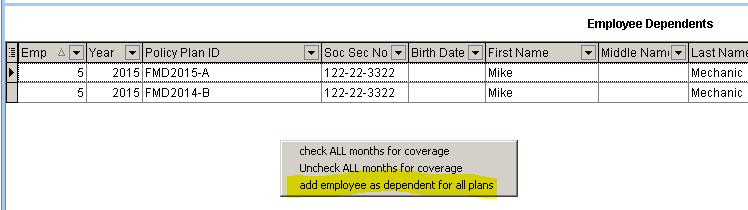

This update is mainly dedicated to all of the new features and reports for the Affordable Care Act Reporting (ACA) for 2015. Many new enhancements have been made to the ACA Screens along with a basic outline of how to proceed with the setup of your employee health insurance information. Aatrix will be updating their software for end users to begin testing the process for the new ACA Tax forms on December 20, 2015. AccuBuild already contains the program menu option to handle the new ACA Forms processing in anticipation of the December 20th update from Aatrix.

Please be sure to review ALL of the release notes in addition to the ACA Enhancements for other important changes and enhancements. The ACA Setup Overview outline can be found on the last pages of these release notes.

Release Notes for 9400 RED

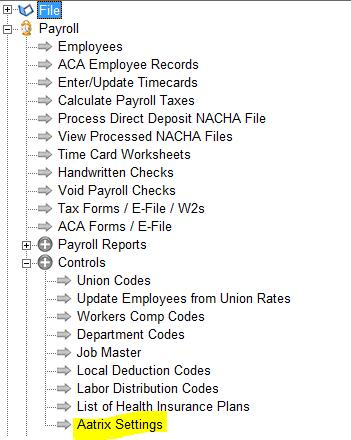

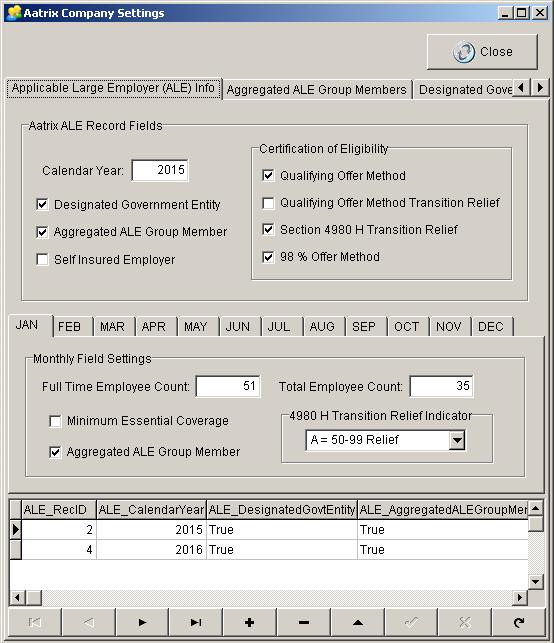

Aatrix Company Settings – Update to Setting Controls

The new Company Settings screen for Aatrix Forms has been updated to eliminate confusion on two of the new information tabs:

•Paid Preparer Info – This tab has been disabled and is now marked as Reserved for Future Use in order to avoid any confusion. The information on this tab is NOT required for the new ACA reporting requirements with Aatrix.

•Designee Info – This tab has been disabled and is now marked as Reserved for Future Use. The information on this tab is NOT required for the new ACA reporting requirements with Aatrix.

•Designated Government Entity – This tab was re-positioned to the left of the Paid Preparer Info and IS part of the new ACA reporting fields.

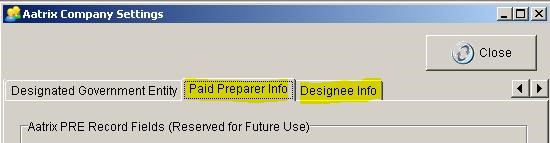

Client List – New 1099 Related Fields

The Acct Tab on the Client List (Vendors, Customers, etc.) was updated with two new fields for the electronic consent of 1099 Forms that are filed via the Aatrix Software:

•Electronic Consent – Check this box if the vendor / subcontractor has consented to an electronic 1099.

•Email Address – Enter the email address for the 1009 to be sent to

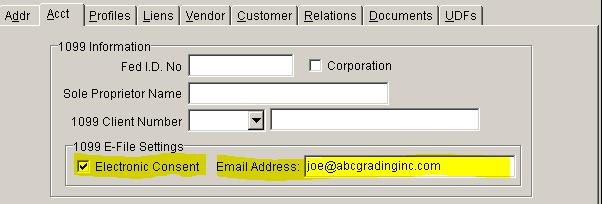

Payroll – ACA Employee Records Screen Enhancements

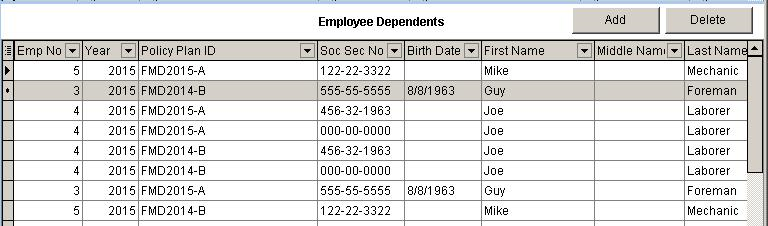

•The Employee Dependents Grid has a new pop-up menu option entitled “add employee as dependent for all plans” which is used to add employees as dependents for each insurance plan for the selected year. You must choose a single year from the Employee List settings in order to use this feature. It is also recommended to have the “Show ALL Employee Records” checkbox checked in order to see the new records as they are added.

