This screen is used to maintain a master list of all Health Plans that are offered to employees each year and the related fields required for W-2 Reporting and the Affordable Care Act (ACA) Reporting for each calendar year. A new set of Health Plan records should be set up for each year at renewal or whenever insurance plans are changed. Once the master list has been established, you will be able to assign the policy plan types to the employees in the Payroll System. This screen can be accessed on the Payroll > Controls > List of Health Insurance Plans menu. The fields contained in each Health Plan Record are documented below.

Add Button – Use this button to add a new health plan record to the master list.

Delete Button – Use this button to remove a health plan record from the master list. If there are employee insurance records linked to the master record, then you will NOT be able to delete the record from the list.

Copy Button – Use this button to make a copy of the current master record so that all the fields are duplicated automatically.

Master Record Field Definitions:

•Policy Plan ID – This is a user defined field that you will use to identify each policy plan type and can contain up to 25 characters. Each Policy Plan ID must be unique in the same Calendar Year. You may wish to use a code provided by your health insurance carrier when applicable, or you may want to create your own code. For example, if the insurance carrier code for a Family Plan including the employee, spouse and family is “FMD2015”, you can use that code by itself or add some additional characters for a more descriptive code such as “FMD2015-Family” which will make it easier to identify the meaning of the Plan ID. Once a Policy Plan ID has been added, you will NOT be able to change the description.

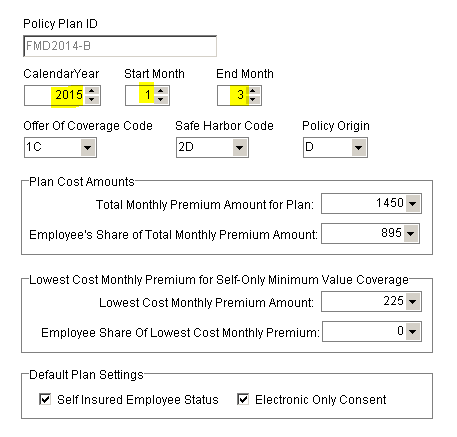

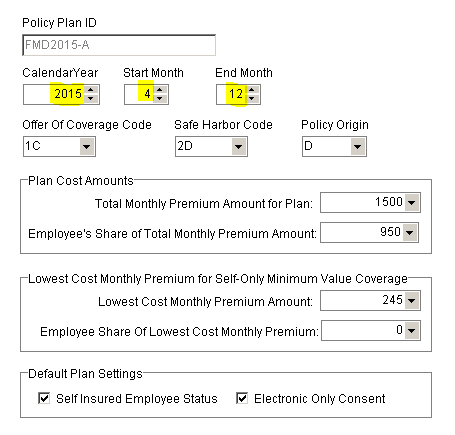

NOTE: If your insurance policy period does NOT follow the Calendar Year, you will need to set up two distinct sets of policy plan ID codes for each year. This is due the the fact that each policy period may have a different set of rates, and the reporting requirements are based on a calendar year. Be sure to set up the Starting Month and Ending Month of each plan so that there is no overlap in the same calendar year AND all months of the calendar year are covered. The following screen samples show two family policies: “FMD2014” and “FMD2015” which are based on a policy period of April through March. The last 3 months of policy “FMD2014” cover the first 3 months of calendar year 2015, and the first 9 months of policy “FMD2015” covers the last 9 months of calendar year 2015. In this example, two codes (“A” and “B”) are set up for each policy in order to cover the entire calendar year for 2015:

•Calendar Year – Enter the Calendar Year covered by the Policy Plan.

•Start Month – Enter the Starting Month of the Plan (1-12).

•End Month – Enter the Ending Month of the Plan (1-12).

•Offer Of Coverage Code – This code is required for ACA Reporting on Form 1095-C Part II-14 (1A – 1I). Please refer to the IRS Instructions on Form 1095-C for more information.

•Safe Harbor Code – This code is required for ACA Reporting on Form 1095-C Part II-16 (2A – 2I). Please refer to the IRS Instructions on Form 1095-C for more information.

•Policy Origin – This code is required for ACA Reporting on Form 1095-B Part I-8 (A – F). Please refer to the IRS Instructions on Form 1095-B for more information.

•Plan Cost Amounts – These amount fields are used mainly for internal record keeping can be very useful for W-2 Reporting at the end of the year. These amount fields are NOT required for ACA Reporting.

oTotal Monthly Premium for Plan – Enter the total cost of the plan (Employer and Employee Portions).

oEmployee’s Share of Total Monthly Premium Amount – Enter the total cost of the plan for the Employee’s Share (if any). If the employee does not pay any part of the insurance premium, then set this field to zero.

