2021 UPDATE FEES RELEASE

•Initial Software Release for 2021

This update is the first software release for 2021 and will require that the 2021 Update Fees are current. AccuBuild Version 10.1.0.3 is the last update for the 2020 Update Fees renewal. Please contact AccuBuild Support for more information on update renewals.

ACCOUNTS PAYABLE

•ENHANCEMENT - 1099 Screen Changes [PMID Ref No 20570]

The 1099 screens have been modified to correspond with the new requirements for the 2020 1099s. The non employee compensation amounts that were previously reported on Form 1099 MISC will now be reported on Form 1099 NEC.

•Correction - A/P Properties - Comdata Settings [PMID Ref No 20780]

The Accounts Payable Settings Screen was updated to fix an issue with the new FTP setting options on the Comdata Settings Tab. The system was automatically changing the FTP Site Address and the Port Number based on the Account Code when the OK Button was clicked. This feature worked correctly for new Comdata customers that contained a dash in the second position of their account code, however it caused issues with existing Comdata customers that were being migrated to the new Comdata FTP Site. Existing customers will maintain their existing Account Code and therefore this screen has been updated to disable the automatic override of the FTP Settings based on the Account Code.

The Set Defaults button will base the defaults on the Account Code, however, when the FTP Site Address or Port Number is changed, they will no longer be overwritten. In addition, when the Set Defaults Button is clicked, an information message will be displayed to show both FTP Site addresses and associated port numbers.

ASCENTIS INTEGRATION

•ENHANCEMENT - FTP File Transfer Changes [PMID Ref No 20259]

The Ascentis HR Integration feature of AccuBuild was updated to work with new folder structure changes on the Ascentis FTP Site for both outgoing and incoming files.

CLIENTS CENTER

•ENHANCEMENT - Reserved Field for CLIENTS table [PMID Ref No 17383]

The Integration with Construction Payroll 2.0 (CP20) will be using the MISC_BOOL1 in the Clients table to identify CP20 Employees that have been added to the Client List from CP20.

CLIENTS CENTER (VENDORS / CUSTOMERS)

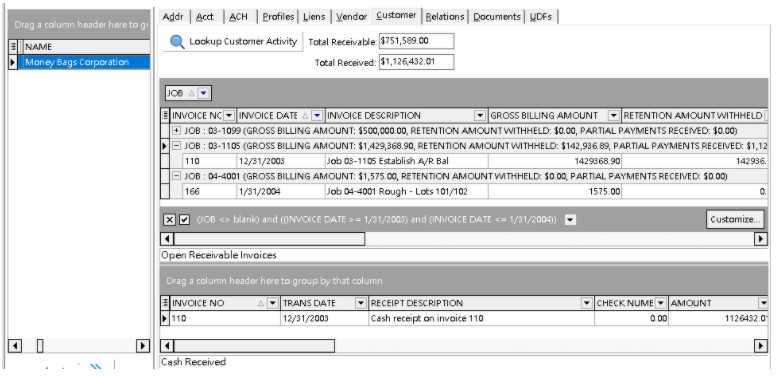

•ENHANCEMENT - New Grid Grouping Totals for Vendors and Customers [PMID Ref No 15653]

The Detail Data Grids that are populated with the vendor transactions (Lookup Vendor Activity) and the customer transactions (Lookup Customer Activity) have been updated to display group totals for any fields that are grouped in the grid.

These group totals also work with any field filtering such as date ranges. This will make it very easy to quickly lookup vendor and customer totals. Simply drag one or more columns to the top of the grid to display the group totals:

oImportant Note: The vendor and customer totals at the top of the screen will ALWAYS reflect the grand totals for the selected vendor or customer and will NOT be affected by the grid filter settings.

PAYROLL

•ENHANCEMENT - New 2021 Tax Tables [PMID Ref No 20570]

•The payroll withholding tables for the 2021 Calendar Year have been updated for the following states:

▪Federal Withholding Tax Tables

▪Arkansas

▪California

▪Illinois

▪Indiana

▪Iowa

▪Maine

▪Mississippi

▪Missouri

▪New Jersey

▪New York

▪North Dakota

▪Oregon

▪Yonkers, NY City Taxes

▪Rhode Island

▪South Carolina

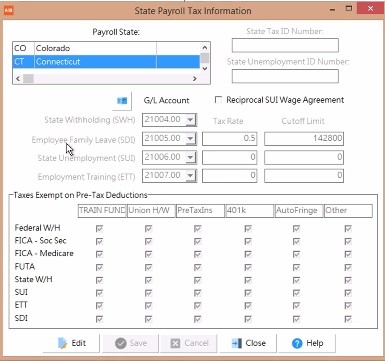

•ENHANCEMENT - New Family Leave Deduction for Connecticut [PMID Ref No 20568]

The State of Connecticut will be requiring a new deduction to be withheld from each employee’s paycheck for Family Leave beginning in the 2021 Calendar Year. This is an employee deduction only and there is no employer portion for this tax. This deduction will be handled in the SDI Accumulator of the PRCHECKS table in the AccuBuild System. You will need to enable this on the State Payroll Tax Information Screen which is accessed from the Payroll Properties Screen.

•G/L Account - A new G/L Account should be set up in your chart of accounts to track the family leave deduction amounts.

•Tax Rate - The initial tax rate is 0.005 for 2021, however you will need to verify this rate and update as needed according to Connecticut Tax regulations.

•Cutoff Limit - Currently the cutoff limit is based on the social security cutoff limit ($142,800 for 2021) and this field will need to be updated as necessary per Connecticut Tax regulations

Currently there are no payroll tax forms provided for this tax at this time, but if and when they are provided by Aatrix (our tax forms partner), we will make them available in the AccuBuild System. If you need to track these amounts right away, you can use the AccuBuild MAR Report entitled “Subject To Earnings Report - Summary - Trans Date” which will provide both the SDI Wages and Employee (EE) SDI Withheld amounts.

Please refer to the following website link for more information: https://ctpaidleave.org/s/?language=en_US

•ENHANCEMENT - New Connecticut 941 Wage Comparison Report [PMID Ref No 20503]

A new report has been added to the Employee PR Reports section of My AccuBuild Reports (MAR) entitled Connecticut 941 Wage Comparison Report. This report can be very useful in reconciling the Federal 941 wages to the wages that should be reported on the Connecticut 941 Form for employers that are performing work in multiple states. A breakdown of wages is provided for each employee for both the State Withholding State (SWH) and the State Unemployment State (SUI). Employee subtotals as well as report grand totals are provided for five different classifications of subject wages:

•FWH - This shows the total of the Federal wages per 941.

•CT SWH - The SWH Wages for CT which is the amount that Aatrix is using on the CT Gross Wages (residents & non residents).

•CT Res Other States - The FEDERAL wages earned in other states for CT residents (transaction SUI code = CT and SWH State code <> CT) (Per the CT website, resident wages are all wages paid to an employee even if the employee works outside CT.)

•CT All - The total of the CT SWH Amount and the CT Res Other States Amount.

•Non Res Other States - Non Residents with earnings in other states