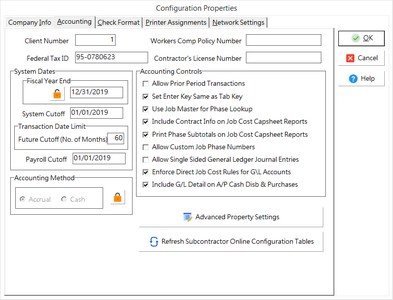

The Accounting Tab contains crucial information about how transactions are processed through AccuBuild. The user should have a thorough understanding of each of the fields contained on this tab before entering any of the data.

The Client Number, Federal Tax ID, Workers Comp Policy Number and the Contractor's License Number fields are mostly self-explanatory. The client number represents your company's client number and is primarily used when setting up a new job. The federal tax identification number will be used when printing the 1099 and W-2 forms. Both the workers compensation policy and the contractor's license number are strictly optional. If these fields are completed, the data will be included on all of the Certified Payroll Reports.

Accounting Controls |

|

System Dates |

|

Accounting Method |

|

Advanced Property Settings |

|

Refresh Subcontractor Online Configuration Tables |

•Allow Prior Period Transactions

| If this option is enabled, it will allow transactions to be spread through the system with a prior period date. A prior period date is defined as a date that precedes the System Cutoff or Payroll Cutoff date. For example, if the system cutoff date is 03/01/2009, and an accounts payable check is processed with a check date of 01/01/2009, then AccuBuild will not allow the check to be posted. The System Cutoff date and the Payroll Cutoff date fields are automatically updated to the next period when you close a period via the Month End option, but these fields can be manually updated as well. |

•Set Enter Key Same As Tab Key

| Pressing the Tab key is the traditional way to move from field to field within a Windows application, however, this option allows you to select the Enter key to move from field to field. |

•Use Job Master for Phase Lookup

| This option ensures that all job cost entries are posted to phases (cost categories) that have been specifically set up for each job. This option limits the display of cost phases to just those phases which exist as an item in the estimate detail file (estdetl.adt) with or without an estimated cost, and to phases not set up in the estimate detail file but that do have actual costs posted to them. |

oTroubleshooting - If the User (or the user's User Group) is restricted from the 'Configuration' menu option, then the user will NOT be able to toggle on or off the 'Job Master Lookup' option. If the Configuration menu option has NOT been restricted in the User or User Group restrictions, and the user is still not able to toggle the 'Job Master Lookup' option, then check the user's level setting. If the user has a level lower than the Configuration menu level, then the user will not be able to access the 'Job Master Lookup' option on the data entry screens.

•Reports for Posting (Spread) Processes

| If this option is enabled, then reports will be printed automatically whenever an automatic payroll check batch is processed. These reports, with the exception of the timecard listing, may be re-created at any time by printing the Check Register and Burden Report, Detail Report by Job - Detail Option, and Employee Transaction Report (Totals Only) in the Payroll > Reports option. |

| Note: Be sure to use the transaction date (check date) when reprinting the reports. Be aware that these reports will be printed based on the date criteria and will not be printed based on the individual batch. Therefore, if more than one batch was processed with the same check date, then the reports will be a summary of all batches with the same transaction date. |

•Include Contract Info on Job Cost Capsheet Reports (Traditional Version Only)

| A summary of the job's profitability will be displayed on the capsheet report if this option is enabled. |

•Print Phase Subtotals on Job Cost Capsheet Reports (Traditional Version Only)

| This option will provide subtotals on the capsheet report for each group of phases based on the integer value of the phase number. For example, if your job cost uses phases 10.00, 10.01 and 10.02, then AccuBuild will supply a subtotal of all phases beginning with 10. |

•Allow Custom Job Phase Numbers

| The job cost phases (cost categories) can be universal for all jobs or they can be unique for a given project. If the Allow Custom Job Phase Numbers option is enabled, then items in the estimate detail file (estdetl.adt) can be entered with phase numbers which do not exist in the phase master file (phasemas.adt) file. |

