field of the Department Master Table:

•0 = Not Enabled

•11 - Misc Pay 1 - Hourly - W/H

•17 - Misc Pay 1 - Hourly - Not W/H

•12 - Misc Pay 2 - Hourly - W/H

•18 - Misc Pay 2 - Hourly - Not W/H

•13 - Misc Pay 3 - Hourly - W/H

•19 - Misc Pay 3 - Hourly - Not W/H

•71 - Misc Pay 4 - Hourly - W/H

•77 - Misc Pay 4 - Hourly - Not W/H

•72 - Misc Pay 5 - Hourly - W/H

•78 - Misc Pay 5 - Hourly - Not W/H

•73 - Misc Pay 6 - Hourly - W/H

•79 - Misc Pay 6 - Hourly - Not W/H

oThe timecard worksheet screen is where the other pay transactions are processed. This process takes place during the Import option where the timecard worksheet entries are imported for processing payroll checks. As each worksheet record is imported, the department code for that record is checked against the department master record setting for that department. If the department is set up with an transaction override setting (as indicated on the Advanced Settings Tab of the Department List), AND the worksheet record pay transaction is set for Regular or Overtime Pay, then the transaction type on the worksheet record will be changed to the Other Pay setting from the Department Master List.

•Salaried Employee Time: This transaction code override feature will also work for timecard worksheet entries that are entered for salaried employees that are set up for Salary - Distributed Hours or Salary @ 40 Hrs - Mobile.

•Overtime Pay Transactions: The pay rates for the Other Pay transactions will be based on the employee’s regular pay rate. It is important to note that all overtime entries will be processed for the department code override feature, however, the Other Pay amount will be computed based on the regular pay rate only and the overtime factor for the computed other pay amount will be ignored.