The purpose for this feature is for self-insured plans where the ACA reporting requirement need to have the employee listed as a dependent in addition to any other dependents on the employee’s health plan. This routine will check to make sure that all employee plans listed in the Employee Coverage Information Grid are added to the Employee Dependents Grid if they are missing. Each new dependent record will include the plan information along with the employee name, social security number, and birth date which are pulled from the employee list.

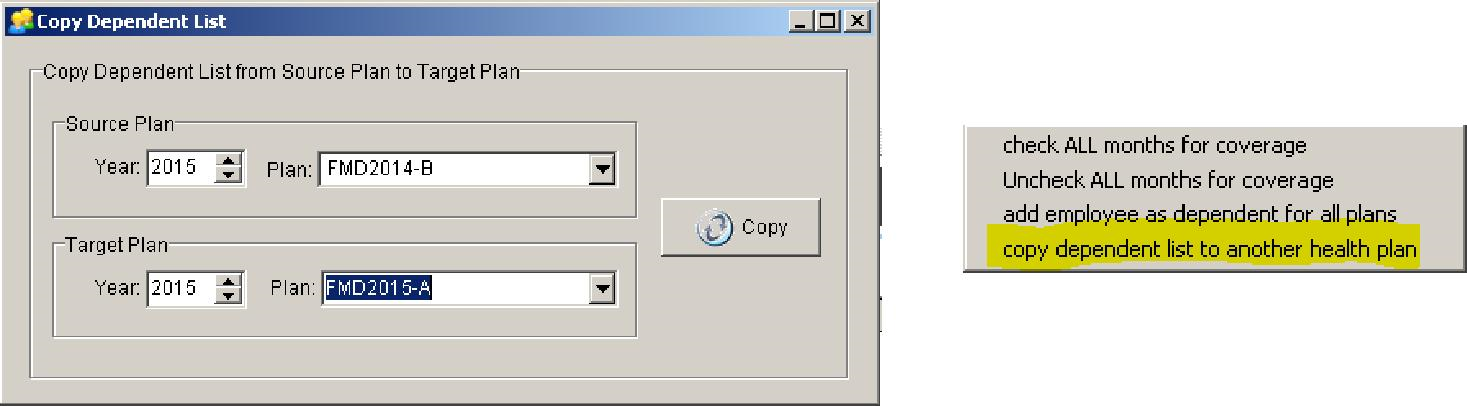

•The Employee Dependents Grid has another new pop-up menu option entitled “copy dependent list to another health plan” which is used to copy employees dependents from one health plan (Source Plan) to another health plan (Target Plan). This feature is very useful for setting up new health plans at the insurance renewal, and works by automatically duplicating the dependent list from one plan to another.

When this option is selected from the pop-up menu, a screen will be displayed entitled “Copy Dependent List”. Select the Year and Plan from the Source Plan Group and the Target Plan Group. This list of plans in the in both of these groups are queried from the Employee Coverage Information Grid. Once the plans have been selected, click the Copy Button to copy the dependents from the Source Plan to the Target Plan.

NOTE: Only the dependent records for employees that exist in both plans will be copied.

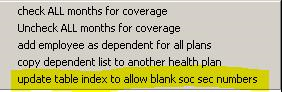

•The Employee Dependents Grid has another new pop-up menu option entitled “update table index to allow blank soc sec numbers” which is used to change the original index file business rules to allow multiple employee dependent records to have blank social security numbers. This option will update the table index to change the unique list of fields from the Original Field List to the New Field List as shown below:

Original Field List: Employee No, Year, Soc Sec Number, Policy ID

New Field List: Employee No, Year, Soc Sec Number, Birth Date, Policy ID, First Name, Middle Name, Last Name

For ACA reporting on Self-Insured plans, the dependent list requires the social security number for each dependent. If the social security number is not provided, the birth date of the dependent can be used. Therefore, if you need to add multiple dependents for the same employee where the social security numbers are not available, this option will allow you to add these dependents without getting a duplicate index violation error message.

IMPORTANT NOTE: You will need exclusive use to the AatrixECIInfo table in order to create the new index. If the index creation process fails, you will need to get other users out of the system and try the process again.

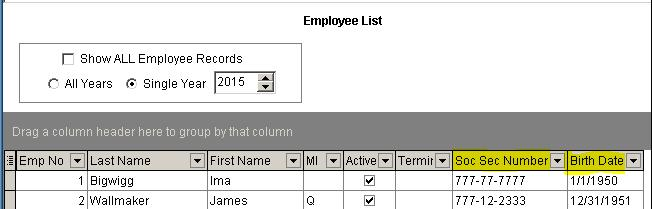

•The Employee List Grid has been updated with two new fields which include the social security number and the employee’s birth date. These fields are hidden by default but can be exposed in the grid if desired. These fields can be useful when setting up employees on the Employee Dependents Grid.

•The Add Button for the Employee Dependents Grid will now use the employee number that is selected on the Employee Coverage Grid for the added dependent record instead of the employee number that is selected in the Employee List Grid. In addition, you must select a single record in the Employee Coverage Grid to use this option.

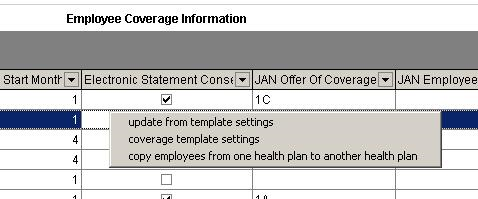

•The Employee List Grid has been updated with a new pop-up menu (right-click) with the following menu options:

oupdate from template settings – Same process that is called from the “Update from Template Settings” button.

ocoverage template settings – Same process that is called from the “Coverage Template Settings” button.

