ACCOUNTS PAYABLE

•ENHANCEMENT - Void / Change Invoice Info Screen Changes [PMID Ref No 27274] 10.2.0.2 RED

The Void / Change Invoice Info Screen which is available from both the Accounts Payable Menu and the Orders Menu has been updated to include new fields in the invoice selection grid. These new fields will make it easier to filter and locate the desired vendor invoice number:

•Batch Number - posting batch number.

•Original Batch Number - if the invoice has been reinstated (paid and then payment voided) then the original posting batch number will be included in this field when it is related to a purchase order payable invoice. This field is required if the reinstated invoice is ever voided in order to handle the reversal of the related purchase order invoice items.

•Source Code - the source code will help determine the origin of the invoice:

o40 - accounts payable invoice

o41 - subcontractor payment sheet

o43 - purchase order payable invoice

o45 - reinstated invoice from a voided accounts payable check

•ENHANCEMENT - Voiding Reinstated Purchase Order Invoices [PMID Ref No 27274] 10.2.0.2 RED

The Void / Change Invoice Info Screen has been updated to handle the voiding of reinstated purchase order payable invoices. Previously, when a purchase order invoice was reinstated from a voided accounts payable check, it had to be cleared using reversing entries on the purchase order invoice screen in order to void the invoice entries.

The purchase order invoice reversal entries will now be handled automatically provided the reinstated payable amounts were NOT related to a partial payment on the vendor invoice. Partial payment reinstated invoices will still need to be reversed using the reversing entries on the purchase order invoice screen.

PAYROLL

•ENHANCEMENT - New 2022 Tax Tables [PMID Ref No 26289]

The payroll withholding tables for the 2022 Calendar Year have been updated for the following states:

oArkansas - new tables for 2022 10.2.0.2 RED

oLouisiana - new tables for 2022 10.2.0.2 RED

oMississippi - new tables for 2022 10.2.0.2 RED

oRhode Island - new tables for 2022 10.2.0.2 BLUE

•ENHANCEMENT - W2 - Box 14 Update [PMID Ref No 26289] 10.2.0.2 BLUE

oThe employee withheld amounts for Paid Family Leave are now included in the Box 14 totals produced by Aatrix for the State of Connecticut.

•ENHANCEMENT - ACA Update for 2021 Form 1095-C Changes [PMID Ref No 26289] 10.2.0.2 BLUE

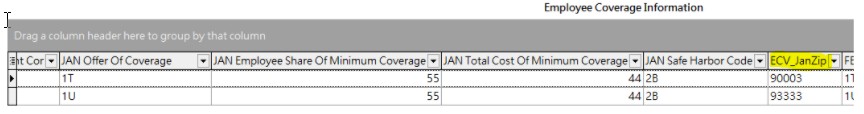

oThe ACA Form 1095-C now requires zip code fields for each coverage month when the Offer of Coverage is set to one of the following codes: 1L, 1M, 1N, 1O, 1P, 1Q, 1T, or 1U. Refer to the IRS Instructions below for more information:

IRS Instructions for Form 1095-C - Line 17. If the ALE Member used code 1L, 1M, 1N, 1O, 1P, 1Q, 1T, or 1U because it offered the employee an individual coverage HRA, enter the appropriate ZIP code used for identifying the lowest cost silver plan used to calculate the Employee Required Contribution in line 15. This will be the ZIP code of the employee’s residence (code 1L, 1M, 1N, or 1T) or the ZIP code of the employee’s primary site of employment if the ALE Member uses the work location safe harbor (code 1O, 1P, 1Q, or 1U). Location safe harbor for individual coverage HRAs. For purposes of section 4980H(b), an employer may use the cost of self-only coverage for the lowest cost silver plan for the employee for self-only coverage offered through the Exchange where the employee’s primary site of employment is located for determining whether an offer of an individual coverage HRA to a full-time employee is affordable. The ZIP code for the employee’s primary site of employment is used to identify the applicable lowest silver plan to determine affordability.

The Employee ACA Health Insurance Information Screen in AccuBuild has been updated with the new zip code fields for each month in the Employee Coverage Information Grid along with a new pop up menu option to help populate these zip code settings:

▪Manual Update Option - The grid allows for manual entry of the zip code fields when needed.

