PAYROLL

•ENHANCEMENT - Payroll Tax Tables for 2023

•Federal Withholding tables - updated for inflation adjusted rate schedules for 2023

•Illinois - new tax rates for 2023

•Maryland - new tax rates for 2023

•Michigan - new tax rates for 2023

•Utah - new tax rates for June 2023

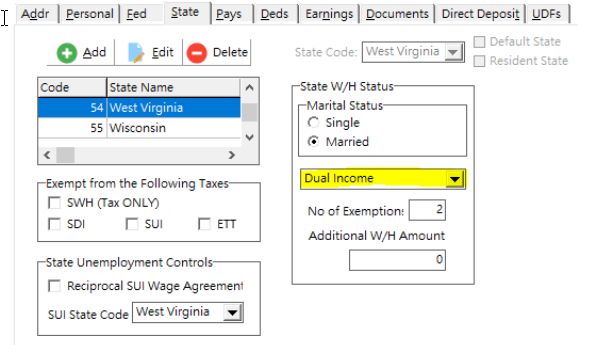

•West Virginia - new tax rates 2023 and now there are two sets of tax tables depending on Dual Income or One Income Status setting. The employee screen for the State tab settings has been updated for West Virginia with a new option to select Income Status setting as shown:Arizona - new tax rates (percentages) for 2023

•California - new tax rates for 2023

•ENHANCEMENT - ConstructionPayroll.Com Integration [PMID Ref No 34776]

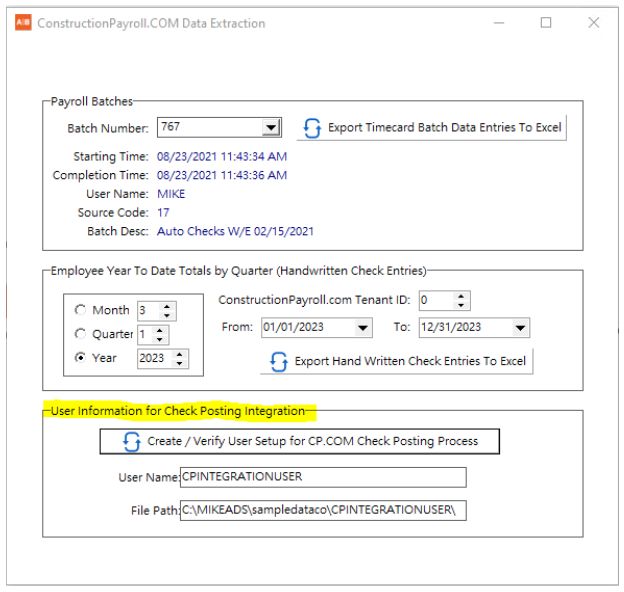

•A new option has been added to the ConstructionPayroll.COM Data Extraction screen entitled User Information for Check Posting integration. This option is used to set up the automatic integration posting between ConstructionPayroll.COM (CP.COM) and AccuBuild so that all of the job cost and accounting transactions created in CP.COM are automatically posted to AccuBuild.

Click on the Create / Verify User Setup for CP.COM Check Posting Process button to create the integration database files that are needed for the posting process. If the database files do NOT exist, they will be created automatically, otherwise these files will be validated. In either case, both the user name and file path will be displayed.Federal

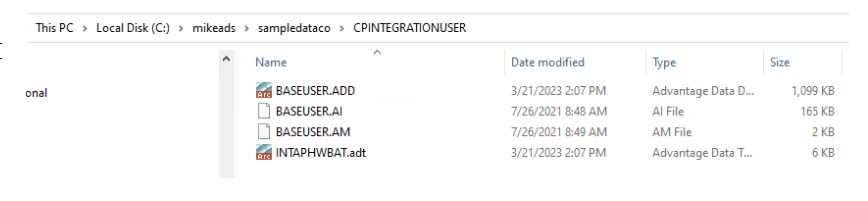

When the files are created, the user directory will contain the user database files for BASEUSER (3 files) as well as the posting batch table entitled INTAPHWBAT as shown:

•CORRECTION - ConstructionPayroll.Com Integration [PMID Ref No 34776]

•The export utility to extract payroll data for ConstructionPayroll.Com had a setting for the certified payroll deduction number 4 property that was wrong. The script for this export utility has been corrected to fix this issue:

oCP20DataExtractRules.adt

oCP20DataExtractRules.adm

•CORRECTION -ConstructionPayroll.Com Integration [AICHD-85]

•The integration procedure that writes check records from ConstructonPayroll.com to the AccuBuild Program for the batch processing has been updated to fix the issues when duplicate check numbers are posted.

SYSTEM ADMINISTRATOR

•ENHANCEMENT - SendGrid Email Service Improvements [PMID Ref No 9549]

•The SendGrid email service that is built into AccuBuild has been updated to support the new TLS 1.2 Version for sending both single and bulk emails. Bulk emails are used for the following email merge processes in AccuBuild:

oDirect Deposit Statements

oACH Statements

oMiscellaneous AR Invoices

oSubcontractor Payment Sheets

If you already have your AccuBuild System set up for the SendGrid feature in the Advanced Settings then there is nothing to configure. If you are interested in using the SendGrid email client, then you will want to contact AccuBuild Support for help in getting this feature configured.

The email merge process should now be quicker when sending multiple emails with attachments such as direct deposit statements. These types of bulk emails will now be handled as batches so that the user does not have to wait for all of the emails to be sent before moving on to another task in AccuBuild.

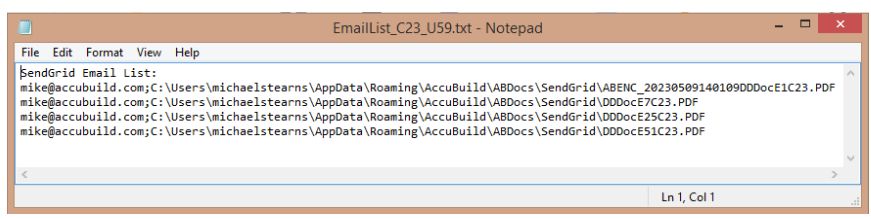

Once the email batch process has been queued up, the list of email addresses and the attached files names will be displayed on the screen for review as needed. Once this screen is closed, the user can continue on with other tasks while the emails are processed in the background: