The Equipment Journal option is used to establish the beginning balances for total expenses and meter hours on each piece of equipment, as applicable. New costs can be charged to the equipment through the Payroll and Payables modules but they can also be charged through this type of journal entry.

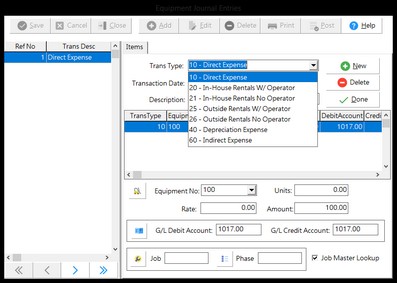

| 1. | Select Add at the top of the Equipment Journal Entries screen to begin a new journal entry and then select the transaction type. The description field on this screen will be updated with the transaction type description but this field may be modified as needed. |

[10] - Direct Expense - This type of entry is used to post an expense amount against a specific piece of equipment. Accounts payable invoices will automatically create a transaction type of this kind in the Equipment module whenever invoices are linked to an equipment code. Likewise, any payroll timecard entry that is linked to a department code that is designated Equipment Maintenance & Repairs is given this transaction type in the Equipment module.

[20] - In-House Rentals with Operator - This transaction types creates a 'utilization' record that posts a rental 'expense' to a job based on the in-house rental rate with an operator. This transaction type can only be created through the Equipment Journal. Note: The hours meter is updated with this transaction type.

[21] - In-House Rentals without an Operator - Same entry as trans type 20 but uses the in-house bare rental rate (in-house rental rate without an operator). Any payroll timecard entry that is linked to a department code that is designated Equipment Rental - In House is given this transaction type in the Equipment module. Note: The hours meter is updated with this transaction type.

[25] - Outside Rentals with Operator - This transaction types creates a 'utilization' record that posts a rental 'expense' to a job based on the outside 3rd party rental rate with an operator. This transaction type can only be created through the Equipment Journal. Note: The hours meter is updated with this transaction type.

[26] - Outside Rentals without an Operator - Same entry as trans type 25 but uses the 3rd party bare rental rate (rental rate without an operator). Any payroll timecard entry that is linked to a department code that is designated Equipment Rental - Outside (3rd Party) is automatically given this transaction type in the Equipment module. Note: The hours meter is updated with this transaction type.

[40] - Depreciation Expense - This transaction type creates a historical depreciation record and updates the book basis depreciation accumulators on a piece of equipment. This transaction type can only be created through the equipment journal.

[60] - Indirect Expense - This transaction type is used to manually allocate indirect expenses to a piece of equipment. The entry must be linked to an equipment code and should debit and credit the same indirect cost account. This task can also be automated by using the Allocate Indirect Costs option on the Equipment Menu.

| 2. | Enter the transaction date of the journal entry. This date will determine the accounting period where the entry will be posted in the various modules. The very first entry of a journal entry reference group will establish the transaction date for all other entries in the group. |

| 3. | Enabling the Reversing Entry option will automatically create a reversing journal entry based on the information entered in the current journal. The reversing entry will be dated the first day of the following month. |

| 4. | The very first entry of a journal entry reference group will establish the transaction description for all other entries in the group. |

•Equipment No - All transactions types, except '60 - Indirect Expenses', require an equipment code.

•Units - Enter the rental hours, or beginning meter hours, associated with the current entry. The units will be accumulated on the job schedule if the entry is assigned a job and phase number.

•Rate - The system will automatically enter the rental rate based on the transaction type selected (20, 21, 25, or 26) and the category code linked to the equipment code. The rate field may then be modified as desired.

•Amount - This field is automatically calculated when the units and rates have been entered. A flat amount may only be entered for transaction types 10, 40, and 60. For credit entries, use the minus sign (-) in front of the number.

•G/L Debit Account and G/L Credit Account - These fields will be automatically updated based on the category code that is linked to each piece of equipment but these accounts may be changed on the screen as desired. When establishing beginning balances for each piece of equipment, it is recommended that the debit account be the same as the credit account so that the beginning balances that have been set up in the general ledger will not be affected.

•Job and Phase - Enter the job and phase if the entry will be expensed to a job. If the entry will not be posted to the job schedule, then be sure to leave these fields blank. Note: If the transaction is to be expensed to a job, then you may wish to enable the Job Master Lookup option. This option will list only the job cost phases that have a budget amount or actual costs charged to them on the selected job. This option must be enabled before entering the job number. This option can be set as a default in the System Administrator > Configuration > Accounting option.

| Use the New Button to enter additional entries for the current group, and repeat the above process for each new entry in the group. Use the Delete Button located just below New to delete a single entry in the group if required. When finished with the journal entry group, press Done, and then press Save at the top left-hand side of the screen. If the debits and credits are not in balance, a warning message will be displayed. |

| 6. | Journal entries are kept together in reference groups and all entries within a group are assigned the same transaction date and transaction description. The Edit button is used to change any entries in a journal entry reference group, and the Delete button at the top of the screen will remove all entries in a reference group. When finished with the journal entries, be sure to use the Print button to view or print the entries to make sure they are correct. Once verified, the entries can be posted through the system. Depending on the entry, the transaction will update the equipment transaction file (eqtrans.adt), the historical general ledger transaction file (gldetail.adt) and the historical job cost transaction file (jobdetl.adt). |