Select the Void Payroll Check option to reverse all entries in all systems for any payroll check that was previously posted through the payroll program. Please follow the steps below to void a payroll check. For more information, please refer to these frequently asked questions:

How do I void a check that has correcting entries made to it under a separate handwritten check entry? |

| 1. | Select the Void Payroll Checks option from the Payroll menu. |

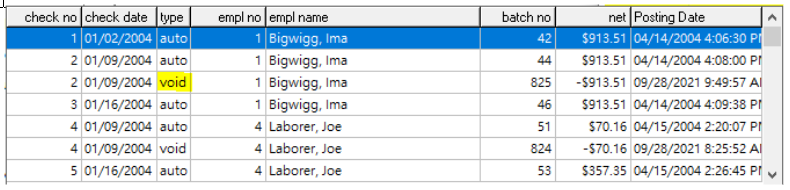

| Check No - Type in the check number. Use the down arrow on the field to display the check number, check date, employee name and number, net amount of the check and the batch number. This list also displays the transaction type as either an automatic check, handwritten check or voided check. |

Note: Previous to software version 10.2.0.1 (October 2021), the system allowed a payroll check to be voided more than once. The system has been enhanced to prevent this duplicate void entry. The drop down list of the check numbers will still display the original check entry, along with a second entry to show the void, however, if you select a record that has already been voided, the system will now display a message that the check was already voided along with the batch number of the transaction.

| Transaction Date - Enter the date to be used with the voided check. The transaction date controls the posting date of the void entry through the entire system. BE SURE that you have entered the proper transaction (void) date! This date can be the same as the original check date if the period is still open. |

| Account - Verify that the correct cash-in-bank account is displayed in this field. This field is based on the general ledger account defaulted in the Payroll > Properties. |

| 2. | Select OK and AccuBuild will search the payroll transaction files to see if the check number is valid. If the check is found, then the system will display the check information on the screen. If the check is not found in the historical payroll checks file, then verify that the check number and the account number were entered correctly. |

| If the system finds a valid check number, then the Review Timecards button is enabled. Select this option to view all related timecard entries for this check. If you own the Multi-State Payroll option, and the check was coded to more than one state, then you can select each state to review the deductions for each state. |

| 3. | Select the Void Check button to post the reversing entries through the accounting system. Voided payroll checks are processed one at a time, therefore, and no audit reports will be printed, however, the detail of the check can be viewed at any time on a variety of payroll reports or in the check register. |