With the release of Version 9.4, AccuBuild is introducing several new screens and database tables which will be used for maintaining health insurance coverage information for ACA Reporting. This initial release of the ACA Tracking Screens will allow you to begin entering employee and employer information required for ACA Reporting. In future updates for the 4th quarter of 2015, there will be additional enhancements to integrate the data gathered from these screens with the Aatrix Tax Software Program to produce the new series of ACA Forms. These new forms include Form 1094-B, Form 1094-C, Form 1095-B, and Form 1095-C.

The following information is an overview of the new screens and the associated fields that will be required for ACA Reporting.

•Employee Information for ACA Reporting – When setting up the employee information for ACA Reporting, you will first want to define the list of various health plans that your company offers using the Health Insurance Plan Master List Screen, and then set up the individual employee information using the Employee ACA Health Insurance Information Screen. The Employee Coverage Template Settings Screen should be used to set up employee templates which can then be used for rapid setup of multiple employees at a time.

•Employer Information for ACA Reporting – Most of the Employer Information for ACA Reporting will be set up using the Aatrix Company Settings Screen.

IMPORTANT: Be sure to check with your company CPA or an ACA Professional to find out the impact that the ACA will have on your company. In addition, the IRS Website contains information on employer reporting requirements for the Affordable Care Act:

https://www.irs.gov/Affordable-Care-Act/Employers

Health Insurance Plan Master List – This screen is used to maintain a master list of all Health Plans that are offered to employees each year and the related fields required for W-2 Reporting and the Affordable Care Act (ACA) Reporting for each calendar year. A new set of Health Plan records should be set up for each year at renewal or whenever insurance plans are changed. Once the master list has been established, you will be able to assign the policy plan types to the employees in the Payroll System. This screen can be accessed on the Payroll > Controls > List of Health Insurance Plans menu. The fields contained in each Health Plan Record are documented below.

Add Button – Use this button to add a new health plan record to the master list.

Delete Button – Use this button to remove a health plan record from the master list. If there are employee insurance records linked to the master record, then you will NOT be able to delete the record from the list.

Copy Button – Use this button to make a copy of the current master record so that all the fields are duplicated automatically.

Master Record Field Definitions:

•Policy Plan ID – This is a user defined field that you will use to identify each policy plan type and can contain up to 25 characters. Each Policy Plan ID must be unique in the same Calendar Year. You may wish to use a code provided by your health insurance carrier when applicable, or you may want to create your own code. For example, if the insurance carrier code for a Family Plan including the employee, spouse and family is “FMD2015”, you can use that code by itself or add some additional characters for a more descriptive code such as “FMD2015-Family” which will make it easier to identify the meaning of the Plan ID. Once a Policy Plan ID has been added, you will NOT be able to change the description.

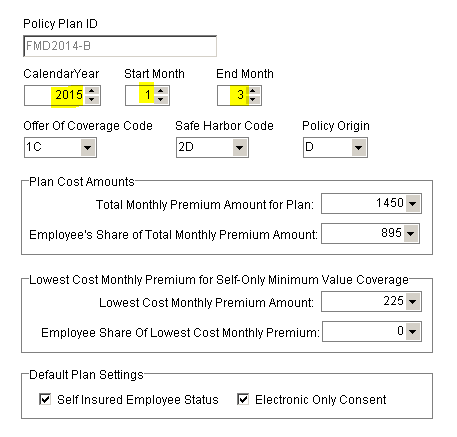

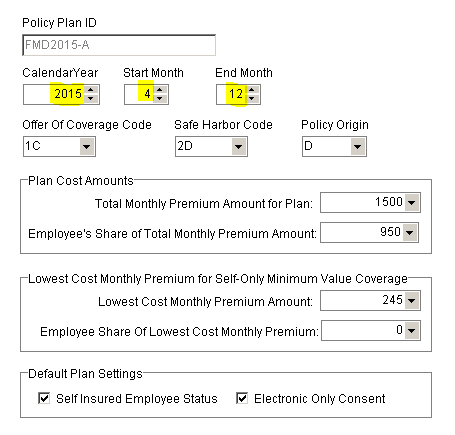

NOTE: If your insurance policy period does NOT follow the Calendar Year, you will need to set up two distinct sets of policy plan ID codes for each year. This is due the the fact that each policy period may have a different set of rates, and the reporting requirements are based on a calendar year. Be sure to set up the Starting Month and Ending Month of each plan so that there is no overlap in the same calendar year AND all months of the calendar year are covered. The following screen samples show two family policies: “FMD2014” and “FMD2015” which are based on a policy period of April through March. The last 3 months of policy “FMD2014” cover the first 3 months of calendar year 2015, and the first 9 months of policy “FMD2015” covers the last 9 months of calendar year 2015. In this example, two codes (“A” and “B”) are set up for each policy in order to cover the entire calendar year for 2015:

•Calendar Year – Enter the Calendar Year covered by the Policy Plan.

