2024 UPDATE FEES RELEASE

•Initial Software Release for 2024

This update is the first software release for 2024 and will require that the 2024 Update Fees are current. AccuBuild Version 10.2.0.7 is the last update for the 2023 Update Fees renewal. Please contact AccuBuild Support for more information on update renewals.

PAYROLL

•ENHANCEMENT - Payroll Tax Tables for 2024

•Federal tax Tables for 2024

oAlabama - OT Pay exemption for 2024

oArkansas - new tables for 2024

oCalifornia - new tables for 2024

oColorado - new tables for 2024

oConnecticut - new tables for 2024

oGeorgia - new tables for 2024

oIndiana - new tables for 2024

oIowa - new tables for 2024

oKentucky - new tables for 2024

oMaine - new tables for 2024

oMichigan - new tables for 2024

oMinnesota - new tables for 2024

oMississippi - new tables for 2024

oMissouri - new tables for 2024

oMontana - new tables for 2024

oNebraska - new tables for 2024

oNew Mexico - new tables for 2024

oNorth Carolina - new tables for 2024

oOklahoma - new tables for 2024

oOregon - new tables for 2024

oRhode Island - new tables for 2024

oSouth Carolina - new tables for 2024

oVermont - new tables for 2024

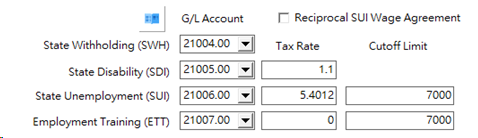

•ENHANCEMENT - California State Disability (SDI) Cutoff Limit

The cutoff limit for SDI in California has been eliminated for 2024. AccuBuild will no longer consider a cutoff limit when computing the SDI tax amount.

NOTE: If you need to run any additional payroll checks for 2023 AFTER the year end update has been installed (Version 10.2.0.8), you will want to set the Override Automatic Tax Calculations checkbox on the Fed Tab of the employee list for any employees that have reached the SDI Limit for 2023 so that you can adjust the SDI subject wages and related tax amounts.

The state settings for California will no longer display a Cutoff Limit field for SDI as shown below:

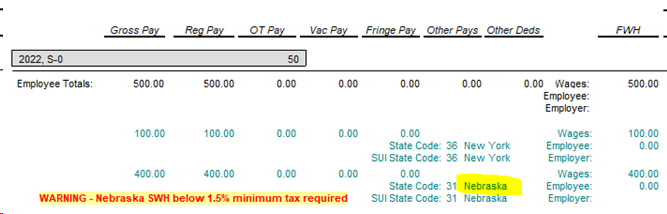

●ENHANCEMENT - Nebraska Minimum State Withholding Warning

Nebraska has issued new requirements for State Withholding tax amounts (SWH) which require that the tax should be at least 1.5% of the employee’s subject wages. The Pre Check Tax Register report has been updated to identify any employee checks where the SWH tax does NOT meet the minimum requirement. See the screenshot below where the message is displayed for these situations. Note: The green text on the report is from the drill down report that is displayed when you click on the Employee Totals line:

If the employee does not have the proper documentation to justify the lower tax amount and you want to change the employee withheld amount, you may need to change the number of dependents that the employee is claiming.

A new report has been added to the Employee P/R Reports list in the MAR Reports Screen which will show all of the state drill down records without the need to click on each employee. This report will be easier to use when checking for employees that have the state withholding minimum warning:

![]()

Please review the following information which can be found in the 2024 Nebraska Circular EN Document:

Special Income Tax Withholding Procedures. Every employer with more than 24 employees must withhold at least 1.5% of each employee’s taxable wages. A lesser amount may be withheld if the employee provides documentation justifying a lesser amount. Documentation may include:

o Verification of children/dependents;

o Marital status; and/or

o The amount of itemized deductions

If this calculation is less than 1.5% of the taxable wage amount, adjust the income tax withholding to be at least 50% or more of the income tax withholding for a single employee with one income tax withholding allowance, or for a married employee with two allowances. These amounts meet the minimum income tax withholding requirement and may be used by the employer to determine an acceptable employee’s state income tax withholding amount.

