The accrued pay fields on the Employees > Pays Tab are used to set an accrual rate for hours earned based on every hour worked or per pay period worked. These amounts are generated for the Accrued Pay Report only and do not create any transactions in the general ledger.

| 1. | Payroll Properties - Determine which miscellaneous pay fields that you will use to track vacation, holiday and/or sick pay and enter the appropriate description for each pay type. These descriptions will appear on the Accrued Pay fields on the Employee List Screen. ** Note: The employee screen already contains a specific field for vacation but this field is reserved for use for employees belonging to a union. |

| 2. | Department Codes - This step is optional but you may want to set up a department code for each pay type in order to post the wages to a specific g/l account. If you don't use a specific department code, then the wages will be posted to the g/l account that is linked to the employee's current default department code, or to the default g/l accounts found in the payroll properties screen if no department code is used on the time card transaction. Keep in mind that if you have an employee that is normally coded to a job, then you may not want their vacation, holiday or sick pay to go to a cost of sales account (job cost related g/l account) unless you are going to job cost the transaction. In this case, it would be a good idea to create a new department code so that the entry will post to a G & A account. |

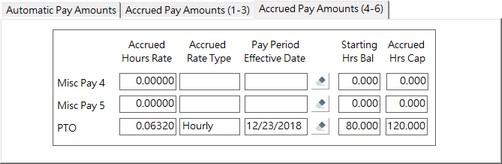

| 3. | Employee Information Setup – On the Pays Tab of the Employee List Screen, enter the appropriate accrual information for each employee. The following information outlines each of the accrued pay fields: |

Accrued Hours Rate – Enter the rate to represent the amount of hours accrued for the pay accumulator. This rate will be used in conjunction with the Accrued Rate Type field to accumulate the total accrued hours for the miscellaneous pay field (1-6). The fields in the personal table representing the Accrued Hours Rate are AccruedPayRate1 thru AccruedPayRate6. This field is a REQUIRED field and must contain a non-zero rate in order to be included in the Accrued Pay Reports.

•Accrued Rate Type – This field identifies the rate type for computing the accrued hours. This field is a REQUIRED field and must a valid (non-zero) rate type in order to be included in the Accrued Pay Reports. The fields in the personal table that represent the Accrued Rate Type are AccruedPayType1 thru AccruedPayType6.

•0 = None (no accrued pays)

•1 = Per Hour – The Accrued Hours Rate is based on the amount of accrued pay hours earned for each hour worked by the employee for Regular Pay and Overtime Pay transactions ONLY. Other types of pay will not be used in the calculations for accrued pay hours. For example, if your company pays 40 hours of sick pay per year, and the employee works 40 hours every week, then you could compute the rate per hour by dividing 40 by the total hours worked in a year (2080) which would be 0.01923. This amount represents the hours of accrued pay earned for each hour worked.

•2 = Per Pay Period – The Accrued Hours Rate is based on a flat amount of accrued pay hours earned per pay period worked by the employee. This method may lend itself better to salaried employees who might work variable hours per week but earn the same amount of accrued pay hours each week regardless of the actual hours worked. For example, if your company pays 40 hours of sick pay per year and payroll is run on a weekly basis, then you would compute the rate by dividing 40 by the total number of pay periods worked in a year (52) which would be 0.76923. This amount represents the hours of accrued pay earned for each pay period worked.

•Pay Period Effective Date – This field indicates when to start accruing hours for the employee and allows you to control the calculations based on a probation period for the employee. When the accrued pay is computed in the MAR report, only pay periods that begin on or after this date will be used in computing the employees accrued pay hours. For example, if you hire an employee on February 1st and your company has a six month probation period before accruing any pay amounts, then you would set the effective date to August 1st. If the employee is terminated before the effective date then NO accrued pay hours will be included in the report. This field is a REQUIRED field and must contain a valid date in order to be included in the Accrued Pay Reports. The fields in the personal table representing the Pay Period Effective Dates are MiscDate1 thru MiscDate6.

•Starting Hours Balance – This field is optional but allows you to set up a forwarding balance of previously earned accrued pay hours when applicable. The accrued pay hours computation will include these hours in addition to the computed hours based on the above field settings. For example, if you are setting up the Payroll system for the first time and need to establish balances for each employee, you can enter the amounts in this field. Remember that these are hours and NOT dollar amounts. You may also use the field in conjunction with the Pay Period Effective Date to set up retroactive hours once the employee has reached the probation period. For example, if the employee is eligible for 40 hours of sick pay in the first year, but not until the probation period is reached, then you could set up the Starting Hours Balance as 20.0 hours to indicate that as soon as the employee has reached the probation period, he will immediately be eligible for 6 months worth of accrued sick pay (20 hours). Again, on the accrued pay report, no amounts will be accrued for the employee until the effective date is reached. The fields in the personal table representing the Starting Hours Balance are AccruedPay1 thru AccruedPay6.

•Accrued Hours Cap – This field is optional but is used to put a cap or limit on the total amount of accrued pay hours the employee can accumulate. This allows for employees to roll over accrued pay amounts from year to year but never accumulate more than the total cap amount of hours. The employee must use the accrued hours before reaching the cap or else they will be lost. The fields in the personal table representing the Accrued Hours Cap are AccruedHours1 thru AccruedHours6.

| 4. | Time Card Entries – When you are ready to pay an employee for any accrued pay amount, you will need to use the time card transaction codes of 151 thru 156 (other pays 1 thru 6 respectfully) and include the hours of pay in the transactions – otherwise the hours paid will not be accumulated and will cause invalid calculations with the accrual totals for each employee. Note: If mistakes are made and accrued pay amounts are made without using the above transaction codes, you can correct the entry by making two additional entries to the employee on the next pay check or create a net zero handwritten check (adjustment check). Simply make a time card entry with a negative amount and zero hours using the same transcode that was used on the original entry, and then enter a second time card entry using one of the above transaction codes (151-156) with the hours included. The pay amount will total to zero but the hours will be accumulated correctly for the Accrued Pay Report. |

| 5. | Prinitng the Accrued Pay Reports – Use the Accrued Pay Report in the MAR to determine an employee accrued pay amount so that you do NOT overpay an employee. There are NO automatic controls for paying these amounts out and you will need to depend on your companies Accrued Pay Reports to compute the proper totals for each employee. |