•Start Month – Enter the Starting Month of the Plan (1-12).

•End Month – Enter the Ending Month of the Plan (1-12).

•Offer Of Coverage Code – This code is required for ACA Reporting on Form 1095-C Part II-14 (1A – 1I). Please refer to the IRS Instructions on Form 1095-C for more information.

•Safe Harbor Code – This code is required for ACA Reporting on Form 1095-C Part II-16 (2A – 2I). Please refer to the IRS Instructions on Form 1095-C for more information.

•Policy Origin – This code is required for ACA Reporting on Form 1095-B Part I-8 (A – F). Please refer to the IRS Instructions on Form 1095-B for more information.

•Plan Cost Amounts – These amount fields are used mainly for internal record keeping can be very useful for W-2 Reporting at the end of the year. These amount fields are NOT required for ACA Reporting.

oTotal Monthly Premium for Plan – Enter the total cost of the plan (Employer and Employee Portions).

oEmployee’s Share of Total Monthly Premium Amount – Enter the total cost of the plan for the Employee’s Share (if any). If the employee does not pay any part of the insurance premium, then set this field to zero.

•Lowest Cost Monthly Premium for Self-Only Minimum Value Coverage – These amount fields are used for ACA Reporting Purposes.

oLowest Cost Monthly Premium Amount - Enter the lowest-cost monthly premium for self-only minimum essential coverage providing minimum value that is offered to the employee.

oEmployee Share of Lowest Cost Monthly Premium – Enter the Employee’s Share of the above lowest-cost monthly premium for self-only minimum essential coverage providing minimum value. If the employee does NOT pay any portion of the above amount, then set this field to zero.

Important Note: This amount is used for ACA Reporting on Form 1095-C – Part II-15. Please refer to the IRS Instructions on Form 1095-C for more information.

•Default Plan Settings – These are additional fields required for ACA Reporting and represent the default settings that will be copied to each employee when the Employee Coverage Template Settings Screen is used to create or update the employee records on the Employee ACA Health Insurance Information Screen. NOTE: These are default settings only and each employee record can be updated individually for these fields after the plan ID has been assigned.

oSelf Insured Employee Status – If the Employer is Self-Insured, then this field indicates if the employee is participating in the Self-Insured Plan.

oElectronic Only Consent –This field is used to indicate if the employee has consented to an electronic statement.

Codes for Form 1905-C: Please refer to the IRS Instructions for Forms 1094-C and 1095-C for detailed information on the Policy Origin Code, Offer of Coverage Code, and Safe Harbor Code. In addition, please check with your CPA or an expert consultant on the ACA for guidance on setting up your employee health insurance information and the associated codes and amounts related to the health insurance information.

Policy Origin Code:

•A = Small Business Health Options Program (SHOP).

•B = Employer-sponsored coverage.

•C = Government-sponsored program.

•D = Individual market insurance.

•E = Multiemployer plan.

•F = Miscellaneous minimum essential coverage.

Offer of Coverage Code:

•1A = Qualifying Offer: Minimum essential coverage providing minimum value offered to full-time employee with employee contribution for self-only coverage equal to or less than 9.5% mainland single federal poverty line and at least minimum essential coverage offered to spouse and dependent(s).

•1B = Minimum essential coverage providing minimum value offered to employee only.

•1C = Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) (not spouse).

•1D = Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to spouse (not dependent(s)).

•1E = Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) and spouse.

•1F = Minimum essential coverage NOT providing minimum value offered to employee, or employee and spouse or dependent(s), or employee, spouse and dependents.

•1G = Offer of coverage to employee who was not a full-time employee for any month of the calendar year and who enrolled in self-insured coverage for one or more months of the calendar year.

•1H = No offer of coverage (employee not offered any health coverage or employee offered coverage that is not minimum essential coverage).