•ENHANCEMENT - Alabama Overtime Pay Exemption for SWH Tax

The state of Alabama has initiated a new tax exemption for State Withholding Tax (SWH) which allows for overtime pay to be exempt from SWH Wages. There are rules for which types of overtime payments are allowed for this exemption and there will be new reporting requirements beginning in 2024 for reporting these amounts throughout the year as well as in Box 14 of the W2 Form. This new tax law will be in effect from January 1, 2024 through June 30, 2025 unless otherwise extended in the future.

The AccuBuild program has been updated to handle these new overtime tax exemptions which will require specific business rules to be followed in order to report the exemptions accurately. Be sure to review these rules (outlined below) so that your payroll checks will compute the correct amount of exempt overtime pay.

A new report that has been added to the AccuBuild MAR Reports List which can recap all of these overtime pay exemption amounts to help with the new Alabama reporting requirements.

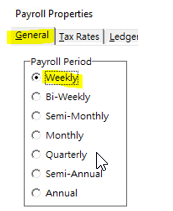

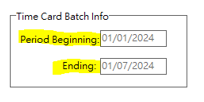

Business Rules: There are certain rules to follow in order for the system to compute the Exempt Overtime Wages correctly. Please follow these rules when processing payroll for weekly payroll checks:

oPayroll Properties Setting: Make sure the Payroll Period setting in the Payroll Properties Screen (General tab) is set for Weekly Payroll:

oPayroll Batch - Period Beginning and Ending Dates: Make sure the payroll period dates represent one week of payroll (7 days):

|

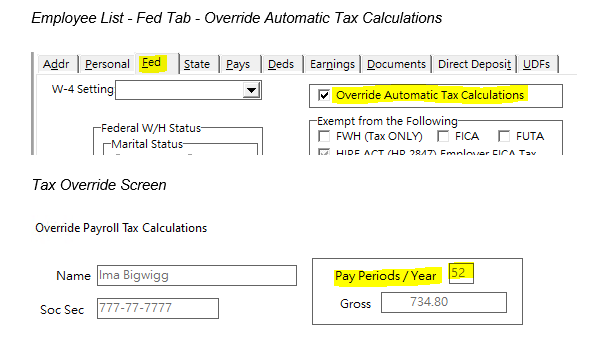

oOverride Automatic Tax Calculations: If you have the Override Automatic Tax Calculations set for any employees in the Employee List (Fed tab), be sure to check the override screen to make sure the check is based on the Weekly Payroll setting. If this is set correctly, then when the override screen pops up, the Pay Periods / Year setting will be set to 52. Any other setting in this field will cause the payroll check to be marked as non-weekly and the exempt overtime amounts will be excluded in the tax reporting forms and Aatrix Reports.

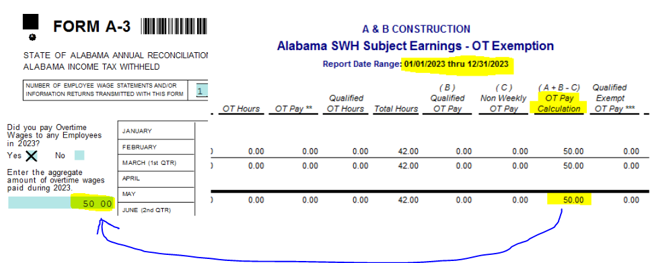

Reporting: A new report has been added to the MAR Report Library under the the Employee P/R Reports list entitled Alabama SWH Subject Earnings - OT Exemption. This report recaps how the overtime exempt pay is calculated based on the Alabama rules for the exempt pay amounts. This report can be used for reporting any preliminary overtime amounts from 2023 as well as amounts in 2024 when the new exemption kicks in. Only weekly payroll checks where the total hours worked exceed 40 hours will be considered for overtime pay exemption. Only regular pay and overtime pay transactions are considered in the exemption calculation and any overtime pay transactions where the total hours do NOT exceed 40 hours are not eligible for the exemption.