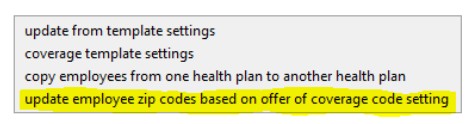

▪Automated Update Option - A new pop up menu option (right click) has been added which is entitled update employee zip codes based on offer of coverage code setting. This option is used as follows:

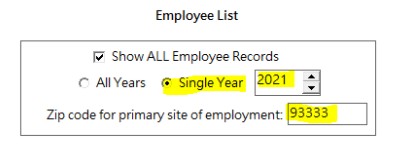

❑Select the Single Year Option and the proper reporting year for the employee coverage records located at the top of the Employee List Grid.

Check to make sure the Zip code for the primary site of employment has been set correctly. This field is defaults to the company shipping address zip code but can be typed in manually:

❑Select the employees to be updated in the Employee List Grid on the left side of the screen.

❑Right click on the Employee Coverage Grid and select the new update employee zip codes menu option. A confirmation screen will appear and if you continue with the update process, the zip code fields will be updated for each of the selected employees.

Business Rules for Update Process - The update process will only update monthly zip code fields where the Offer of Coverage code is set for a code that requires a zip code. If the Offer of Coverage code does NOT require a zip code, then the zip code field will be cleared. When the zip code field is required, it will be updated as follows:

❖Employee address zip codes - The employee address zip code will be used when the Offer of Coverage code is set to one of the following codes: 1L, 1M, 1N, or 1T.

❖Primary site of employment zip code - The primary site of employment zip code will be used when the Offer of Coverage code is set to one of the following codes: 1O, 1P, 1Q, or 1U.

These new zip code fields will now be included in the Aatrix Forms processing screens whenever the ACA Form 1095-C is processed.

SYSTEM ADMINISTRATOR

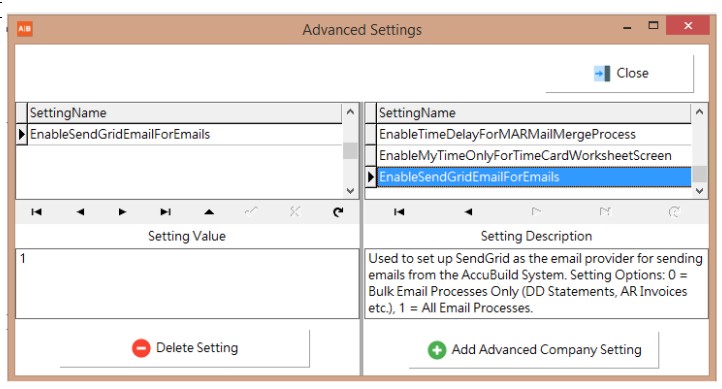

•ENHANCEMENT - Advanced Setting for User Email Settings [PMID Ref No 26186]

A new advanced setting has been added entitled EnableSendGridEmailForEmails. This setting will allow you to use the new AccuBuild Email settings to send bulk emails and individual emails and avoid configuration issues with other 3rd Party email providers. Two options exist for this new setting which are set under the Setting Value field:

o0 = Enable for Bulk Emails Only - This is the default setting and indicates that the AccuBuild email provider (SendGrid) will be used for Bulk Email processes ONLY where multiple emails are sent at once to different recipients for such things as employee direct deposit statements, customer A/R invoices, etc.

o1 = Enable for ALL Email Processes - This option indicates that the AccuBuild email provider will be used for ALL email processes.

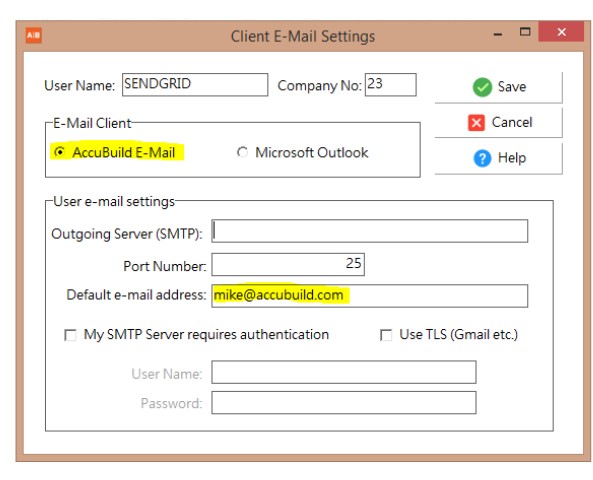

Important Note: If the default Setting Value (0) is used, then you will still need to set up ALL of the email configuration settings for each AccuBuild user in the E-Mail Settings Screen as shown. However, if you use the Setting Value of (1), you will ONLY need to set up the following two fields:

oE-Mail Client: Needs to be set to the AccuBuild E-Mail option.

oDefault e-mail address: Enter the user’s email address here.