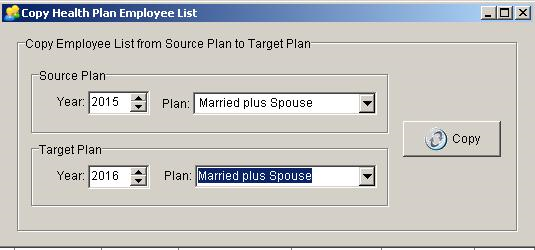

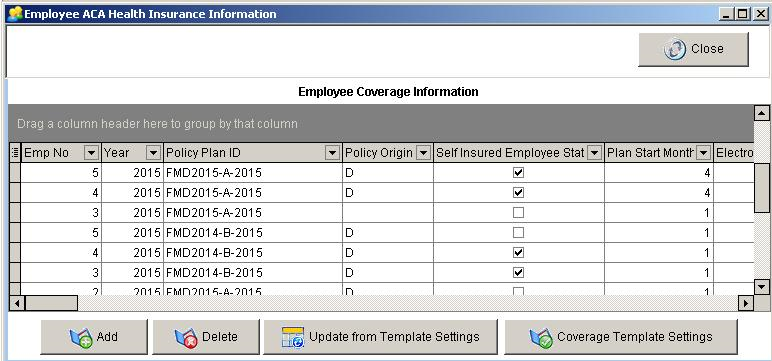

oCopy employees from one health plan to another health plan – This feature is used to copy all of the employees that are listed under one health plan in the Employee List Grid, to a new health plan that is selected from the ”Health Insurance Plan Master List”. This feature will be very useful at policy renewal in order to set up employees for a new policy or new plan year.

Source Plan: Select the Source Plan Year and Plan Description. This list of Insurance Plans is obtained from the Employee Coverage Information Grid.

Target Plan: Select the Target Plan Year and Plan Description. This list of Insurance Plans is obtained from the Health Insurance Plan Master List.

Copy Button: Click the Copy Button to duplicate the employees from the Source Plan to the Target Plan.

Important Note: All of the Settings from the Source Plan will be copied exactly for each employee into the Target Plan based on the current settings in the Employee Coverage Information Grid. You will then want to update these Target Plan settings based on the current settings in the Health Plan Master as using the following steps:

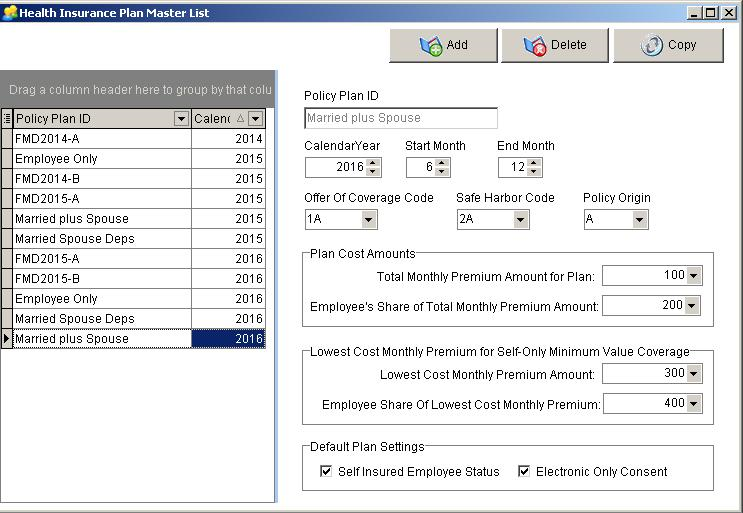

1.Review the Target Plan Settings in the Health Insurance Plan Master List:

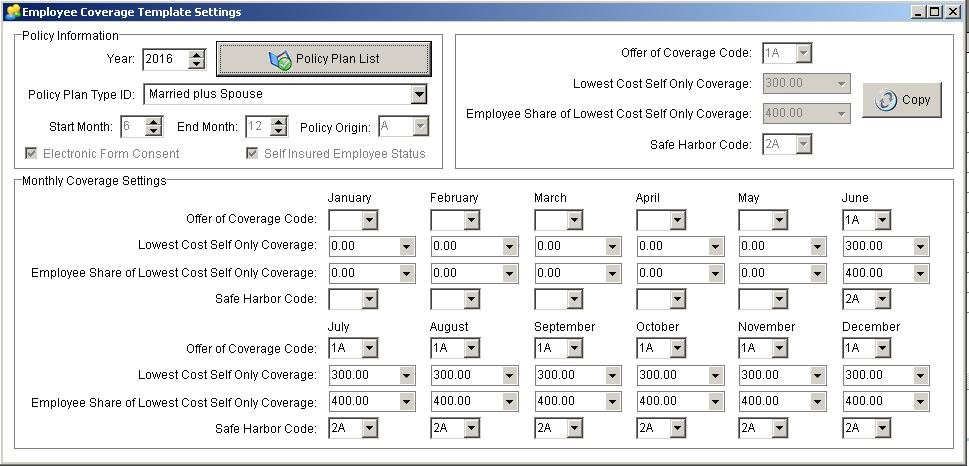

2.Select the Target Plan Policy and Year from the Employee Coverage Template Settings Screen:

3.Click the Copy Button to fill in the all the fields in the Monthly Coverage Settings section of the Employee Coverage Template Settings Screen.