•1I = Qualifying Offer Transition Relief 2015: Employee (and spouse or dependents) received no offer of coverage, received an offer that is not a qualifying offer, or received a qualifying offer for less than 12 months.

•1J = Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage NOT offered to your dependent(s). (New for 2016)

•1K = Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage offered to your dependent(s). (New for 2016)

Safe Harbor Code:

•2A = Employee not employed during the month.

•2B = Employee not a full-time employee.

•2C = Employee enrolled in coverage offered.

•2D = Employee in a section 4980H(b) Limited Non-Assessment Period.

•2E = Multiemployer interim rule relief.

•2F = Section 4980H affordability Form W-2 safe harbor.

•2G = Section 4980H affordability federal poverty line safe harbor.

•2H = Section 4980H affordability rate of pay safe harbor.

•2I = Non-calendar year transition relief applies to this employee.

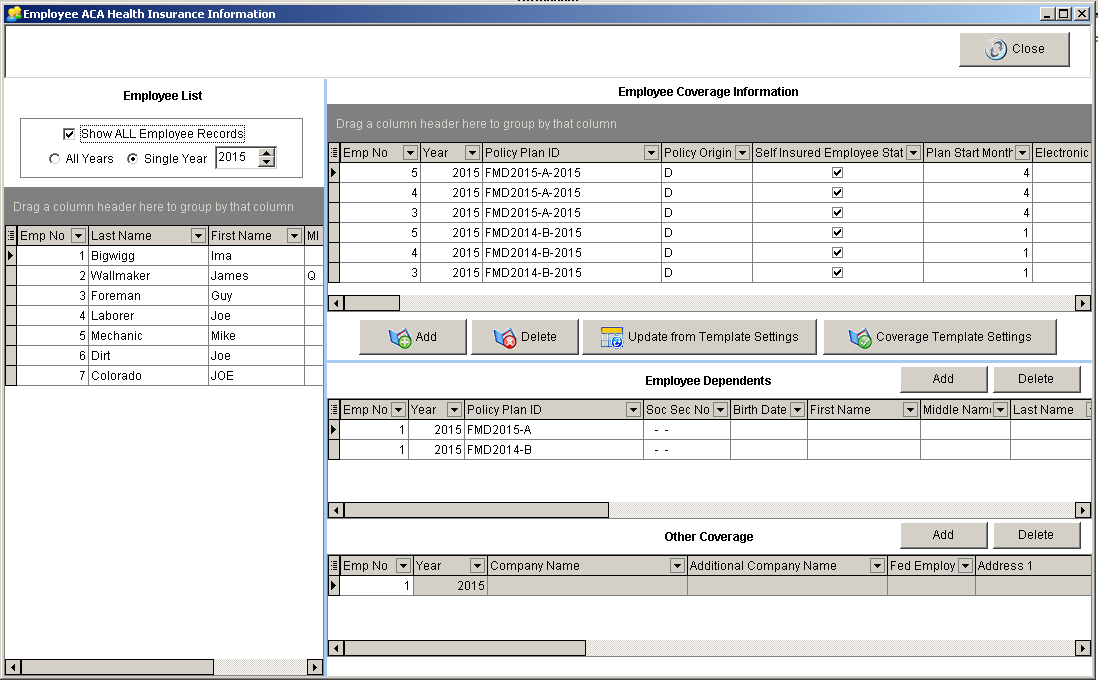

ACA Employee Records

The Payroll > ACA Employee Records menu option is used to access the Employee ACA Health Insurance Information

screen which is used to maintain employee health insurance records to aid in W-2 and ACA Reporting. Use the features on this screen to rapidly update one or more employees with the fields from the Health Insurance Plan Master records. The individual employee record can then be edited as necessary.

As a quick overview, updating the employee ACA records should be carried out in this order:

1.Go to Payroll > ACA Employee Records.

2.Click the Coverage Template Settings button to display the Employee Coverage Template Settings screen; this screen must remain open as you update the employees. Select a plan from the master list. Use the Copy button to update the Monthly Coverage Settings.

3.Select one or more employees on the left side of the screen.

4.Use the Update from Template Settings Button to update the selected employees with the selected plan information.

5.Edit an individual employee ACA record as necessary.

The Employee ACA Health Insurance Information Employee is divided into four sections: Employee List; Employee Coverage Information, Employee Dependents, and Other Coverage.

