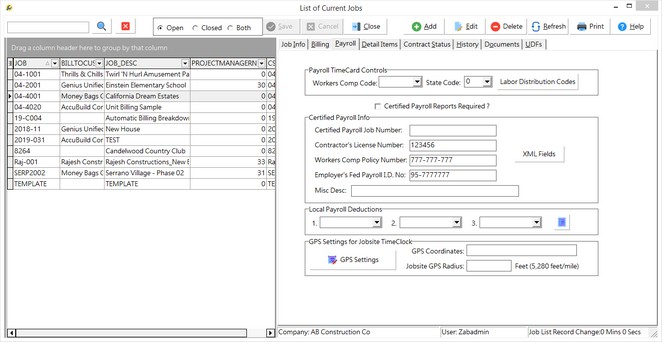

The Job Master option is a link to the Job Cost > Update Jobs option and is primarily used by AccuBuild users who have purchased the stand-alone payroll system. The stand-alone payroll package allows access only to the basic job information for certified payroll report and local deduction purposes.

| 1. | Select the Job Master option to display the List of Jobs screen. If you own the stand-alone Payroll System, only the information contained on the Job Info Tab and the Payroll Controls Tab will need to be entered. |

| 2. | On the Job Info Tab, select Add to enter a new job number and description. The job number may contain up to eight alpha/numeric characters and the description field may contain up to thirty-five characters. If the job number already exists, then select the appropriate job and select Edit to make any necessary changes. The job address, city, state and postal code should be entered as well as this information will be printed on the certified payroll report. |

| 3. | Select the Payroll Controls Tab and complete the following information: |

| Certified Payroll Reports Required ? - This option will be automatically enabled every time that a new job is set up. If this option is enabled, then you will be automatically prompted on the timecard entry screen to certify the hours for that transaction. If you do not require certified payroll reports on a job, simply click on the box to remove the check mark. |

| Certified Payroll Job Number - This field will be printed as the project number on the certified payroll report. In most cases this field will be the same as the job number field, however, if the owner has a different project number that should be printed on the report, you can enter that number here without affecting the actual job number in the accounting system. |

| Contractor's License Number, Workers Comp Policy Number, Employer's Fed Payroll I.D No - This information is automatically copied from the Accounting Tab on the System Administrator > Configuration screen. If you do not want this information to appear on the certified payroll report, then erase the data in these fields. |

| Misc Desc - This field can be used to print additional job information on the certified payroll report that could not be included in the job description or address fields. This field may contain up to fifty alpha/numeric characters. |

| Local Deduction Code - If your employees work in a state where a city or county payroll tax is based on the job location, then a local deduction code must first be set up for the specific tax. Up to three local tax codes may be linked to a single job. |

| 4. | Select Save to either add the job to the Job Master file or to record your changes to an existing job. |