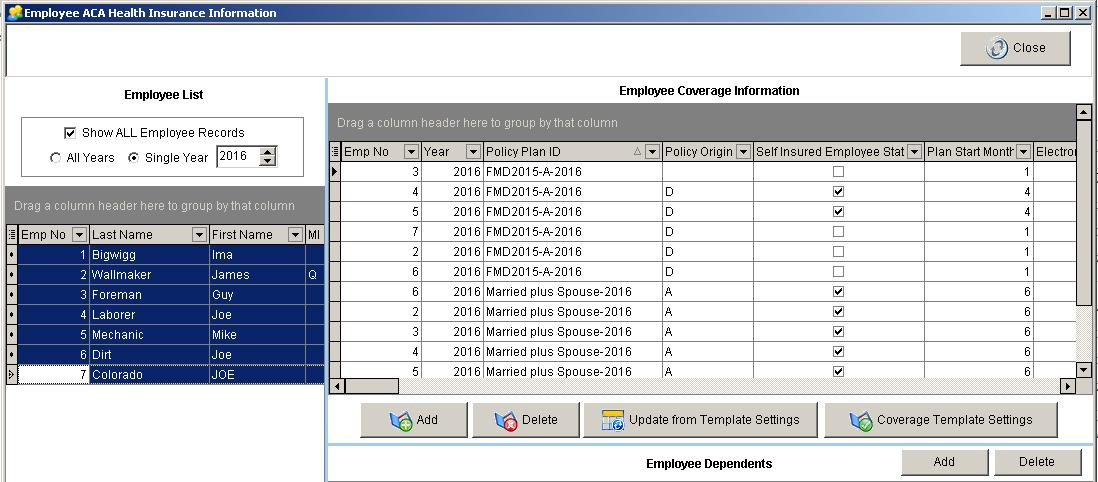

4.Select all the employees to be updated with the new Target plan settings from the Employee List Grid on the Employee ACA Health Insurance Information Screen.

5.Click the Update from Template Settings Button to apply the Health Plan Master Settings to the selected employees for the new Target Plan.

MAR – New Payroll Reports for ACA information

•Four new Payroll Reports have been added to the MAR Library for reporting on the new employee health insurance information for the Affordable Care Act:

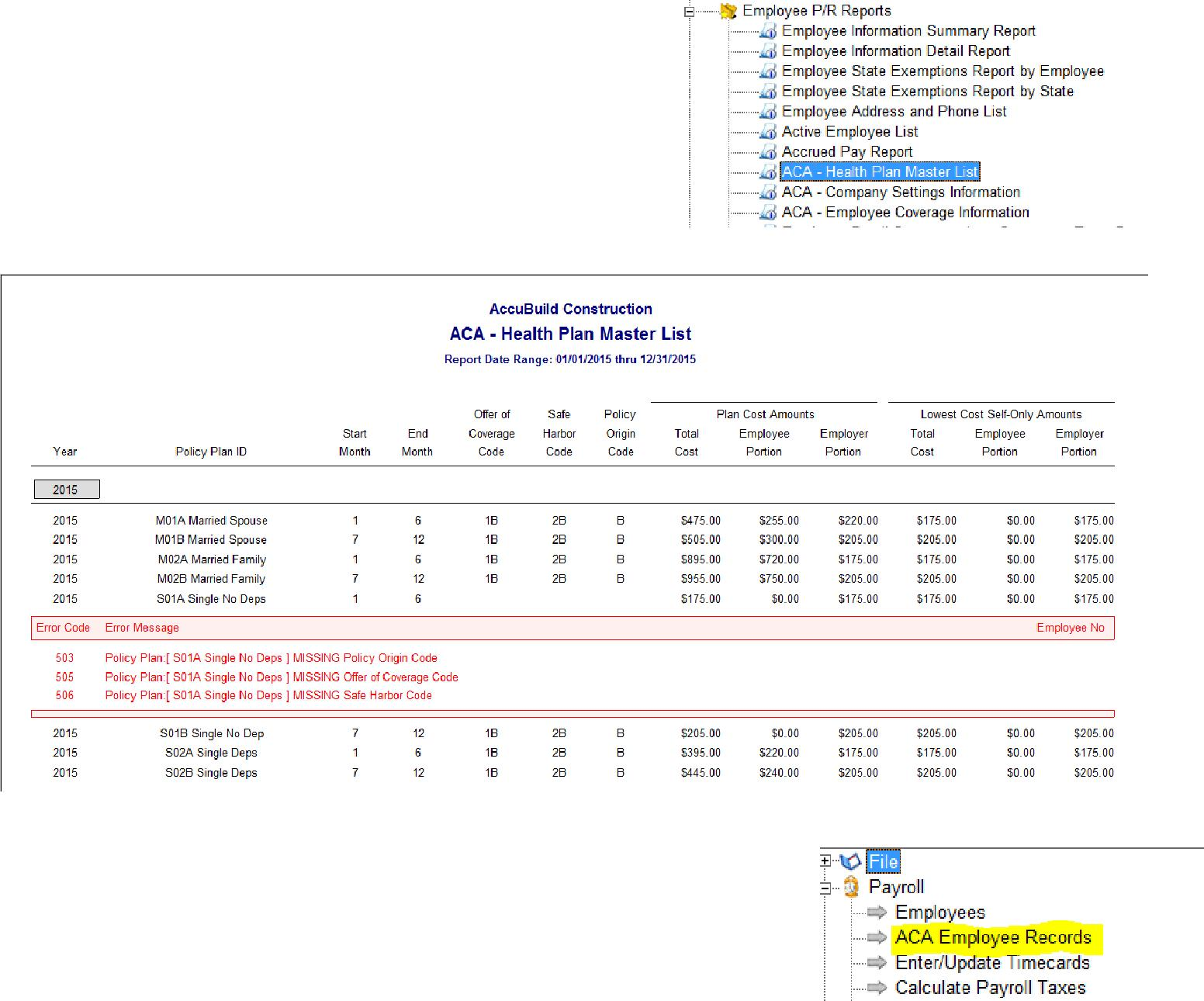

oPRREP01H.624 - ACA Health Plan Master List – This report lists all of the Insurance Policy Plans and related settings along with any errors for missing fields or invalid settings.

oPRREP01I.624 – ACA Company Settings Information – This report lists all of the company settings for ACA including the ALE Monthly Settings and Controls, Aggregated ALE Group Members, and Designated Government Employer Information. Error codes are included in the report for validating field information.

oPRREP01J.624 – ACA Employee Coverage information Report – This Report lists all of the employee plan information including dependent records and other coverage records where applicable.

oPRREP03D.608 – Employee Hours Report – This Report lists the total hours for each employee for the reporting period with monthly subtotals at the employee level. This report can be very useful when determining you company’s ALE Status and for filling out the ALE Information Tab on the Aatrix Company Information Screen.

