•ENHANCEMENT - Alabama Overtime Pay Exemption for SWH Tax (VERSION 10.2.0.8)

The state of Alabama has initiated a new tax exemption for State Withholding Tax (SWH) which allows for overtime pay to be exempt from SWH Wages. There are rules for which types of overtime payments are allowed for this exemption and there will be new reporting requirements beginning in 2024 for reporting these amounts throughout the year as well as in Box 14 of the W2 Form. This new tax law will be in effect from January 1, 2024 through June 30, 2025 unless otherwise extended in the future.

The AccuBuild program has been updated to handle these new overtime tax exemptions which will require specific business rules to be followed in order to report the exemptions accurately. Be sure to review these rules (outlined below) so that your payroll checks will compute the correct amount of exempt overtime pay.

A new report that has been added to the AccuBuild MAR Reports List which can recap all of these overtime pay exemption amounts to help with the new Alabama reporting requirements.

Business Rules: There are certain rules to follow in order for the system to compute the Exempt Overtime Wages correctly. Please follow these rules when processing payroll for weekly payroll checks:

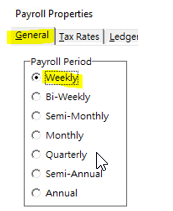

oPayroll Properties Setting: Make sure the Payroll Period setting in the Payroll Properties Screen (General tab) is set for Weekly Payroll:

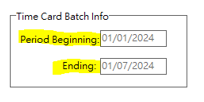

oPayroll Batch - Period Beginning and Ending Dates: Make sure the payroll period dates represent one week of payroll (7 days):

|

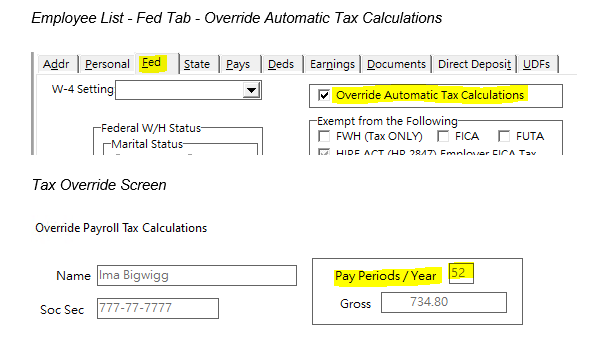

oOverride Automatic Tax Calculations: If you have the Override Automatic Tax Calculations set for any employees in the Employee List (Fed tab), be sure to check the override screen to make sure the check is based on the Weekly Payroll setting. If this is set correctly, then when the override screen pops up, the Pay Periods / Year setting will be set to 52. Any other setting in this field will cause the payroll check to be marked as non-weekly and the exempt overtime amounts will be excluded in the tax reporting forms and Aatrix Reports.

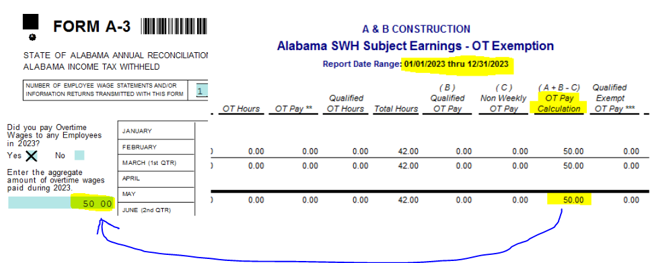

Reporting: A new report has been added to the MAR Report Library under the the Employee P/R Reports list entitled Alabama SWH Subject Earnings - OT Exemption. This report recaps how the overtime exempt pay is calculated based on the Alabama rules for the exempt pay amounts. This report can be used for reporting any preliminary overtime amounts from 2023 as well as amounts in 2024 when the new exemption kicks in. Only weekly payroll checks where the total hours worked exceed 40 hours will be considered for overtime pay exemption. Only regular pay and overtime pay transactions are considered in the exemption calculation and any overtime pay transactions where the total hours do NOT exceed 40 hours are not eligible for the exemption.

Alabama SWH Subject Earnings - OT Exemption

This report has many columns and the following information will help to understand the specific amounts that are considered for the overtime pay exemption amount:

o( A ) Reg Pay Over 40 * - This column will compute any regular pay transactions that are considered for the exempt amount. Any regular pay hours that exceed 40 hours will be included in the exempt amount calculation even though they were not coded as overtime. NOTE: If the paycheck represents more than one week of pay (non weekly paycheck), then this column will be set to zero as it will not qualify for the exemption.

o( B ) Qualified OT Pay - This amount is based on the Qualified OT Hours which are made up of any overtime hours that exceed the total hours requirement of 40 hours. If the regular hours are less than 40, then a portion of the overtime hours will be excluded until the 40 hour minimum is reached.

o( C ) Non Weekly OT Pay - If the Qualified OT Pay is computed on a paycheck that represents more than one week of pay (non weekly paycheck), then any Qualified OT Pay will be listed in this column and will NOT be eligible for the exemption.

o( A + B - C ) OT Pay Calculation - This column represents the computed overtime pay exemption amount - Column A plus Column B minus Column C.

oNOTE: The amount in this column can be used for any overtime payments in 2023 that would qualify for overtime based on the new rules for the overtime exemption amounts. Simply run the report for the 2023 calendar year.

The Annual FORM A-3 for the Calendar Year 2023 provides an entry for 2023 Overtime wages. You will need to type in this amount for 2023 which can be pulled from this column of the report as shown in the screenshots below. For 2024, this amount will be filled in automatically from the Qualified Exempt OT Pay *** column:

oQualified Exempt OT Pay *** - This amount is the same as the OT Pay Calculation amount for any check that is dated between the effective dates of 1/1/2024 and 6/30/2025. If the check date falls outside of this date range, then this column will be set to zero as the amount will NOT be exempt.

oSWH Wages - This column represents the wages that are subject to Alabama state withholding taxes AFTER the overtime exemption has been deducted. This is the wage amount that is used as the basis amount for computing the Alabama state withholding tax amount. The wages that are subject to Federal Withholding are shown in the FWH Wages column for comparison purposes to the SWH Wages.

oWeek Count Calc - This is the calculated week count based on the week beginning date and week ending date of each paycheck. This column is then compared to the actual week count column used on the paycheck when taxes were calculated. If this column does not match the Week Count column, then it will be flagged with 4 asterisks (****) which could indicate that the above business rules (above) were not used for proper overtime calculations.

oComments - This column helps to identify any checks that are not considered for the overtime pay exemption:

▪NON Weekly Pay ** - Only weekly payroll checks can be considered for the overtime pay calculation

▪Prior to 2024 ** - Any payroll checks that are dated prior to 1/1/2024 are not eligible for the overtime pay exemption. However, the overtime pay calculations may be useful in reporting 2023 overtime pay projections.

▪Total Hours <= 40 ** - Overtime pay is considered for exemption ONLY when the total hours exceed 40.

Important Note: Due to the nature of construction related payroll, where prevailing rates and union rates can vary for the same employee on the same paycheck, depending on the various tasks being performed, all overtime calculations are performed on a blended rate basis. The Regular OT rate is based on the Regular Pay (Reg Pay) divided by the Regular Hours (Reg Hrs) and the Overtime OT Rate is based on the Overtime Pay (OT Pay **) divided by the Overtime Hours (OT Hours).