Employee List – This grid contains a list of all employees in the system and is used to select and filter the employee list for editing related health insurance records. Several fields can be enabled on the grid to help with the employee filtering process. The available fields include the Active Status, Termination Date, Social Security Number, Birth Date, Union Code, Union Work Class, Department Code, Workers Comp Code, State Code, and all of the User Defined fields on the employee list. These fields can be very useful for filtering the employee list for specific health plan updates. In addition to the grid filtering, separate controls exist at the top of the Employee List for further filtering options:

Pop Up Menu – The Employee List grid contains a pop up menu (right-click) with the following options:

•update from template settings – Same process that is called from the “Update from Template Settings” button.

•coverage template settings – Same process that is called from the “Coverage Template Settings” button.

•Copy employees from one health plan to another health plan – This feature is used to copy all of the employees that are listed under one health plan in the Employee List Grid, to a new health plan that is selected from the ”Health Insurance Plan Master List”. This feature will be very useful at policy renewal in order to set up employees for a new policy or new plan year.

Source Plan: Select the Source Plan Year and Plan Description. This list of Insurance Plans is obtained from the Employee Coverage Information Grid.

Target Plan: Select the Target Plan Year and Plan Description. This list of Insurance Plans is obtained from the Health Insurance Plan Master List.

Copy Button: Click the Copy Button to duplicate the employees from the Source Plan to the Target Plan.

Important Note: All of the Settings from the Source Plan will be copied exactly for each employee into the Target Plan based on the current settings in the Employee Coverage Information Grid. You will then want to update these Target Plan settings based on the current settings in the Health Plan Master as using the following steps:

1.Review the Target Plan Settings in the Health Insurance Plan Master List.

2.Select the Target Plan Policy and Year from the Employee Coverage Template Settings Screen.

3.Click the Copy Button to fill in the all the fields in the Monthly Coverage Settings section of the Employee Coverage Template Settings Screen.

4.Select all the employees to be updated with the new Target plan settings from the Employee List Grid on the Employee ACA Health Insurance Information Screen.

5.Click the Update from Template Settings Button to apply the Health Plan Master Settings to the selected employees for the new Target Plan

Show ALL Employee Records – When the option is unchecked, then only the health records for the current selected employee are displayed on the right side of the screen. When this option is checked, then all employee records on the right side of the screen are displayed regardless of the employee list filtering options.

All Years – When this option is checked, then the employee records for ALL Years are displayed on the right side of the screen. NOTE: when this option is checked, you will NOT be able to edit the data. Editing of the employee health insurance records can only be done when a Single Year is selected.

Single Year – Use this option in conjunction with the Year Control to select the desired calendar year for filtering employee records. Under this option, you will be able to edit employee health insurance records.

Group Selections – The Employee List allows for selected employees to be updated from the Employee Coverage Template Settings screen and supports multiple selections for one or more employees. For multiple employee selection use the Shift-Click, Ctrl-Click, or Shift-Up/Down Arrow Keys.

Employee Coverage Information – These records represent the health coverage information for each employee with individual fields for all 12 months of the calendar year. These fields can be easily updated using the fields from the Health Insurance Plan Master table in conjunction with the Employee Coverage Template Settings Screen. The fields in this section are mainly used for the new ACA Form 1095-C - Part II - Employee Offer and Coverage. There are 12 sets of fields (one set for each month) that will be used to update Form 1095 C – Part II:

•Offer of Coverage Code – Part II – Box 14

•Employee Share of Minimum Coverage – Part II – Box 15

•Safe Harbor Code – Part II – Box 16

•Total Cost of Minimum Coverage – for record keeping purposes only, does not get updated on Form 1095.

Important Note: The Calendar Year and Plan Type ID must be unique for each employee. If the health plan does not follow a calendar year, then you will have multiple health coverage records for each employee in the same calendar year. See the documentation on the Health Insurance Plan Master Screen for more information on non calendar year health plans.

![]()

Click the Coverage Template Settings Button and select the desired calendar year and a policy plan type. Click the Copy Button to update the fields in the Monthly Coverage Settings section located at the bottom portion of the screen. This function will copy the fields from the master code to each applicable month covered by the plan. Edit the Monthly Coverage Settings if necessary and then update one or more employees with the template fields using the Update from Template Settings Button located on the Employee ACA Health Insurance Information Screen. Note: The Employee Coverage Template Settings Screen MUST remain open when using the Update form Template Settings option.