IMPORTANT NOTE: You will need to audit each employee's totals to make sure the hour totals are accurate. Additional factors that can impact total hours include employees that are paid on a salary basis with no hours and any other pay transactions. Hours that are entered with Other Pay transactions ARE included in the report totals.

BE SURE to check with your company CPA, Controller, or an ACA Consulting Expert when determining your ALE Status for ACA and filling in the various fields on the Aatrix Company Information Screen.

ACA – Error Code Reference List

•The new MAR Payroll Reports for ACA Reporting reference a variety of error codes which relate to the new ACA Screens in AccuBuild. These error codes are documented below:

Health Insurance Plan Error Codes (500–511) - These error codes are related to the records in the AatrixECVTemplate Table which are set up via the Health Insurance Plan Master List Screen:

•500 - Policy Plan ID Field is blank.

•501 - Policy Plan is MISSING the Starting Month.

•502 - Policy Plan is MISSING the Ending Month.

•503 - Policy Plan is MISSING the Policy Origin Code.

•504 - Policy Plan is MISSING the Self Insured Employee Status.

•505 - Policy Plan is MISSING the Offer of Coverage Code.

•506 - Policy Plan is MISSING the Safe Harbor Code.

•507 - Policy Plan is MISSING the Employee Share of Total Cost of Coverage Amount.

•508 - Policy Plan is MISSING the Total Cost of Coverage Amount.

•509 - Policy Plan is MISSING the Lowest Cost of Self Only Coverage Amount.

•510 - Policy Plan is MISSING the Employee Share of Lowest Cost of Self Only Coverage Amount.

•511 - The Health Plan Self-Insured Setting does NOT match the Employer Self-Insured Setting (Aatrix Company Settings Screen).

Employee Insurance Coverage Information Errors (1000–5500) - These error codes are related to the records in the AatrixECVInfo Table which are set up via the Employee ACA Health Insurance Information Screen in the Employee Coverage Information Grid:

•1000 - Offer of Coverage OVERLAP - Multiple Offer of Coverage Codes for the same month.

•1100 - Safe Harbor OVERLAP - Multiple Safe Harbor Codes for the same month.

•1200 - Employee Share of Coverage OVERLAP - Multiple Employee Share of Coverage Amounts for the same month.

•1300 - Total Cost of Coverage OVERLAP - Multiple Total Cost of Coverage Amounts for the same month.

•2000 - Offer of Coverage MISSING - WARNING that Offer of Coverage Code is missing for the month.

•2100 - Safe Harbor MISSING - WARNING that Safe Harbor Code is missing for the month.

•2300 - Total Cost of Coverage MISSING - Warning that there is no Total Cost of Coverage for the month.

•3000 - The Employee Setting for the Offer of Coverage Code DOES NOT MATCH the Policy Plan Master Setting.

•3100 - The Employee Setting for the Employee Share Of Lowest Cost Self Only Coverage DOES NOT MATCH the Policy Plan Master Setting.

•3200 - The Employee Setting for the Lowest Cost Self Only Coverage DOES NOT MATCH the Policy Plan Master Setting.

•3300 - The Employee Setting for the Safe Harbor Code DOES NOT MATCH the Policy Plan Master Setting.

•3400 - The Employee Setting for the Policy Origin Code DOES NOT MATCH the Policy Plan Master Setting.

•3500 - The Employee Setting for the Self Insured Employee Status DOES NOT MATCH the Policy Plan Master Setting.

•3600 - The Employee Setting for the Plan Start Month DOES NOT MATCH the Policy Plan Master Setting.

•5000 - The Employee Setting for the Safe Harbor Code Should Be Blank per the Policy Plan Master Setting.

•5100 - The Employee Setting for the Offer of Coverage Code Should Be Blank per the Policy Plan Master Setting.

•5200 - The Employee Setting Amount for the Employee Share Of Minimum Coverage Should Be Zero per the Policy Plan Master Setting.

•5300 - The Employee Setting Amount for the Total Cost Of Minimum Coverage Should Be Zero per the Policy Plan Master Setting.

•5400 - WARNING - The employee has earnings for Reporting Period (Year), but there are NO Employee Coverage Information Records for ACA Reporting.

•5500 - The Employee Self-Insured Setting does NOT match the Employer Self-Insured Setting (Aatrix Company Settings Screen).

Employee Dependent Setting Errors (6000–7700) - These error codes are related to the dependent records in the AatrixECIInfo Table which are set up via the Employee ACA Health Insurance Information Screen in the Employee Dependents Grid:

•6000 - The Dependent should NOT be Covered for the month per the Policy Plan Master Settings for the Policy Period Dates. Make sure dependent coverage is not outside the policy start and stop months.

•6100 - The Dependent setting for the Safe Harbor Code should not be set per the Policy Plan Master Settings for the Policy Period Dates. Make sure dependent coverage is not outside the policy start and stop months.

•6200 - The Dependent setting for the Offer of Coverage Code should not be set per the Policy Plan Master Settings for the Policy Period Dates. Make sure dependent coverage is not outside the policy start and stop months.

•7000 - The Dependent entry is MISSING the Policy Plan ID.