•Lowest Cost Monthly Premium for Self-Only Minimum Value Coverage – These amount fields are used for ACA Reporting Purposes.

oLowest Cost Monthly Premium Amount - Enter the lowest-cost monthly premium for self-only minimum essential coverage providing minimum value that is offered to the employee.

oEmployee Share of Lowest Cost Monthly Premium – Enter the Employee’s Share of the above lowest-cost monthly premium for self-only minimum essential coverage providing minimum value. If the employee does NOT pay any portion of the above amount, then set this field to zero.

Important Note: This amount is used for ACA Reporting on Form 1095-C – Part II-15. Please refer to the IRS Instructions on Form 1095-C for more information.

•Default Plan Settings – These are additional fields required for ACA Reporting and represent the default settings that will be copied to each employee when the Employee Coverage Template Settings Screen is used to create or update the employee records on the Employee ACA Health Insurance Information Screen. NOTE: These are default settings only and each employee record can be updated individually for these fields after the plan ID has been assigned.

oSelf Insured Employee Status – If the Employer is Self-Insured, then this field indicates if the employee is participating in the Self-Insured Plan.

oElectronic Only Consent –This field is used to indicate if the employee has consented to an electronic statement.

Codes for Form 1905-C: Please refer to the IRS Instructions for Forms 1094-C and 1095-C for detailed information on the Policy Origin Code, Offer of Coverage Code, and Safe Harbor Code. In addition, please check with your CPA or an expert consultant on the ACA for guidance on setting up your employee health insurance information and the associated codes and amounts related to the health insurance information.

Policy Origin Code:

•A = Small Business Health Options Program (SHOP).

•B = Employer-sponsored coverage.

•C = Government-sponsored program.

•D = Individual market insurance.

•E = Multiemployer plan.

•F = Miscellaneous minimum essential coverage.

Offer of Coverage Code:

•1A = Qualifying Offer: Minimum essential coverage providing minimum value offered to full-time employee with employee contribution for self-only coverage equal to or less than 9.5% mainland single federal poverty line and at least minimum essential coverage offered to spouse and dependent(s).

•1B = Minimum essential coverage providing minimum value offered to employee only.

•1C = Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) (not spouse).

•1D = Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to spouse (not dependent(s)).

•1E = Minimum essential coverage providing minimum value offered to employee and at least minimum essential coverage offered to dependent(s) and spouse.

•1F = Minimum essential coverage NOT providing minimum value offered to employee, or employee and spouse or dependent(s), or employee, spouse and dependents.

•1G = Offer of coverage to employee who was not a full-time employee for any month of the calendar year and who enrolled in self-insured coverage for one or more months of the calendar year.

•1H = No offer of coverage (employee not offered any health coverage or employee offered coverage that is not minimum essential coverage).

•1I = Qualifying Offer Transition Relief 2015: Employee (and spouse or dependents) received no offer of coverage, received an offer that is not a qualifying offer, or received a qualifying offer for less than 12 months. (This code is valid for Tax Year 2015 filings only.)

•1J = Minimum essential coverage providing minimum essential coverage NOT offered to your dependent(s).

•1K = Minimum essential coverage providing minimum value offered to you; minimum essential coverage conditionally offered to your spouse; and minimum essential coverage offered to your dependent(s).

•1L = Individual coverage health reimbursement arrangement (HRA) offered to you only with affordability deteremined by using employee's primary residence location ZIP code.

•1M = Individual coverage HRA offered to you and dependent(s) (not spouse) with affordability determined by using employee's primary residence location ZIP code.

•1N = Individual coverage HRA offered to you, spouse and dependent(s) with affordability determined by using employee's primary residence location ZIP code.

•1O = Individual coverage HRA offered to you only using employee's primary employment site ZIP code affordability safe harbor.

•1P = Individual coverage HRA offered to you and dependent(s) (not spouse) using the employee's primary employment site ZIP code affordability safe harbor.

•1Q = Individual coverage HRA offered to you, spouse and dependent(s) using the employee's primary employment site ZIP code affordability safe harbor.

•1R = Individual coverage HRA that is NOT affordable offered to you; employee and spouse or dependent(s); or employee, spouse and dependents.

•1S = Individual coverage HRA offered to an individual who was not a full-time employee.

•1T = Individual coverage HRA offered to employee and spouse (no dependents) with affordability determined using employee's primary residence location ZIP code.

•1U = Individual coverage HRA offered to employee and spouse (no dependents) using employee's primary employment site ZIP code affordability safe harbor.

Safe Harbor Code:

•2A = Employee not employed during the month.

•2B = Employee not a full-time employee.

•2C = Employee enrolled in coverage offered.

•2D = Employee in a section 4980H(b) Limited Non-Assessment Period.

•2E = Multiemployer interim rule relief.

•2F = Section 4980H affordability Form W-2 safe harbor.

•2G = Section 4980H affordability federal poverty line safe harbor.

•2H = Section 4980H affordability rate of pay safe harbor.

•2I = Non-calendar year transition relief applies to this employee.