District of Columbia - Effective July 2020, the Paid Family Leave tax is paid by the employer only and therefore will be accrued as a payroll tax burden. The PFLA for the District of Columbia does not need to be reported on the employee's W-2.

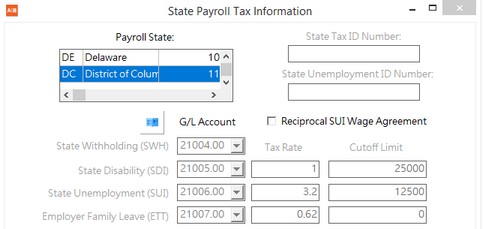

The ETT Tax in AccuBuild will be used to track the Family Leave amount which should be set up as shown in the following screen:

|

Employer Family Leave (ETT) - The accrued Family Leave amount will be tracked under the ETT Tax field in the PRCHECKS table:

•G/L Account - A new G/L Account should be set up to track the family leave amount.

•Tax Rate - The initial tax rate is 0.62 % for 2019, however you will need to verify this rate and update as needed according to DC Tax regulations.

•Cutoff Limit - Currently there is no cutoff limit and this tax applies to all employee gross wages. Leave this field set to zero.

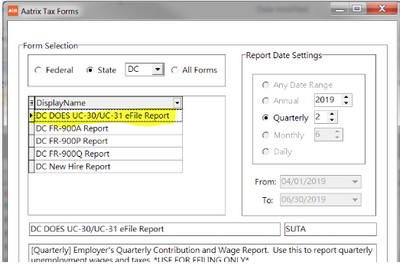

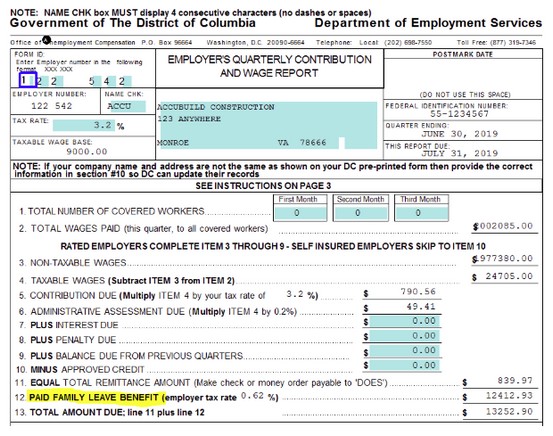

The Family Leave Tax Amounts will be included in the Aatrix Tax Form for the DC Quarterly Reporting (DC DOES UC-30):