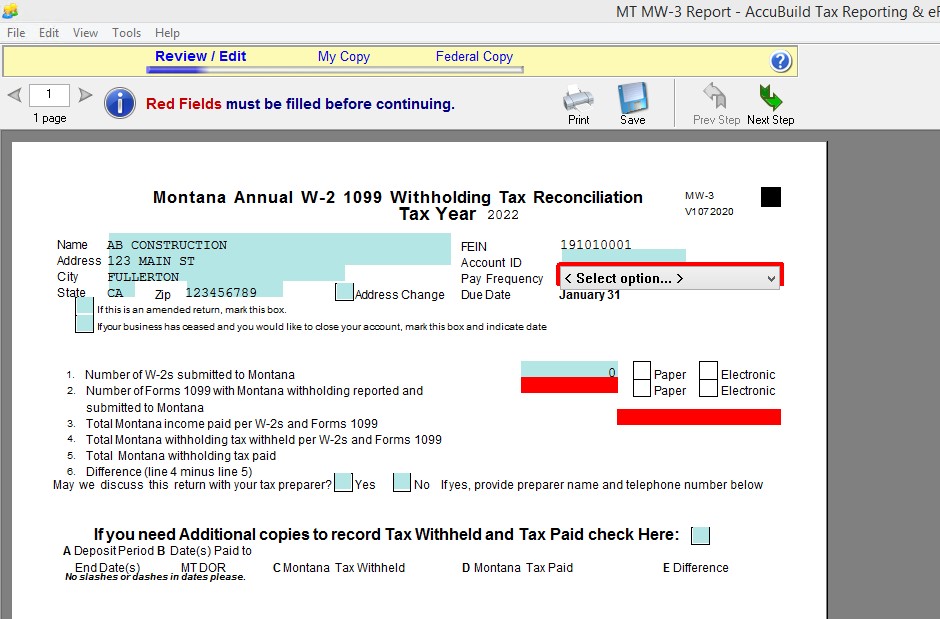

If you have employees with earnings in the state of Montana, then the state requires that form MT MW-3 Annual W-2 and 1099 Withholding Tax Reconciliation report be sent along with the state copy of the W2s.

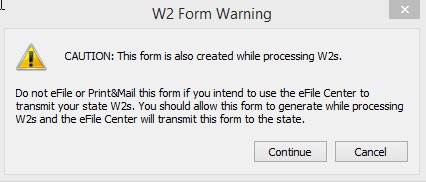

When W2s are processed through Aatrix (Payroll > Efile >Tax Forms > W2s menu option), then the system will prompt you for the information required for this form. If you will be e-filing, be sure to process this form through this W2 option.

Please note that this form will prompt you for the number of 1099s that you will be processing for the year so be sure that you have processed the 1099-NEC and 1099-MISC forms, as needed, before starting the W2 process.

This form is used to provide a list of all your tax deposit dates and amounts for the year. Although AB keeps a record of your payroll tax liability, it does not track your actual tax deposits. You can use the Cash Disbursements Detail Report in the Reports > Payables module to view a list of the check entries that you have created to the Montana Department of Revenue.

If you are required to make weekly tax deposits, then it may be easier for you to create this form outside of the W2 processing screen, if you are not required to e-

file the reconciliation report. Instead of selecting the W2/W3 menu option, click the Montana state option and then choose the MT MW-3 form. When entering data on this form, you will be allowed to save your entries if you are not able to make all the entries in one sitting. The form does not have that ability when processed through the W2 screen.

•Pay Frequency

oAccelerated - Choose this option if you are required to deposit your tax weekly.

▪[A] Manually enter the date of the payroll liability (payroll check date) in the Deposit Period field.

❑Click on the date field, check the box to the left of the field, and select the date from the pop up calendar OR type in the date. The date field consists of three parts: MM DD YYYY. Click on each part to manually enter a number.

Example: Click on MM to enter 01 for January, click on DD to enter 07, click on YYYY to enter 2022.

▪[B] Manually enter the paid date of each deposit.

▪[C] Manually enter the amount of the Montana Tax Withheld for the period.

▪[D} Manually enter the amount of the Montana Tax Paid.

▪[E] The system will calculate any difference between D & E.

oMonthly

▪[A] This system will auto populate twelve Deposit Period dates for you.

▪[B] Manually enter the paid date of each deposit.

▪[C] Manually enter the amount of the Montana Tax Withheld for the period.

▪[D} Manually enter the amount of the Montana Tax Paid.

▪[E] The system will calculate any difference between D & E.

oAnnual

▪[A] This system will auto populate one Deposit Period date for you (123120XX).

▪[B] Manually enter the paid date of the deposit.

▪[C] Manually enter the total amount of the Montana Tax Withheld for the year.

▪[D} Manually enter the amount of the Montana Tax Paid.

▪[E] The system will calculate any difference between D & E.

oNot Required

If you are required to make weekly tax deposits, then it may be easier for you to create this form outside of the W2 processing screen, if you are NOT required to e-file the reconciliation report. Instead of selecting the W2/W3 menu option, click the Montana state option and then choose the MT MW-3 form. You will get a message that you should NOT use this form if you will be efiling your w2s.

When entering data on this form, you will be allowed to save your entries if you are not able to make all the entries in one sitting. The form does not have that ability when processed through the W2 screen.