AB ANALYTICS

•BUG FIX - Made changes to the database connection paths to use UNC Paths from the mobile configuration table. This will require the User UNC Paths to be updated inside the AccuBuild Main Program (User Maintenance Screen) as part of the setup process for users to access the AccuBuild Analytics program. This corrections fixes the connection errors on networks using mapped drive letters.

•Customer Transactions Cube - added new fields for class 8564

oMailing Address

oMailing CityStateZip

oShipping Address

oShipping CityStateZip

•New Fiscal Year Fields for each transaction date (TRANS_DATE)

oJob Cost Capsheet Transactions Cube

oLedger Transactions Cube

•FY_MONTH - Fiscal Year Month Number (1st, 2nd 3rd month of Fiscal Year)

•FY_QUARTER - Fiscal Year Quarter Number

•FY_YEAR - Fiscal Year - for Fiscal Year End

•BUG FIX - The Cube Security List was not displaying all users and user groups that a cube had security settings for. The security list only included the current user and the user groups that the current user belongs to. The settings screen has been corrected and now all secured users and groups will be displayed for each cube.

•New Project Managment Cubes added to Library - Two new cubes that handle Change Order Request Breakdown amounts for both the Project Management Side and the Accounting Side have been added to the Cube Library which use the new class of 8811. These cubes can be very useful for Change Order Analysis and comparing contract and cost estimate changes between the project management system and the accounting system:

oPMCUBE02.MDS - COR Analysis - Accounting Link Status

oPMCUBE03.MDS - COR - Accounting Variance

AB MOBILE - NEW SETTING

•The AccuBuild Mobile Screen has a new setting which allows for the required job cost phase to be zero (skipped) when this option is enabled. By default when this setting is UNCHECKED, you must enter a cost phase if the time entry is charged to a job to prevent any invalid job / phase entries from being made. If this box is checked, then this phase requirement will be DISABLED and the user can save the time entry to a job without needed to select a cost phase on the job.

AFFORDABLE CARE ACT (ACA) - UPDATE FOR 2016 REPORTING

•The ACA Screens in AccuBuild have been updated to support two new “Offer of Coverage” codes for the 2016 Reporting Year:

•1J = Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage NOT offered to your dependent(s).

•1K = Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage offered to your dependent(s).

GENERAL LEDGER - BANK RECONCILIATION - BUG FIX

•When a bank reconciliation batch is created and then closed, and then a vendor name is changed in the client list and that vendor has one or more outstanding checks in the current bank reconciliation batch, it was causing a new entry to be added to the bank reconciliation batch when the bank reconciliation was reopened. This problem has been corrected, and a new record will no longer be added, and the current entry in the bank reconciliation will keep the original vendor name description. If you MUST have the vendor name updated in the bank reconciliation batch, you will need to delete the bank reconciliation and start over.

JOB COST - ESTIMATE IMPORT - ENHANCEMENT

•Estimate Import Process has been updated to handle a new field mapping for the Job Number for detail items that are imported from Excel. This means that you will be able to import items for multiple job numbers at the same from a single spreadsheet.

•The business rules for using this new process are outlined below:

oIf the JOB Field is one of the field mappings in the estimate import template layout, then the job number from the JOB column of the spreadsheet will be used as the target job number for each detail item that is created. If there is no JOB field in the field mappings list, then the target job will be pulled from the Job setting in the Job Info Group Box at the top left of the screen.

oAll the Jobs in the job import file MUST already exist on the Job List. You will NOT be able to import estimate items on jobs that have not been set up in AccuBuild. If any jobs do not exist, then the posting process will display a list of missing jobs and then the posting will be cancelled until the jobs are added. NOTE: You can use the Job List button in the Job Info Group Box to add new jobs if needed.

oWhen multiple jobs are involved in the import, the item numbers will be automatically numbered for the next sequential item number for each specific job.

•The MAR Form for printing out the estimate import has been updated to include the job number to help group job estimates together on multi-job imports.

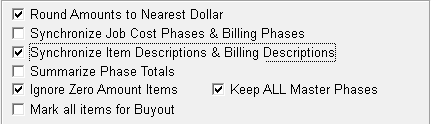

•The import screen check box options are now saved and restored on a user by user basis each time the screen is opened so that the settings will be remembered each time an import operation is done.

MAR REPORTS LIST - BUG FIX

•The MAR Reports List had a bug where a Library Report was listed for the user when the report class of the library report matched the ADMS Record ID of a Custom Report that the user had access to. This bug has been corrected.

•The MAR Reports Security List had a bug where the security for a library report was displayed as enabled when the class of the library report matched a custom report ADMS Record ID and the user had access to that custom report. In addition, the user name was listed twice on the custom report / form. This bug has been corrected.

PAYROLL - TAX UPDATES FOR 2017

•Federal Withholding - new tax tables added for 2017

•California - new tax tables added for 2017

•Idaho - new tax tables added for 2017

•Indiana - new tax rates added for state withholding for 1017. New county tax rates updated for 2017 on counties listed below. In addition, the tax rate is now identical for both resident and non residents.

oBoone

oBrown

oJackson

oJennings

oMonroe

oNoble

oParke

oPosey

oTipton

•Kentucky - new tax tables added for 2017

•Maine - new tax tables added for 2017

•Maryland - new tax tables added for 2017

•Minnesota - new tax tables added for 2017

•Missouri - new tax tables added for 2017

•Nebraska - new tax tables added for 2017

•New Mexico - new tax tables added for 2017

•New York State - new tax tables added for 2017

•New York - Yonkers City Tax - new tax tables added for 2017

•Oklahoma - new tax tables added for 2017

•Oregon - new tax tables added for 2017

•North Carolina - new tax tables added for 2017

•Rhode Island - new tax tables added for 2017

•South Carolina - new tax tables added for 2017

•Vermont - new tax tables added for 2017

PAYROLL - LOCAL DEDUCTION - ENHANCEMENTS

•Several changes were made to the Local Deduction Tracking in AB in order to automate the year end process of updating the employee cutoff limits for deductions that need to be adjusted at the start of each new calendar year. These types of deductions such as employee loans, tax levies etc., need to have the cutoff balances revised at the end of each Calendar Year so that they are accurate for the new Calendar Year. This adjustment process has now been automated and instructions for using this new feature are outlined below:

Cutoff Limit Type - The Local Deduction Codes Screen has been updated with a new field for the cutoff limit type. All existing local deductions that were set up prior to this release will default to a Fixed Balance cutoff type so that these types of local deduction balances will not be adjusted unless the Cutoff Limit Type is changed by the user. In order to enable a local deduction to be set up for automatic year end balance adjustments, you will need to set the Cutoff Limit Type to Reducing Balance BEFORE you roll your payroll totals for the Calendar Year:

•Fixed Balance - This type of cutoff limit will remain the same each year as the starting balance for the calendar year such as a 401K Contribution Limit.

•Reducing Balance - This type of cutoff limit will be recomputed at the start of each calendar by reducing the loan balance by the amount withheld in the previous year. NOTE: An audit record will be created for each employee that has this type of local deduction cutoff limit so that there is a record each year of the opening balance and the deduction activity against the balance. This type of Cutoff Limit is used for Employee Loans, Tax Levies, etc. where the amount is a decreasing balance with each withheld amount from the employee.

Balance Update Process - When the Payroll Cutoff Date is changed in the Company Configuration Screen, a new test will be performed to see if the year is being moved forward to a new calendar year and if so, the employee local deduction cutoff limits will be updated automatically. NOTE: This process is only done one time for each Calendar Year so if you need to re-open a year for W-2 Adjustments etc, the rolled balances are preserved. These balances are maintained in a new local deduction audit table called “LocalDedCutoffHistory” and a new MAR Report has been added to the Employee Reports list which will recap the employees that were updated with new cutoff limits. The report will include the Open Cutoff Balance before any changes were made, the Yearly Activity (deduction total) for the year being rolled, and the Year End Balance which will be the new cutoff balance in the employee file.

Employee List - After the adjustments have been made, the employee list will reflect the new cutoff balances for any local deduction that is set for a Reducing Balance cutoff limit. In addition, some new changes have been made to the Local Deduction Fields on the Employee Screen as outlined below:

•Deduct Type - A new Deduct Type has been add called “Paid in Full”. During the payroll year end roll calculations for local deductions, if the computed balance for the new calendar year is zero (amount is paid in full), the deduction will be flagged as “Paid in Full” automatically. This new setting allows for the local deduction information to be left remaining on the employee file without the need to clear the local deduction code from the employee file.