•7100 - The Dependent entry has an INVALID social security number. Social Security Number MUST be entered with format of 999-99-9999 unless birth date is provided.

•7200 - The Dependent entry has NO social security number and NO birth date. One of these two fields MUST be provided for self insured plans.

•7300 - The Dependent entry is missing the FIRST Name field.

•7400 - The Dependent entry is missing the LAST Name field.

•7500 - The Dependent entry is missing the YEAR field.

•7600 - A Dependent entry exists for an employee that is not listed in the Coverage Information.

•7700 - The Employee Dependent Record is missing in the Employee Dependent List. For Self-Insured Plans, a list of employee dependents is required and the Employee (identified by the social security number) MUST be included in this list.

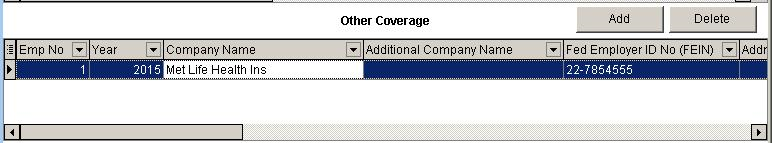

Employee Other Coverage Information Errors (14000-14600) - These error codes are related to the other coverage provider records in the AatrixOCPInfo Table which are set up via the Employee ACA Health Insurance Information Screen in the Other Coverage Grid:

•14000 - The Other Coverage Provider Record is missing the Company Name field.

•14100 - The Other Coverage Provider Record is missing the Federal Employer ID No (FEIN) field.

•14200 - The Other Coverage Provider Record is missing the Address 1 field.

•14300 - The Other Coverage Provider Record is missing the City field.

•14400 - The Other Coverage Provider Record is missing the State field.

•14500 - The Other Coverage Provider Record is missing the Zip Code field.

•14600 - The Other Coverage Provider Record is missing the Contact Phone Number.

Company Settings Information Errors (9000–13600) - These error codes are related to the records in the AatrixCompanyInfo Table (Designated Government Entity Info), the AatrixALEInfo Table (Company ALE Settings Info), and the AatrixAGGInfo Table (List of ALE Aggregated Group Members). All of the field information for these tables is set up in the Aatrix Company Settings Screen:

Designated Government Entity Errors:

•9000 - The Designated Government Entity Setting is ENABLED (Aatrix Company Settings Screen) - But the Designated Government Entity NAME field is blank.

•9100 - The Designated Government Entity Setting is ENABLED (Aatrix Company Settings Screen) - But the Designated Government Entity FEDERAL EMPLOYER TAX ID field is blank.

•9200 - The Designated Government Entity Setting is ENABLED (Aatrix Company Settings Screen) - But the Designated Government Entity ADDRESS 1 field is blank.

•9300 - The Designated Government Entity Setting is ENABLED (Aatrix Company Settings Screen) - But the Designated Government Entity CITY field is blank.

•9400 - The Designated Government Entity Setting is ENABLED (Aatrix Company Settings Screen) - But the Designated Government Entity STATE field is blank.

•9500 - The Designated Government Entity Setting is ENABLED (Aatrix Company Settings Screen) - But the Designated Government Entity ZIP CODE field is blank.

•9600 - The Designated Government Entity Setting is ENABLED (Aatrix Company Settings Screen) - But the Designated Government Entity CONTACT FIRST NAME field is blank.

•9700 - The Designated Government Entity Setting is ENABLED (Aatrix Company Settings Screen) - But the Designated Government Entity CONTACT MIDDLE NAME field is blank.

•9800 - The Designated Government Entity Setting is ENABLED (Aatrix Company Settings Screen) - But the Designated Government Entity CONTACT LAST NAME field is blank.

•9900 - The Designated Government Entity Setting is ENABLED (Aatrix Company Settings Screen) - But the Designated Government Entity CONTACT PHONE field is blank.

•10000 - The Designated Government Entity Setting is ENABLED (Aatrix Company Settings Screen) - But the Designated Government Entity RECORD COUNT is invalid - Must have 1 Record per Company.

Aggregated ALE Group Member Errors:

•11000 - The Aggregated ALE Group Member Setting is ENABLED (Aatrix Company Settings Screen) - But there is no related ALE Member Record for the company. ALE Member Record must have a MATCHING Federal Tax ID.

•11100 - The Aggregated ALE Group Member Setting is ENABLED (Aatrix Company Settings Screen) - But there are MULTIPLE related ALE Member Record for the company. Only 1 ALE Member Record is allowed that has a MATCHING Federal Tax ID.

Company General Setting Errors:

•13000 - The Certificate of Eligibility Setting for 4980 Transaction Relief DOES NOT Match the Monthly Setting for 4980 Transaction Relief Indicator.

•13100 - The Minimum Essential Coverage is NOT CONSISTENT for all 12 Months on Employer ALE Record Settings.

•13200 - The Aggregated ALE Group Member Setting is NOT CONSISTENT for all 12 Months on Employer ALE Record Settings.

•13300 - WARNING - The Total Employee Count is zero for the specified month.

•13400 - WARNING - The Full Time Employee Count is zero for the specified month.

•13500 - The Total Employee Count is LESS THAN the Full Time Employee Count for the specified month.

•13600 - WARNING - ALE Group Member has less than 50 Full Time Employees for the specified month.