•Year – Calendar Year for the plan policy records. This field is also used to filter the Policy Plan Type drop down for the specific calendar year policies.

•Policy Plan Type ID – Select the desired plan ID from the drop down list. The policy list is maintained in the Health Plan Master Screen which can be accessed using the Policy Plan List Button. After a policy is selected, all of the related fields will be copied to the field controls in the upper half of the screen. Please refer to the documentation on the Health Insurance Plan Master List for more information on each of these fields.

•Copy Button – Use this button to copy the policy plan settings to each setting control in the Monthly Coverage Settings section of the screen. NOTE: If your policy plans are not based on a calendar year, then only the months that are represented by the plan are updated. The Start Month and End Month settings of each plan will dictate which fields are updated on the template screen.

•Monthly Coverage Settings Section – once the policy fields have been copied, you can still manually edit the fields in this section of the screen. This may be necessary for situations where certain employees have not been covered for the entire policy period.

![]()

The Update from Template settings Button is used to update the selected employee record with the selected insurance plan information.

1.Select one or more employees from the Employee List Grid.

2.Click the Coverage Template Settings button and select a plan. Use the Copy button to copy the plan settings into the Monthly Coverage Settings section of the screen. Make any necessary adjustments to the plan settings on this screen as needed for the selected employee(s). Be sure to leave this screen open before proceeding to the next step.

3.Click the Update from Template Settings button to update the selected employees with the selected insurance plan information.

4.Once the employee(s) have been updated, the employee's record can be further modified in the Employee Coverage Information grid.

Employee Dependents – This section lists the employee dependents associated with each Employee Coverage Information Record. These records are required for reporting on Form 1095-B Part IV and reporting on Form 1095-C Part III. Please refer to the IRS Instructions for more information on the reporting requirements for this information. (Employee dependent information is only required for companies that are self-insured).

•Add Button - Select one employee on the Employee Coverage Grid at the top of the screen and then click the Add button to add a dependent record . You may not select more than one employee with this option.

Pop Up Menu – The Employee Dependents grid contains a pop up menu (right-click) which allows you to check or uncheck ALL months on one or more selected dependent records.

•Add employee as dependent for all plans - This option on the pop-up menu is used to add employees as dependents for each insurance plan for the selected year. You must choose a single year from the Employee List settings in order to use this feature. It is also recommended to have the “Show ALL Employee Records” box checked in order to see the new records as they are added.

| The purpose for this feature is for self-insured plans where the ACA reporting requirement need to have the employee listed as a dependent in addition to any other dependents on the employee’s health plan. This routine will check to make sure that all employee plans listed in the Employee Coverage Information Grid are added to the Employee Dependents Grid if they are missing. Each new dependent record will include the plan information along with the employee name, social security number, and birth date which are pulled from the employee list. |

•Copy dependent list to another health plan - This option on the pop-up menu is used to copy employees dependents from one health plan (Source Plan) to another health plan (Target Plan). This feature is very useful for setting up new health plans at the insurance renewal, and works by automatically duplicating the dependent list from one plan to another.

| When this option is selected from the pop-up menu, a screen will be displayed entitled “Copy Dependent List”. Select the Year and Plan from the Source Plan Group and the Target Plan Group. This list of plans in the in both of these groups are queried from the Employee Coverage Information Grid. Once the plans have been selected, click the Copy Button to copy the dependents from the Source Plan to the Target Plan. |

| NOTE: Only the dependent records for employees that exist in both plans will be copied. |

•Update table index to allow blank soc sec numbers - This option is used to change the original index file business rules to allow multiple employee dependent records to have blank social security numbers. This option will update the table index to change the unique list of fields from the Original Field List to the New Field List as shown below:

Original Field List: Employee No, Year, Soc Sec Number, Policy ID

New Field List: Employee No, Year, Soc Sec Number, Birth Date, Policy ID, First Name, Middle Name, Last Name

For ACA reporting on Self-Insured plans, the dependent list requires the social security number for each dependent. If the social security number is not provided, the birth date of the dependent can be used. Therefore, if you need to add multiple dependents for the same employee where the social security numbers are not available, this option will allow you to add these dependents without getting a duplicate index violation error message.

IMPORTANT NOTE: You will need exclusive use to the AatrixECIInfo table in order to create the new index. If the index creation process fails, you will need to get other users out of the system and try the process again.

Other Coverage – This section lists any other coverage providers for the employee for reporting on Form 1095-B – Part III. Please refer to the IRS Instructions on Form 1095-B for more information.