•Audit Trail - A new audit trail feature has been added for all of the Local Deduction Fields (1-20) that will capture any change to a local deduction setting. Any time a field is changed on a local deduction, a log will be kept of the “Before” and “After“ values of each field for existing local deduction changes, as well as new values for local deductions that are set up for the first time. These changes can be viewed in a new MAR Report on the Employee Report list called Local Deductions - Audit Trail. The report will include all of the field changes on local deductions including the timestamp of the change and the user name of the user that made the change.

PAYROLL - TIMECARD WORKSHEET - ENHANCEMENT

•The audit trail on the Timecard Worksheet Screen has been updated to log any filters that are active in the timecard worksheet grid when the Import Button is clicked. The Audit Log can be displayed using the right click menu on the grid and choosing the view timecard worksheet activity menu option. You must close the timecard worksheet screen and reopen it in order to update and refresh the log as this log is updated each time the screen is closed. This additional audit information will show ALL columns that had filters set during the time card import process.

PROJECT MANAGEMENT - COR PRICE BREAKDOWN SCREEN CHANGES

•When the COR Breakdown Screen is opened, it will no longer automatically extend the first breakdown item amounts based on the current fields settings.

•The radio button controls for cost only, billing only and both will now be disabled when the editing is blocked due to prior period accounting business rules. This will prevent amounts from being changed when these buttons are clicked.

PURCHASE ORDERS - BUG FIX

•When a new order of any type was created and saved, if the order number being saved was a duplicate order number, the save process would fail without showing any error message. This problem has been corrected and when a duplicate order number is encountered, an exception error will be displayed indicating that the field must be unique (unique key value required).

SUBCONTRACTOR PAYMENT SHEETS - NEW FEATURE

•The Subcontractor Payments Sheets Screen can now support paying a single subcontractor across multiple jobs in one batch process. This feature is mainly used by residential developers where each lot in a development project is setup with a separate job number. For example, if a new development phase was opened for 50 new home sites and the same drywall contractor was going to install the drywall for all 50 homes, this would require processing sub payment sheets for 50 different jobs when each home is set up with a unique job number. The normal process for sub payment sheets has been to process one job at a time. With this new feature, you can select a subcontractor, and then process multiple job numbers at the same time which streamlines the payment process. In order to use this new feature, you will need to enable the Advanced Setting (see Company Configuration Properties screen) entitled “SubPaymentSheetsPayBySub”.

NOTE: There are new Business Rules that are triggered for the subcontractor payment sheets when this option is enabled along with some new and disabled screen settings:

•The Job List control is disabled since the payments are done by subcontractor, not by job.

•The All Subcontractors on Job checkbox is disabled since only one subcontractor is processed at a time.

•The Auto and Retention buttons are disabled for this option.

•A new Job Column has been added to the grid so that you can identify the job number when multiple jobs are processed at a time.

•A new Job Picklist Button has been added for selecting one or more jobs for the subcontractor being paid. After selecting the subcontractor to be paid, the job picklist will display a list of OPEN Jobs that the subcontractor is working on. Select one or more jobs from the picklist list and then use the Fixed % or Manual Button options to generate the payment sheets.

Sort Order - Use this option to sort the subcontractor jobs by job number or by job description.

Selection Buttons - Use the Select All and Clear All buttons at the bottom of the screen for a faster selection process, or simply click on individual jobs in the grid.

Once the payment sheets are generated, you can edit as normal and carry out all the other functions just like the job driven payment sheets.

SYSTEM ADMINISTRATOR - ADVANCED SETTINGS - NEW FEATURE

•A new option has been added the to Advanced Settings Master Table titled “SubPaymentSheetsPayBySub” which allows for the subcontractor payment sheets to be processed by Subcontractor across multiple jobs at a time. You will need to add this new setting via the Advanced Property Settings on the Company Configuration Properties Screen. Refer to the documentation on subcontractor payment sheets for more information on how this feature works.