JOB COST

●ENHANCEMENT - Procore Integration update (Ticket Ref No: PTK-978)

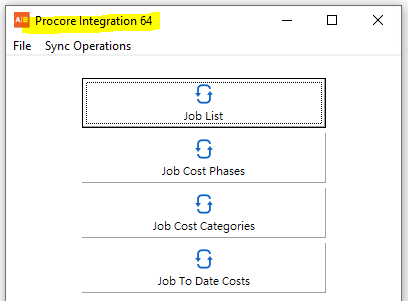

Changes to the connection method for the Procore Integration were made in order to comply with the new API requirements by Procore. These changes are now distributed in the new ProcoreIntegration64.exe App which replaces the previous App version entitled ProcoreIntegration.exe. With this release of AccuBuild, the Procore Integration menu option on the Job Cost menu will now launch the new App version as shown:

●CORRECTION - Production Units by Detail Item (PMID 36606)

The library version of the stored procedure abm_Get_DPU_BidItemMasterRecs_FullDetail_Lookup was updated in this release to correct a potential issue with the production hours total at the cost phase level.

PAYROLL

●ENHANCEMENT - Payroll Tax Tables for 2023

oArkansas - new tax rates for 2023

oIdaho - new tax rates for 2023

oIllinois - new tax rates for 2023

oIndiana - new county tax rates for 2023

oNorth Dakota - new tax rates for 2023

oOhio - new tax rates for 2023

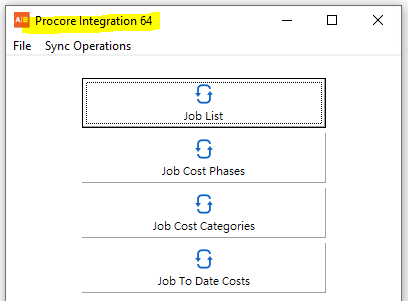

●ENHANCEMENT - Payroll Exemption Change for Indiana

The state of Indiana has added a new exemption option on form WH-4 for qualifying first-time dependent exemptions. These exemptions can be entered under the new field under the Indiana State W/H Status groupbox entitled First Time Add’l Exemptions as shown below. The tax calculation for the Indiana State Withholding Tax (SWH) has been updated to include these new exemptions in the tax calculation.

•CORRECTION - Accrued Pay Reporting

The computations for the actual paid amounts on the accrued pay accumulators were modified to exclude pay amounts that were processed prior to the effective date of the accrued pay accumulator. These new computations are included in the MAR Reports Library for the following report classes:

●Class 610 - Accrued Pay Report

●Class 261 - Payroll Check - Stub - Check - Stub With Accruals

●Class 263 - Employee Direct Deposit Statement WIth Accruals

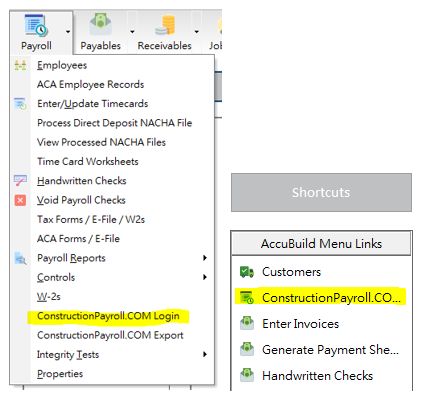

●ENHANCEMENT - Menu Updates for ConstructionPayroll.COM

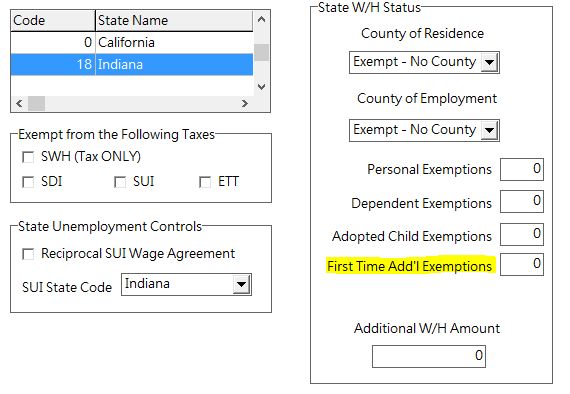

Menu Access Settings: New settings have been added to block certain payroll functions in AccuBuild after the customer has gone live with ConstructionPayroll.com. These changes were put in place to prevent a new payroll check from being generated in AccuBuild accidentally. The menu items that are affected include the following:

●Enter Update Timecards

●Print Paychecks

●Post to Master

●Handwritten Checks

●Void Payroll Checks

●Add New Employee

If one of these menu items are selected after the payroll process has been moved into ConstructionPayroll.com, you will receive the following message:

ConstructionPayroll.COM App: A new payroll menu option was added to make it easy to open the Construction Payroll App from within the AccuBuild System. You can now add this menu option to your AccuBuild Menu Links for faster access.

●CORRECTION - ConstructionPayroll.com update to posting process (PTK-1697)

The posting synchronization process from ConstructionPayroll.com has been updated to allow posting of checks that have a zero net check amount for check adjustment postings made by Construction Payroll staff.