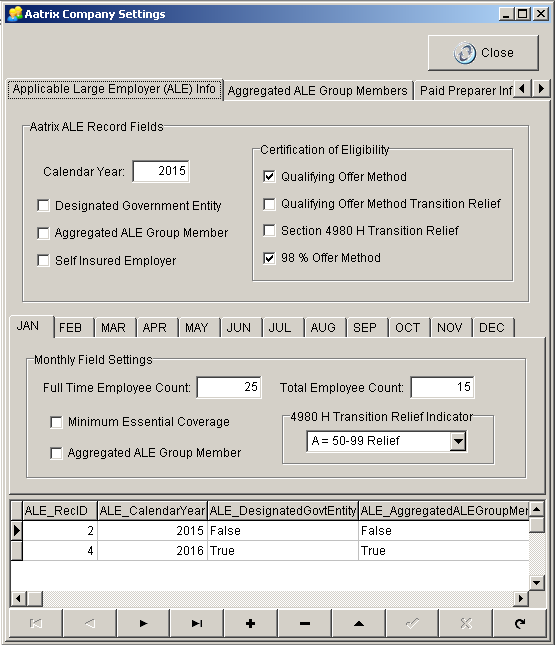

Aatrix Company Settings – This screen is used to maintain Applicable Large Employer (ALE) Information and Designated Government Entity Information for ACA Reporting.

•Applicable Larger Employer (ALE) Info Tab

oCalendar Year – Enter the Calender Year for the Record Information. You will need a separate record for each calendar year reporting.

oDesignated Government Entitiy – refer to Form 1094-C – Part I - Boxes 9-16

oAggregated ALE Group Member – refer to Form 1094-C – Part II – Box 21

oSelf Insured Employer – refer to Form 1095-C – Part III

oCertificate of Eligibility Group – refer to Form 1094-C – Part II – Box 22 A, B, C & D.

12 Sets of Monthly Field Settings (Jan-Dec):

•Full Time Employee Count - Form 1094-C – Part III a

•Total Employee Count - Form 1094-C – Part III – Box c

• Full Time Employee Count - Form 1094-C – Part III – Box b

•Minimum Essential Coverage – Form 1094-C – Part III Box a

•Aggregated ALE Group Member - Form 1094-C – Part III – Box d

•4980 H Transition Relief Indicator - Form 1094-C – Part III – Box e

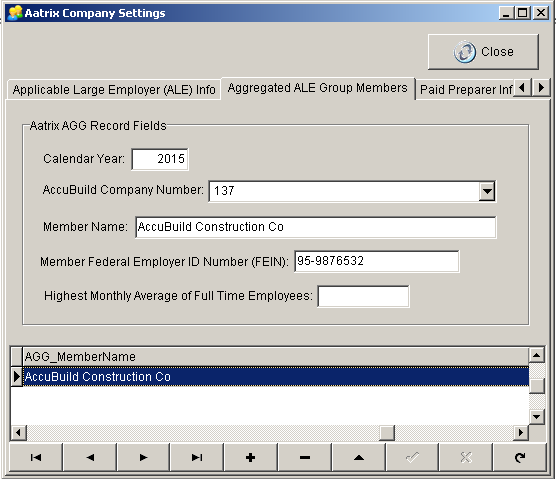

•Aggregated ALE Group Members Tab - Use this tab to list the ALG Group Members if applicable for Form 1094-C – Part IV.

oCalendar Year – Member Records will need to be set up for each Calendar Year

oAccuBuild Company Number – Optional but if the member is set up as a company in AccuBuild, then the Federal Employer ID Number will be populated automatically.

oMember Name – Members Name.

oMember Federal Employer ID Number (FEIN): Member’s Federal ID Number.

oHighest Monthly Average of Full Time Employees – This field is used to sort the list of ALG Group Members on the IRS Form 1094-C in order by the Highest Monthly Average of Full Time Employees.