Alabama SWH Subject Earnings - OT Exemption

This report has many columns and the following information will help to understand the specific amounts that are considered for the overtime pay exemption amount:

o( A ) Reg Pay Over 40 * - This column will compute any regular pay transactions that are considered for the exempt amount. Any regular pay hours that exceed 40 hours will be included in the exempt amount calculation even though they were not coded as overtime. NOTE: If the paycheck represents more than one week of pay (non weekly paycheck), then this column will be set to zero as it will not qualify for the exemption.

o( B ) Qualified OT Pay - This amount is based on the Qualified OT Hours which are made up of any overtime hours that exceed the total hours requirement of 40 hours. If the regular hours are less than 40, then a portion of the overtime hours will be excluded until the 40 hour minimum is reached.

o( C ) Non Weekly OT Pay - If the Qualified OT Pay is computed on a paycheck that represents more than one week of pay (non weekly paycheck), then any Qualified OT Pay will be listed in this column and will NOT be eligible for the exemption.

o( A + B - C ) OT Pay Calculation - This column represents the computed overtime pay exemption amount - Column A plus Column B minus Column C.

oNOTE: The amount in this column can be used for any overtime payments in 2023 that would qualify for overtime based on the new rules for the overtime exemption amounts. Simply run the report for the 2023 calendar year.

The Annual FORM A-3 for the Calendar Year 2023 provides an entry for 2023 Overtime wages. You will need to type in this amount for 2023 which can be pulled from this column of the report as shown in the screenshots below. For 2024, this amount will be filled in automatically from the Qualified Exempt OT Pay *** column:

oQualified Exempt OT Pay *** - This amount is the same as the OT Pay Calculation amount for any check that is dated between the effective dates of 1/1/2024 and 6/30/2025. If the check date falls outside of this date range, then this column will be set to zero as the amount will NOT be exempt.

oSWH Wages - This column represents the wages that are subject to Alabama state withholding taxes AFTER the overtime exemption has been deducted. This is the wage amount that is used as the basis amount for computing the Alabama state withholding tax amount. The wages that are subject to Federal Withholding are shown in the FWH Wages column for comparison purposes to the SWH Wages.

oWeek Count Calc - This is the calculated week count based on the week beginning date and week ending date of each paycheck. This column is then compared to the actual week count column used on the paycheck when taxes were calculated. If this column does not match the Week Count column, then it will be flagged with 4 asterisks (****) which could indicate that the above business rules (above) were not used for proper overtime calculations.

oComments - This column helps to identify any checks that are not considered for the overtime pay exemption:

▪NON Weekly Pay ** - Only weekly payroll checks can be considered for the overtime pay calculation

▪Prior to 2024 ** - Any payroll checks that are dated prior to 1/1/2024 are not eligible for the overtime pay exemption. However, the overtime pay calculations may be useful in reporting 2023 overtime pay projections.

▪Total Hours <= 40 ** - Overtime pay is considered for exemption ONLY when the total hours exceed 40.

Important Note: Due to the nature of construction related payroll, where prevailing rates and union rates can vary for the same employee on the same paycheck, depending on the various tasks being performed, all overtime calculations are performed on a blended rate basis. The Regular OT rate is based on the Regular Pay (Reg Pay) divided by the Regular Hours (Reg Hrs) and the Overtime OT Rate is based on the Overtime Pay (OT Pay **) divided by the Overtime Hours (OT Hours).

SYSTEM ADMINISTRATOR

•ENHANCEMENT - AccuBuild Program User List Changes

This AccuBuild Program User List is used by system administrators to get a list of all users that are currently running the Accubuild Program. There were instances where an exception error was displayed indicating that the user list could not be opened. A delay process has been added to fix a timing issue in order to work around this error.

The process to Kill an AccuBuild Process has been disabled and a new message will be displayed indicating that the users should now use the AB Cleanup Icon on the Parallels menu to properly clean up their AccuBuild program connection for the AccuBuild Cloud.

●ENHANCEMENT - AccuBuild Main Screen Sidebar Menu Hints

This AccuBuild Main Screen has been updated to show hints on all of the sidebar menu items so that the full description of the menu can be displayed. This will help to identify items where the menu description is clipped on the right side. If you hover over the menu item with the mouse, a new pop up hint will display the full menu name. These hints have been updated on all of the sidebar menus:

oAccuBuild Menu Links

oProgram Links

oWebsite Links

oReport List

oMAR Data Views