The State Unemployment (SUI) Report is available in three different formats.

Full Detail Report option prints a list of all checks written to each employee and includes the gross wage amount, the wages subject to SUI, the calculated SUI tax amount along with the SUI state code and the Reciprocal Agreement setting.

State & Emp Totals option prints a summary of employee wages by state.

Employee Totals option prints a summary of total wages by employee. The Employee Totals option is the same report that may be printed for SUI in the Quarterly Payroll Tax Reports option.

Note: If you own the Multi-State Payroll option, then be sure to print this report for each individual state rather than for all states.

State Unemployment Report Options:

❑State Unemployment (SUI) Report - Trans Date (prrep14c.644)

❑State Unemployment (SUI) Report - Week Ending Date (prrep14c.645)

•As of Version 9.1.0.1, the MAR version of the State Unemployment Reports show the new state wage amount based on the new calculations for the Aatrix SUI Tax Forms (see below) so be sure to use this version of the SUI reports going forward. The traditional report will not be modified for the wages column and will still show the federal totals for wages column.

| Note: Aatrix Tax Forms - Computation Change for SUI Total Wages - The Total Wages for SUI Reporting was using the Federal Totals for Section 125 and other pre-tax deduction amounts. For some states, the Section 125 pre-tax deductions are not exempt. The SUI Subject To Wages were always being reported correctly base on the pre-tax deduction settings, however the Total Wages were using the federal wages amounts. The Aatrix calculations have been changed for the Total Wages for SUI Reporting to check all six pre-tax deductions for each individual state and compute the wages based on those settings at the time the report is printed. This should insure that each individual state settings are considered for all State SUI Total Wages. |

❑Subject Earnings - StateSUIComboGroup - Summary - Trans Date (prrep14f.644)

❑Subject Earnings - StateSUIComboGroup - Detail - Week Ending Date (prrep14g.644)

Introduced in Version 10.0.0.5, these reports are different from the other SUI reports in that the data groupings are based on the combined STATE_CODE and SUISTATECODE fields for each payroll check record so that both state codes are included in each group. For multi-state payroll situations, this new grouping method will make sure that separate groups are created when the state code and the SUI State code are NOT the same which occurs when employees have state earnings in another state but need to report state unemployment earnings to their home state.

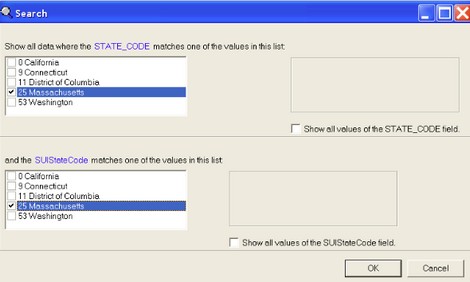

Both of these reports have a built in filter for selecting the desired State Codes and SUI State Codes so that you can run the report for all states or for specific combinations of states.