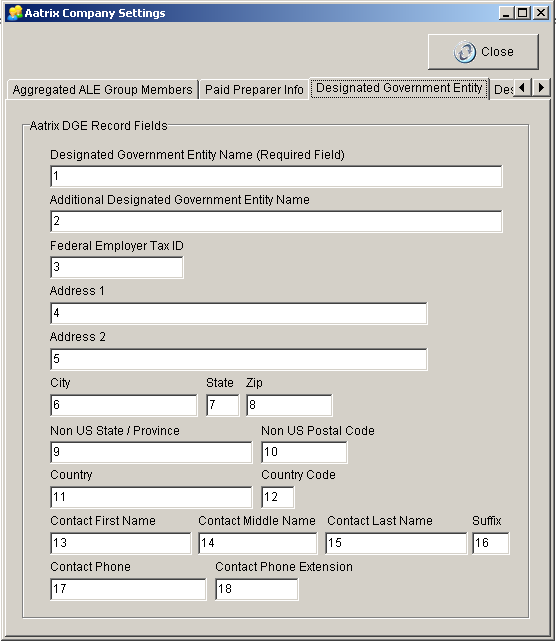

•Designated Government Entity Tab – These fields are used for Form 1094-C – Part I – Boxes 9-16 if your company is a Designated Government Entity:

•Paid Preparer Info Tab – This tab is disabled and is reserved for future use. The information on this tab is NOT required for the new ACA reporting requirements with Aatrix.

•Designee Info Tab – This tab is disabled and is reserved for future use. The information on this tab is NOT required for the new ACA reporting requirements with Aatrix.

MAR – New Payroll Reports for ACA information

•Four Payroll Reports have been added to the MAR Library for reporting on the new employee health insurance information for the Affordable Care Act:

oPRREP01H.624 - ACA Health Plan Master List – This report lists all of the Insurance Policy Plans and related settings along with any errors for missing fields or invalid settings.

oPRREP01I.624 – ACA Company Settings Information – This report lists all of the company settings for ACA including the ALE Monthly Settings and Controls, Aggregated ALE Group Members, and Designated Government Employer Information. Error codes are included in the report for validating field information.

oPRREP01J.624 – ACA Employee Coverage information Report – This Report lists all of the employee plan information including dependent records and other coverage records where applicable.

oPRREP03D.608 – Employee Detail of Hours Worked by Check Date – This Report lists the total hours worked for each employee for the reporting period with monthly subtotals at the employee level. This report can be very useful when determining you company’s ALE Status and for filling out the ALE Information Tab on the Aatrix Company Information Screen.

IMPORTANT NOTE: The above report totals the employee hours by month but you will need to audit each employee’s totals to make sure the totals are accurate. If an employee has multiple checks per pay period or has several voided and re-issued checks, then the total hours can be skewed when computing your monthly hours for ACA Reporting. Additional factors include employees that are paid on a salary basis for a diffent pay perid or paid with no hours included.

BE SURE to check with your company CPA or Controll or an ACA Consulting Expert when determining your ALE Status for ACA and filling in the various fields on the Aatrix Company Information Screen.

ACA – Error Code Reference List

•The new MAR Payroll Reports for ACA Reporting reference a variety of error codes which relate to the new ACA Screens in AccuBuild. These error codes are documented below:

Health Insurance Plan Error Codes (500–511) - These error codes are related to the records in the AatrixECVTemplate Table which are set up via the Health Insurance Plan Master List Screen:

•500 - Policy Plan ID Field is blank.

•501 - Policy Plan is MISSING the Starting Month.

•502 - Policy Plan is MISSING the Ending Month.

•503 - Policy Plan is MISSING the Policy Origin Code.

•504 - Policy Plan is MISSING the Self Insured Employee Status.

•505 - Policy Plan is MISSING the Offer of Coverage Code.

•506 - Policy Plan is MISSING the Safe Harbor Code.

•507 - Policy Plan is MISSING the Employee Share of Total Cost of Coverage Amount.

•508 - Policy Plan is MISSING the Total Cost of Coverage Amount.

•509 - Policy Plan is MISSING the Lowest Cost of Self Only Coverage Amount.

•510 - Policy Plan is MISSING the Employee Share of Lowest Cost of Self Only Coverage Amount.

•511 - The Health Plan Self-Insured Setting does NOT match the Employer Self-Insured Setting (Aatrix Company Settings Screen).

Employee Insurance Coverage Information Errors (1000–5500) - These error codes are related to the records in the AatrixECVInfo Table which are set up via the Employee ACA Health Insurance Information Screen in the Employee Coverage Information Grid:

•1000 - Offer of Coverage OVERLAP - Multiple Offer of Coverage Codes for the same month.

•1100 - Safe Harbor OVERLAP - Multiple Safe Harbor Codes for the same month.

