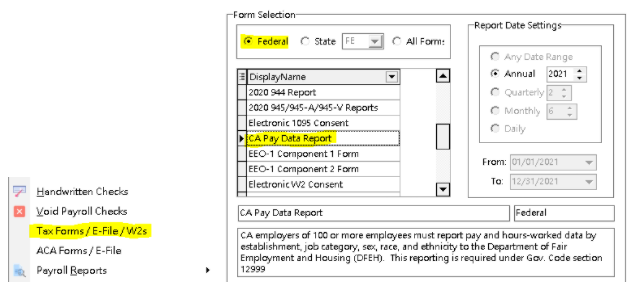

In 2021, California introduced the California Pay Data Report. This report can be accessed using the Tax Forms / E-File / W2s menu option of the Payroll main menu. You will need to select the Federal Forms option, not the State Forms option, on the Aatrix Dialog to locate the form:

|

You will need to review the Personal Tab on the Employee Center Screen to make sure each employee is set up correctly for the related EEO fields: Gender, Ethnic Code, & EEO Job Category.

When generating this form, Aatrix will prompt you to select a pay period from a drop down list.

•If you choose a specific date, then Aatrix will display only those employees that received a check on that date. The hours will be the total of all hours for the reporting year (regular, overtime and PTO hours) not just for the selected pay date.

•If you choose the 'No payroll within snapshot' option, then ALL employees that had earnings for the reporting year will be displayed. The hours will be the total of all hours for the reporting year (regular, overtime and PTO hours).