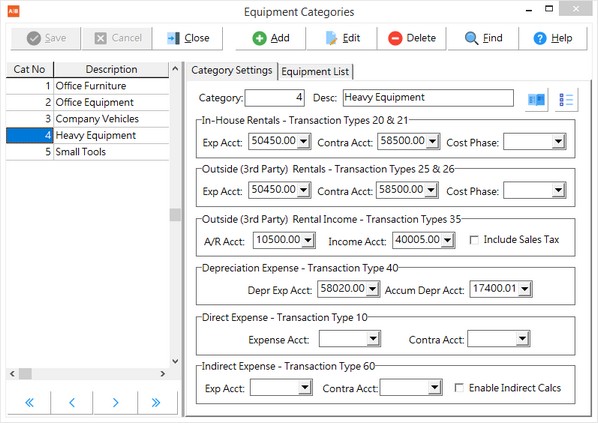

Each piece of equipment that is entered into the Equipment List must be linked to an equipment category. Examples of equipment categories are: Heavy Equipment, Company Vehicles, Small Tools, and Office Equipment. When an entry is made that contains an equipment code, the system will use the linked category code to instruct it how to update the Ledger, Receivables, Job Cost, and the Equipment modules.

There are six basic types of transactions that are associated with each category code. Each transaction type is associated with a set of general ledger accounts, and some transaction types may be linked to a job cost phase. All six types of transactions do not need to be set up for each group; simply leave the fields blank for the transaction type you do not wish to use with a particular category.

Transaction Type |

Rental Rate |

Sources |

20 - In House Rental |

With Operator |

Equipment Journal Only |

21 - In House Rental |

NO operator |

1. Time cards with an 'Equip Rental - In House' dept code (Time card entry expenses the operator time separately.) 2. Equipment Journal |

25 - Outside Rental |

With Operator |

1. Equipment Journal Only |

26 - Outside Rental |

NO Operator |

1. Time cards with an 'Equip Rental - 3rd Party' dept code (Time card entry expenses the operator time separately). 2. Equipment Journal |

35 - Outside Income |

With Operator |

1. Miscellaneous Receivable Invoices with an equipment code |

40 - Depreciation |

1. Equipment Journal Only |

|

10 - Direct Expenses |

1. Accounts Payable Invoices 2. Purchase Order Invoices 3. Time entries with an 'Equip Maint & Repairs' dept code 4. Equipment Journal |

|

60 - Indirect Expenses |

1. Allocate Indirect Costs Option 2. Equipment Journal |

In-House Rentals (Transaction Types 20 & 21) and Outside (3rd) Party Rentals (Transaction Types 25 & 26) The in-house rental and the outside rental fields should only be completed for a category that is set up for equipment rentals. These transaction types are used to post a 'rental' expense to a job even though the equipment is owned by your company. Charging the job with the rental amount serves two purposes: first, the job cost will reflect a more accurate accounting of the expenses incurred in running the job and, second, the equipment module will reflect that the piece has been utilized. The amount is not an actual expense to the company so the entry is offset to a 'contra' account within the equipment cost account group. Note: The hours meter is updated with these transaction types.

•Exp Acct - This field represents the 'debit' side of the rental transaction and should be linked to a direct job cost account that has been set up for company-owned equipment rentals. A default job cost phase may also be linked.

•Contra Acct - This field represents the 'credit' side of the rental transaction. The rental expense is not an actual expense to the company so the entry is offset to a 'contra' account within the equipment cost account group.

Outside (3rd Party) Income (Transaction Type 35): This transaction type represents miscellaneous billing amounts that have been linked to a piece of equipment. This entry will use the outside rental rates with an operator as defined in the equipment list. The category may also be set up to include sales tax.

•A/R Acct - This field represents the debit side of the invoice entry and would be typically linked to the 'Accounts Receivable - Current' account but a separate receivable account may be set up for equipment rental invoices if desired,

•Income Acct - This field represents the credit side of the equipment rental invoice.

Depreciation Expense (Transaction Type 40): All equipment depreciation entries are posted with this transaction type. This type of transaction may only be entered through the Equipment Journal option.

•Depr Exp Acct - Link the equipment expense account for depreciation to this field.

•Accum Depr Acct - Link the asset account for accumulated equipment depreciation to this field.

Direct Expense (Transaction Type 10): Accounts payable invoices, whether entered through the Payables or Orders module, will automatically create a transaction type of this kind in the Equipment module whenever invoices are linked to an equipment code. Likewise, any payroll timecard entry that is linked to a department code that is designated Equipment Maintenance & Repairs is given this transaction type in the Equipment module.

•Expense Acct - Only the equipment journal will use the default account that has been linked to this field. The payable invoices and the payroll entries will follow the business rules for those modules.

•Contra Acct - Only the equipment journal will use the default account that has been linked to this field for the 'credit' portion of the entry.

Indirect Expense (Transaction Type 60): This type of transaction is automatically generated when the Allocate Indirect Costs option is used to create a journal entry that will apply the total of the indirect equipment costs for a given period to the various pieces of equipment. Indirect costs will only be allocated to equipment codes that have been linked to an equipment category that has the Enable Indirect Calcs checked. For example, you may not want the small tools category to have the indirect costs allocated to it so you would not place a check in the Enable Indirect Calcs box.

•Exp Acct & Contra Acct - The equipment journal that is automatically created through the Allocate Indirect Costs option will post a debit and credit to the same account number that the original expense was posted to; it will not use the default accounts as set up on this screen. The system will only use these default accounts whenever an equipment journal for indirect expense is manually created.