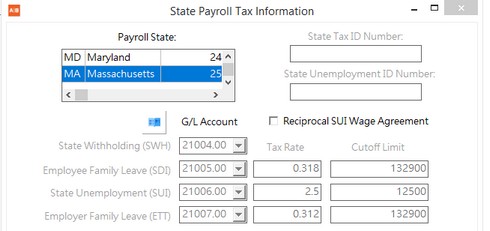

Massachusetts - Effective July 2019, the Family Leave tax is paid by both the employee and the employer with the employee portion being handled with the SDI accumulator and the employer portion being handled with the ETT accumulator as shown:

| Employee Family Leave (SDI) - The employee Family Leave amount will be withheld from the employee's pay amount and tracked under the SDI Tax field in the PRCHECKS table: |

•G/L Account - A new G/L Account should be set up to track the family leave amount for the employee.

•Tax Rate - The initial tax rate is 0.318 % for 2019, however you will need to verify this rate and update as needed according to Massachusetts Tax regulations.

•Cutoff Limit - Currently the cutoff limit is based on the social security cutoff limit and this field will need to be updated as necessary according Massachusetts Tax regulations.

Employer Family Leave (ETT) - The accrued Family Leave amount will be tracked under the ETT Tax field in the PRCHECKS table:

•G/L Account - A new G/L Account should be set up to track the family leave amount for the employer.

•Tax Rate - The initial tax rate is 0.312 % for 2019, however you will need to verify this rate and update as needed according to Massachusetts Tax regulations.

•Cutoff Limit - Currently the cutoff limit is based on the social security cutoff limit and this field will need to be updated as necessary according Massachusetts Tax regulations.

A|B will automatically print the Massachusets PFLA deduction in Box 14 of the W-2; no Box 14 setup is necessary.

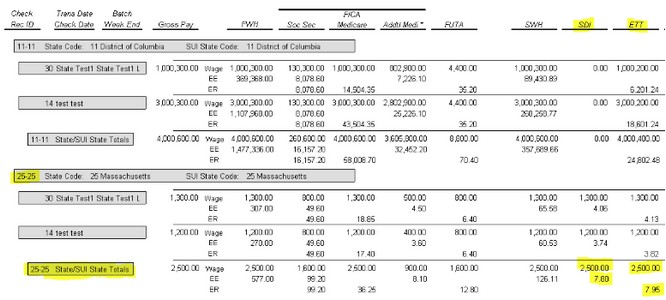

At this time, the state of Massachusetts has not released any official form for reporting the Family Leave Tax Amounts and therefore the Aatrix Tax Form generator in AccuBuild does not provide a form yet. The AccuBuild MAR Library Report has been updated with two new Subject Earnings Reports that can be used to obtain the Family Leave totals for the SDI (employee deduction) and ETT (employer portion) totals for Massachusetts. This report is different from the other Subject Earning Reports in that the report grouping are based on the combined STATE_CODE and SUISTATECODE fields for each payroll check record so that both state codes are included in each group. For multi-state payroll situations, this new grouping method will make sure that separate groups are created when the state code and the SUI State code are NOT the same which occurs when employees have state earnings in another state but need to report state unemployment earnings to their home state.

•Subject Earnings - StateSUICombo Group - Summary - Trans Date

•Subject Earnings - StateSUICombo Group - Detail - Trans Date

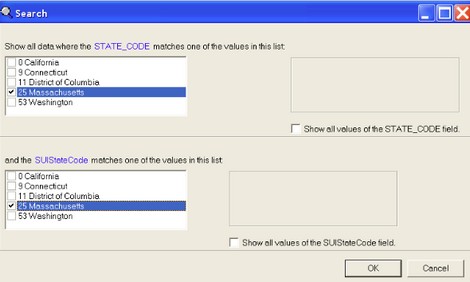

Both of these reports have a built in filter for selecting the desired State Codes and SUI State Codes so that you can run the report just for Massachusetts if needed:

The Summary Report will provide totals for each State / SUI Combo Group along with subtotals for each employee within the Group. The Detail Report will include details for each employee check that make up the employee totals. The Subject Wages are reported on the Wage line for both the Employee (SDI) and the Employer (ETT) Subject Wages. The Employee Withheld Amount (SDI) is reported on the EE Line and the Employer Burden Amount (ETT) is reported on the ER Line.

Hint: You may want to run this report as a MAR Data View as well so that you can filter the data and/or export the data to excel as needed.