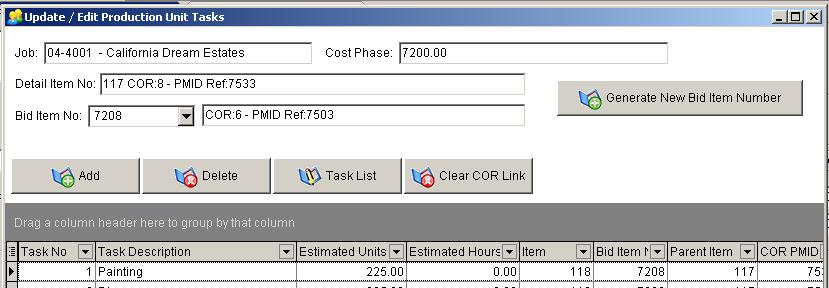

Production Units by Detail Item – Enhancements

The Update / Edit Production Unit Tasks Screen has been updated with new features for interacting with Bid Items that are linked to Change Order Requests (CORs) in Project Management.

•When the screen is launched from the COR Log, it will now check to see if any Bid Items exist for the cost phase associated with the COR. If there are NO Bid Items associated with the cost phase, then a new bid item number will be generated automatically for the COR, and a message will be displayed to the user indicating the new bid item number.

If there are bid items already associated with the cost phase of the COR, then you can select from any of the existing bid items in the list for the COR. If you need a new bid item number for the COR, then use the Generate New Bid Item Number Button, and the next sequential bid item number will be generated AND assigned automatically.

•The Task List grid on the bottom half of the screen has been updated with a new field for the COR PMID Number associated with each task. This will make it easier to identify tasks that are linked to a change order request.

•Changes to the task information including the task description, task number, estimated hours, and estimated units will now be synchronized with the COR Record information when the task is linked to a COR.

•Changes to the bid item number or bid item description will now be synchronized with the COR Record information when the task is linked to a COR.

•BUG FIX - A bug was fixed on the Clear COR links button where the process was failing.

•BUG FIX - The Units and Hours for new Tasks added to COR Breakdown Items were flip flopped on the PROJMGMT COR Record.

Production Unit by Detail Item – BUG FIXES

•When a new Bid Item Number was being generated for a COR Breakdown Item, the screen was reverting back to the first bid item in the group instead of changing the current set of production unit records to the newly generated bid item. This problem has been corrected.

•On the COR Log, when a new COR Number was created using the Duplicate Highlighted menu, if the COR was related to a Bid Item for Production Unit tracking, the Bid Item information and associated task records were being duplicated into the new COR. This process has been corrected to clear any links to production and ignore production task records when duplicating the COR.

NOTE: New COR Log entries are NOT yet linked to the accounting system and therefore they cannot be linked to Production Units. When a new COR Log is created, any links to Accounting and Production must be created again in the COR Breakdown Screen.

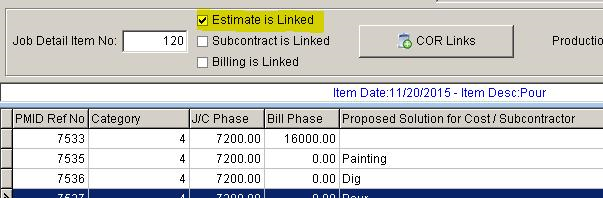

•When new tasks were added to a BID Item that was linked to a COR in project management, the cost link flag (Estimate is Linked checkbox) was not being set properly on the new tasks. When the cost link was not established, any changes to the estimated units on the COR Log were not being updated for the associated task hours for production tracking. This problem has been corrected and the tasks will be updated if the related COR Breakdown record is updated.

NOTE: The COR Breakdown screen MUST be CLOSED before any changes to the tasks are updated in production.

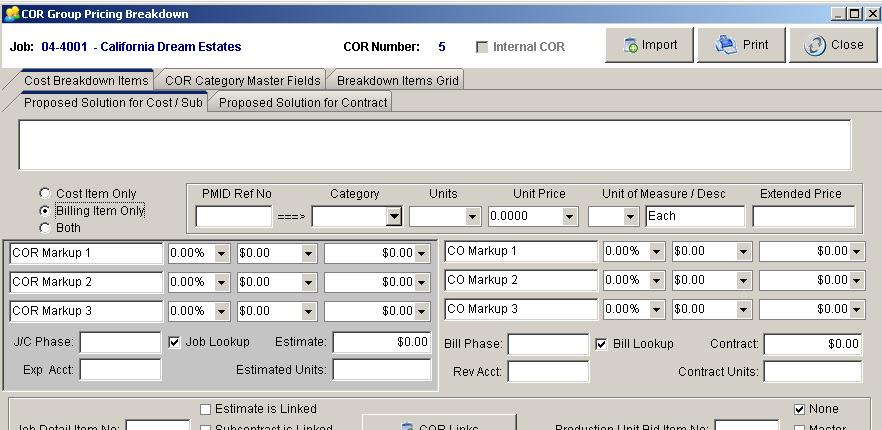

COR Breakdown Screen – Enhancements

•When linking a COR Breakdown item to production unit bid items, the system will now warn the user if the contract units are zero as units will need to be non-zero for production unit tracking.

•A cosmetic change was made to the COR Breakdown Screen in order to visually show the fields that are affected when the Cost Item Only or Billing Item Only options are selected. The set of fields relating that are disabled will be indented and the background color will be a light gray color.

