●ENHANCEMENT - Nebraska Minimum State Withholding Warning (VERSION 10.2.0.8)

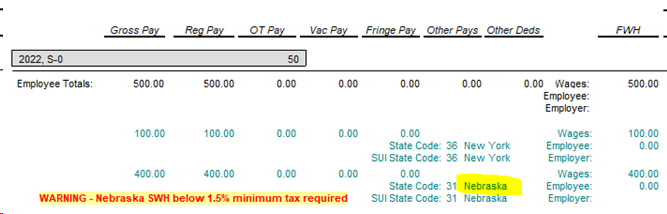

Nebraska has issued new requirements for State Withholding tax amounts (SWH) which require that the tax should be at least 1.5% of the employee’s subject wages. The Pre Check Tax Register report has been updated to identify any employee checks where the SWH tax does NOT meet the minimum requirement. See the screenshot below where the message is displayed for these situations. Note: The green text on the report is from the drill down report that is displayed when you click on the Employee Totals line:

If the employee does not have the proper documentation to justify the lower tax amount and you want to change the employee withheld amount, you may need to change the number of dependents that the employee is claiming.

A new report has been added to the Employee P/R Reports list in the MAR Reports Screen which will show all of the state drill down records without the need to click on each employee. This report will be easier to use when checking for employees that have the state withholding minimum warning:

![]()

Please review the following information which can be found in the 2024 Nebraska Circular EN Document:

Special Income Tax Withholding Procedures. Every employer with more than 24 employees must withhold at least 1.5% of each employee’s taxable wages. A lesser amount may be withheld if the employee provides documentation justifying a lesser amount. Documentation may include:

o Verification of children/dependents;

o Marital status; and/or

o The amount of itemized deductions

If this calculation is less than 1.5% of the taxable wage amount, adjust the income tax withholding to be at least 50% or more of the income tax withholding for a single employee with one income tax withholding allowance, or for a married employee with two allowances. These amounts meet the minimum income tax withholding requirement and may be used by the employer to determine an acceptable employee’s state income tax withholding amount.