•1200 - Employee Share of Coverage OVERLAP - Multiple Employee Share of Coverage Amounts for the same month.

•1300 - Total Cost of Coverage OVERLAP - Multiple Total Cost of Coverage Amounts for the same month.

•2000 - Offer of Coverage MISSING - WARNING that Offer of Coverage Code is missing for the month.

•2100 - Safe Harbor MISSING - WARNING that Safe Harbor Code is missing for the month.

•2200 - Employee Share of Coverage MISSING - WARNING that there is no Employee Share of Coverage for the month.

•2300 - Total Cost of Coverage MISSING - Warning that there is no Total Cost of Coverage for the month.

•3000 - The Employee Setting for the Offer of Coverage Code DOES NOT MATCH the Policy Plan Master Setting.

•3100 - The Employee Setting for the Employee Share Of Lowest Cost Self Only Coverage DOES NOT MATCH the Policy Plan Master Setting.

•3200 - The Employee Setting for the Lowest Cost Self Only Coverage DOES NOT MATCH the Policy Plan Master Setting.

•3300 - The Employee Setting for the Safe Harbor Code DOES NOT MATCH the Policy Plan Master Setting.

•3400 - The Employee Setting for the Policy Origin Code DOES NOT MATCH the Policy Plan Master Setting.

•3500 - The Employee Setting for the Self Insured Employee Status DOES NOT MATCH the Policy Plan Master Setting.

•3600 - The Employee Setting for the Plan Start Month DOES NOT MATCH the Policy Plan Master Setting.

•5000 - The Employee Setting for the Safe Harbor Code Should Be Blank per the Policy Plan Master Setting.

•5100 - The Employee Setting for the Offer of Coverage Code Should Be Blank per the Policy Plan Master Setting.

•5200 - The Employee Setting Amount for the Employee Share Of Minimum Coverage Should Be Zero per the Policy Plan Master Setting.

•5300 - The Employee Setting Amount for the Total Cost Of Minimum Coverage Should Be Zero per the Policy Plan Master Setting.

•5400 - WARNING - The employee has earnings for Reporting Period (Year), but there are NO Employee Coverage Information Records for ACA Reporting.

•5500 - The Employee Self-Insured Setting does NOT match the Employer Self-Insured Setting (Aatrix Company Settings Screen).

Employee Dependent Setting Errors (6000–7700) - These error codes are related to the dependent records in the AatrixECIInfo Table which are set up via the Employee ACA Health Insurance Information Screen in the Employee Dependents Grid:

•6000 - The Dependent should NOT be Covered for the month per the Policy Plan Master Settings for the Policy Period Dates.

•6100 - The Dependent setting for the Safe Harbor Code should not be set per the Policy Plan Master Settings for the Policy Period Dates.

•6200 - The Dependent setting for the Offer of Coverage Code should not be set per the Policy Plan Master Settings for the Policy Period Dates.

•7000 - The Dependent entry is MISSING the Policy Plan ID.

•7100 - The Dependent entry has an INVALID social security number. Social Security Number MUST be entered with format of 999-99-9999 unless birth date is provided.

•7200 - The Dependent entry has NO social security number and NO birth date. One of these two fields MUST be provided for self insured plans.

•7300 - The Dependent entry is missing the FIRST Name field.

•7400 - The Dependent entry is missing the LAST Name field.

•7500 - The Dependent entry is missing the YEAR field.

•7600 - A Dependent entry exists for an employee that is not listed in the Coverage Information.

•7700 - The Employee Dependent Record is missing in the Employee Dependent List. For Self-Insured Plans, a list of employee dependents is required and the Employee (identified by the social security number) MUST be included in this list.

Employee Other Coverage Information Errors (14000-14600) - These error codes are related to the other coverage provider records in the AatrixOCPInfo Table which are set up via the Employee ACA Health Insurance Information Screen in the Other Coverage Grid:

•14000 - The Other Coverage Provider Record is missing the Company Name field.

•14100 - The Other Coverage Provider Record is missing the Federal Employer ID No (FEIN) field.

•14200 - The Other Coverage Provider Record is missing the Address 1 field.

•14300 - The Other Coverage Provider Record is missing the City field.

•14400 - The Other Coverage Provider Record is missing the State field.

•14500 - The Other Coverage Provider Record is missing the Zip Code field.

•14600 - The Other Coverage Provider Record is missing the Contact Phone Number.