•Disable Transaction Tracking During Payroll Spreads (BDE Version of AccuBuild Only) This option should only be used with extreme discretion. The BDE Version of AccuBuild uses Paradox tables for its data and Paradox contains a transaction tracking feature that automatically rolls back the data in a user batch when a posting routine is interrupted. In this way, data is not committed to a file until the posting process has been completed successfully. However, Paradox can only handle a set number of records for each batch. The total record count is not determined just by the number of employees within the batch but rather by the number of individual transactions created. For example, an employee's timecard may be posted to a single job but to three different cost phases and the hours may need to be included on the certified payroll report. Therefore, one timecard may generate three postings to the historical job cost transaction file (jobdetl.db), three postings to the certified payroll detail file (cprdetl.adt), a posting to the historical general ledger transaction file (gldetail.db) and payroll check detail file (prchecks.adt), and multiple postings to the historical timecard transaction file (timecard.adt). Assuming you have 100 employees with the same number of transactions for each timecard, AccuBuild will prompt you to disable the transaction tracking process during the post routine for the current batch. To avoid this 'error' message, the transaction tracking can be disabled altogether with this configuration setting. If the tracking feature is disabled and a posting routine fails, then each detail file will have to be examined manually to determine if any transactions were partially posted. The best solution to this situation is NOT to disable the transaction tracking in the configuration settings, but rather to create multiple batches for the same payroll period. If creating multiple batches is not an acceptable solution, then the transaction tracking may be temporarily disabled by going to the Help menu on the main menu of AccuBuild. The Disable Transaction Tracking feature located here will stay on only until the user logs out. This option will disable the transaction tracking for all batch types not just payroll entries.

| The Enterprise Version of AccuBuild does not limit the transaction tracking feature to 250 records as does the BDE Version of AccuBuild. Therefore, the options to disable the transaction tracking found in the Company Configuration Settings and the Trucking Properties have been removed in the Enterprise Version. If the batch contains more than 10,000 records, then the transaction tracking may be temporarily disabled on the Help Menu. Please contact AccuBuild's support staff for more information on permanently changing the maximum number of records that may be posted within a single batch. |

•Allow Single Sided General Ledger Journal Entries

| This option is primarily used during the conversion process for new companies. One sided journal entries are used to set up beginning balances in the job cost system (please refer to the Getting Started Manual) and are typically not used during normal operations. Once the system conversion has been completed, this option should be disabled so that journal entries are not accidentally posted out of balance. |

•Enforce Direct Job Cost Rules for G/L Accounts

| If this option is enabled, the system will determine if a general ledger account has been flagged as a job cost account and will force the user to enter a job/phase with the entry. Likewise, a non-job cost designated account cannot be linked to a job/phase. This option should prevent discrepancies from occurring between the job cost and the general ledger. |

•Include G/L Detail on A/P Cash Disb & Purchases

| This option will allow the detail of both the debit and credit side of an automatic check or payables invoice transaction to post to the general ledger. If this option is not enabled, then AccuBuild will summarize the credit entries to cash and accrued accounts payable with a single total and description (ie. A/P Automatic Checks 1/1/2009 or Posting Payable Invoices 2/3/2009). The gldetail file will also use the GL_REF_NO field to hold either the check number or the invoice reference no depending on the type of entry. |

•Fiscal Year End - This date represents the end of the company's business year. The date in this field are entered with the last day of the month, such as 12/31/2009 or 02/28/2009. This field will be updated automatically as each year is rolled during the month end routine. The fiscal year-end date is used to determine whether or not transactions being processed in the system should be included in the current fiscal year totals. This mainly pertains to the general ledger totals, and the year-to-date totals in the Job Cost module. The Payroll and the Accounts Payable modules are always handled on a calendar year basis to comply with W-2s and 1099 processing requirements. EXTREME CAUTION should be used when setting up or updating this field as a wrong entry could cause the data files to become corrupt or an unwanted year-end roll to occur. To change the date manually, click on the 'unlock' icon to disable the read-only status of the field. Click on the 'lock' icon or the OK button on the screen to save any change you have made to the date field. Be sure to thoroughly read the documentation in this manual on closing a fiscal year.

•If your fiscal year should change for tax reasons, please sure to carefully follow the documentation titled Change the Fiscal Year. This is a complex procedure and should be reviewed with AccuBuild's support staff before attempting to make the change.