MAR – New Library Form for ADMS Forms

•A new Preliminary Notice Form was added for the state of Texas to the ADMS Forms:

oCLPRELM2.244 – Preliminary Notice - Texas

MAR – New Payroll Check and Direct Deposit Forms

•New MAR Check Format – A new check format has been added to the MAR Library along with new report script for Report Class 261 which creates new data tables for summarizing Other Pay transactions by Department Code with the Department Description used for the pay transaction description. The new data table name is “TimecardPayTransactionDeptDesc“. This will help the new pay stub format to show more clearly the types of pay when department codes are used for setting up other pays.

oPRCHECK4.261 - Payroll Check - Stub-Check-Stub Dept Desc

•New Employee Direct Deposit Statement Format – A Direct Deposit Statement has been added to the MAR Library along with new report script for Report Class 263 which creates new data tables for summarizing Other Pay transactions by Department Code with the Department Description used for the pay transaction description. The new data table name is “TimecardPayTransactionDeptDesc“.

oPRDDEP3.263 - Employee Direct Deposit Statement Dept Desc

MAR Reports – Vendor Activity Report Update

•The Vendor Activity Reports for MAR have been updated to fix an issue when a joint check receipt is entered without a check number.

oAPREP07.594 Vendor Activity Report – Partial By Job

oAPREP07.595 Vendor Activity Report – Partial By Vendor

ACA Setup Overview

This outline will help you to set up your company's health insurance information in preparation for the Affordable Care Act reporting. Each step should be completed in the order given. Detailed instructions for each step are provided in the ACA documentation found in the 9400 release notes and the changes found in the 9400 RED release notes.

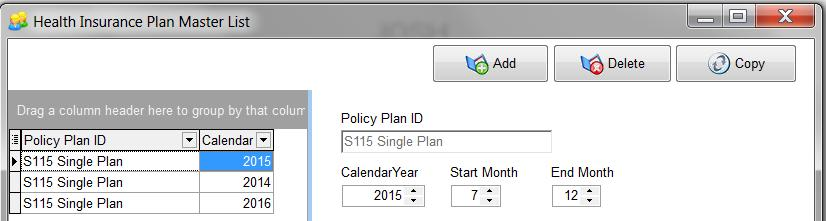

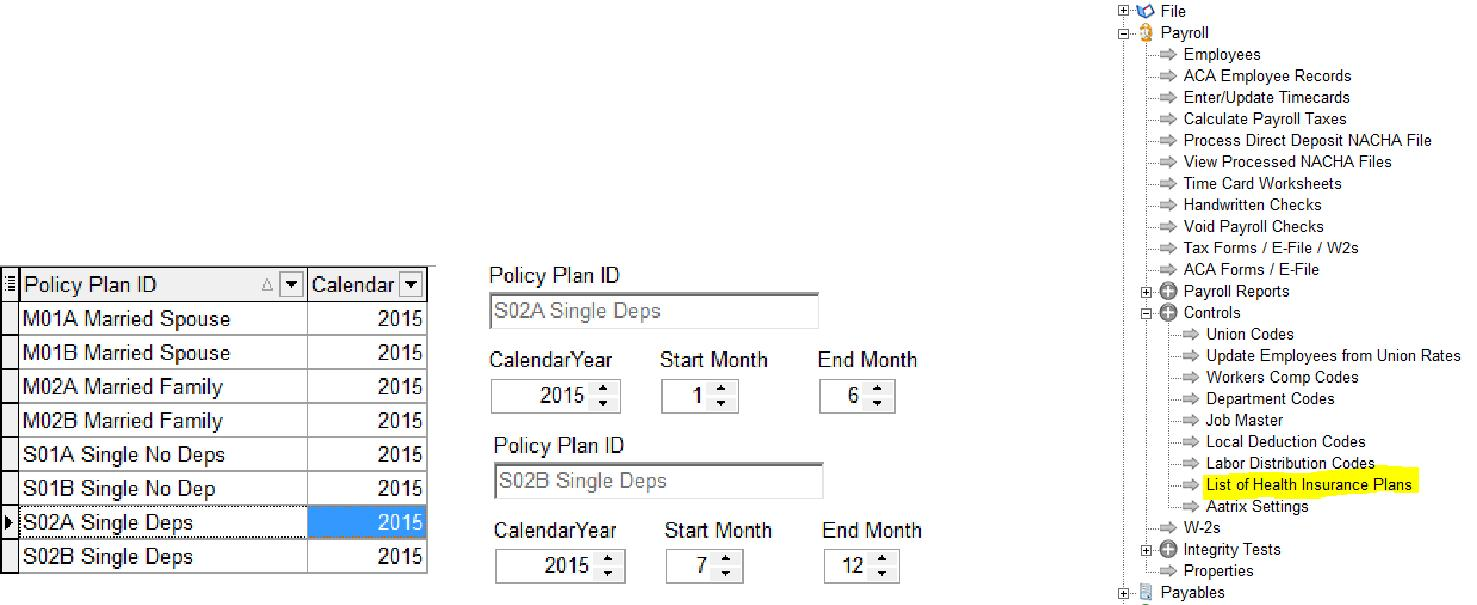

1.Set up Health Plan Master Table – Payroll|Controls|List of Health Insurance Plans menu option. If the health plans are not renewed on a calendar year basis, then you will want to set up two sets of codes for each calendar year. For example, code “A” for the first part of the calendar year and code “B” for second part of calendar year.

2.Print the ACA Health Plan Master List report and check for any errors in the health plan master list. If any errors are found, make the corrections before continuing on. Most error messages are self-explanatory but you may refer to the 9400 Red release notes for more detail on the error codes.

3.Set up Employee Insurance Plan Information – Payroll|ACA Employee Records menu option.

4.Print the ACA Employee Coverage Information report and check for any errors in the employee health plans. Most error messages are self-explanatory but you may refer to the 9400 Red release notes for more detail on the error codes.

5.Set up Aatrix Company Settings – Payroll|Controls|Aatrix Settings menu option. This screen contains fields for the ACA reporting through Aatrix. The fields on this screen will be used to report your total employee count and your full time employee count on a month by month basis. To assist you with this task, print the Employee Hours Report and verify the report for accuracy. Be sure to run the report for the entire calendar year. This report is provided as a tool only but the employee totals MUST be audited to make sure that the information is correct. Factors such as salaried employees that have been entered without hours, or miscellaneous pay entered without hours, will impact the report results.