•System Cutoff and Payroll Cutoff - The system cutoff date indicates the current month of each accounting module except for payroll. The Payroll module uses the payroll cutoff date to determine the current month. The dates in these two fields are entered with the first day of the month, such as 01/01/2009 or 12/01/2009. The system dates are automatically updated as each month is closed during the month end routine. The dates are used by the various modules to indicate whether or not the post routines should update the master data files. For example, if the check date for a batch of payroll checks is 12-31-2008 and the payroll cutoff date is 01-01-2008, then the Employee Year-to-Date Earnings File (wagemast.adt) will be updated with the check amounts because the two dates are in the same calendar year. However, if the check date is 01-07-2009, then the system would prevent you from posting the check because the payroll cutoff date is in a different calendar year.

oChanging the Payroll Year - Whenever the payroll cutoff YEAR is changed on this screen, the system will prompt the user to update the employee totals for the new year. This is necessary so that the proper year-to-date totals are used when calculating taxes on new payroll batches.

▪If you respond 'No' to the prompt, then a warning screen will be displayed and logged in the User Activity Log indicating that the payroll totals were not updated as required. (Ver.10.0.0.4 [PMID Ref No 12851]).

▪If you respond 'Yes' to the prompt, then the YTD totals will be updated for the new year.

❑When updating the YTD totals to a new year, the system will also review whether the new Payroll year is greater than the original Payroll year. If this condition is true, then the system will update the balances on all Local Deduction Codes (LDC) that are setup with the type 'Reducing Balance'. Note: If the payroll date has been rolled back instead of forward, then the balances will NOT be updated.

❖For each employee that has a local deduction code with this deduction type, the system will review the Starting Balance of the deduction (as entered in the employee file) and reduce this amount by all transactions found for that deduction for the year that is closed. The Starting Balance field will be updated with the new remaining balance.

❖If the remaining balance is zero, then the LDC in the employee file will be updated with the deduction type 'Paid in Full'.

❖The 'Paid in Full' LDC will remain in the employee's file until it is manually deleted by the Payroll clerk.

❖The update of the LDC balances will only be performed ONCE for any payroll year and the results are logged in the audit trail table 'LocalDedCutoffHistory'. In addition, if the LDC balances were updated, a new message will be displayed indicating that the update was performed. This message will also be logged in the User Activity Log.

•Transaction Date Limit - This field is used in conjunction with the System Cutoff date to determine how far into the future you wish to be able to post an entry. By default, AccuBuild will allow you to post up to 25 months beyond the System Cutoff date but you may set this option from 1 to 60 months.

In order to produce more meaningful reports and to take advantage of more features in the software, AccuBuild only uses the accrual method of accounting. The accrual option will ensure that the general ledger is updated with the payables and receivables as they are processed. You or your CPA may make the appropriate general journal entry adjustments in the system to reflect cash basis financial statements, or you can export the accrual basis financial statement to Excel or Word and make your adjustments to cash basis through those programs.

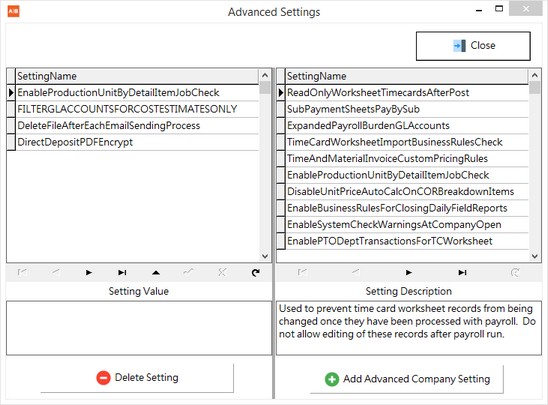

This option is used to enable new tailored solutions for existing companies and handle any custom setting for those solutions. A Master List of Settings will be updated with each release of AccuBuild, and you can choose to enable any option by adding the setting to your company’s advanced settings list.

Refresh Subcontractor Online Configuration Tables

This option is used to set up the default record values in the new Subcontractor Online Payment system and to refresh these settings as new options become available in future updates of AccuBuild.

●Subcontractor Online Payments - These procedures are kept on the Company Dictionary:

○sop_GetItemsbySC (EXISTING)

○sop_WritePOAPInvoiceItemPercentage (EXISTING)

○sop_WritePOAPInvoiceItemAmount (NEW)

○sop_WritePOAPInvoiceItemUnits (NEW)