This screen is used to maintain Applicable Large Employer (ALE) Information and Designated Government Entity Information for ACA Reporting.

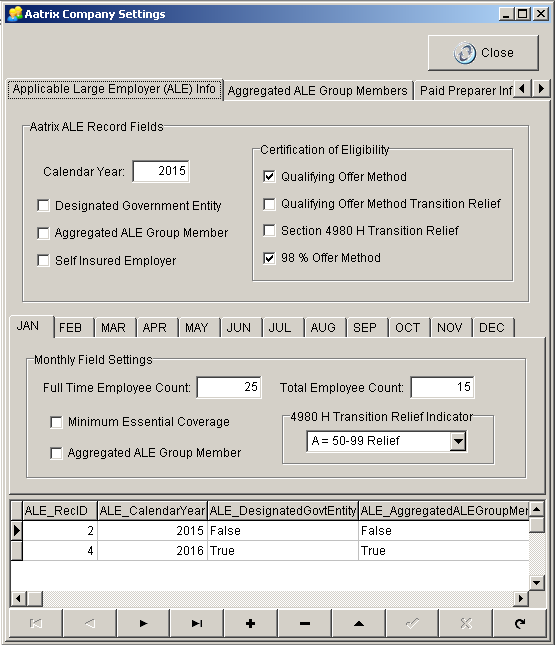

•Applicable Larger Employer (ALE) Info Tab

oCalendar Year – Enter the Calender Year for the Record Information. You will need a separate record for each calendar year reporting.

oDesignated Government Entitiy – refer to Form 1094-C – Part I - Boxes 9-16

oAggregated ALE Group Member – refer to Form 1094-C – Part II – Box 21

oSelf Insured Employer – refer to Form 1095-C – Part III

oCertificate of Eligibility Group – refer to Form 1094-C – Part II – Box 22 A, B, C & D.

12 Sets of Monthly Field Settings (Jan-Dec):

•Full Time Employee Count - Form 1094-C – Part III a

•Total Employee Count - Form 1094-C – Part III – Box c

• Full Time Employee Count - Form 1094-C – Part III – Box b

•Minimum Essential Coverage – Form 1094-C – Part III Box a

•Aggregated ALE Group Member - Form 1094-C – Part III – Box d

•4980 H Transition Relief Indicator - Form 1094-C – Part III – Box e

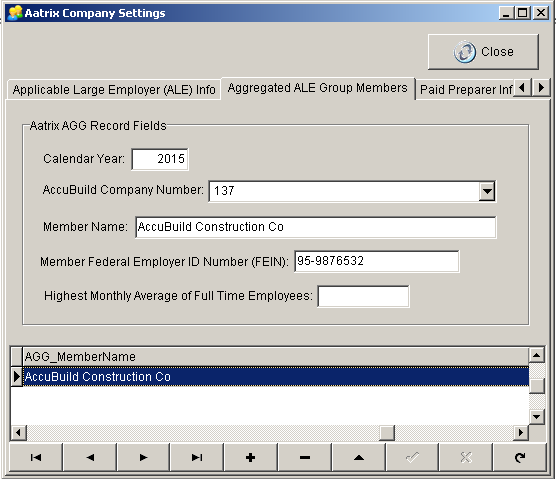

•Aggregated ALE Group Members Tab - Use this tab to list the ALG Group Members if applicable for Form 1094-C – Part IV.

oCalendar Year – Member Records will need to be set up for each Calendar Year

oAccuBuild Company Number – Optional but if the member is set up as a company in AccuBuild, then the Federal Employer ID Number will be populated automatically.

oMember Name – Members Name.

oMember Federal Employer ID Number (FEIN): Member’s Federal ID Number.

oHighest Monthly Average of Full Time Employees – This field is used to sort the list of ALG Group Members on the IRS Form 1094-C in order by the Highest Monthly Average of Full Time Employees.

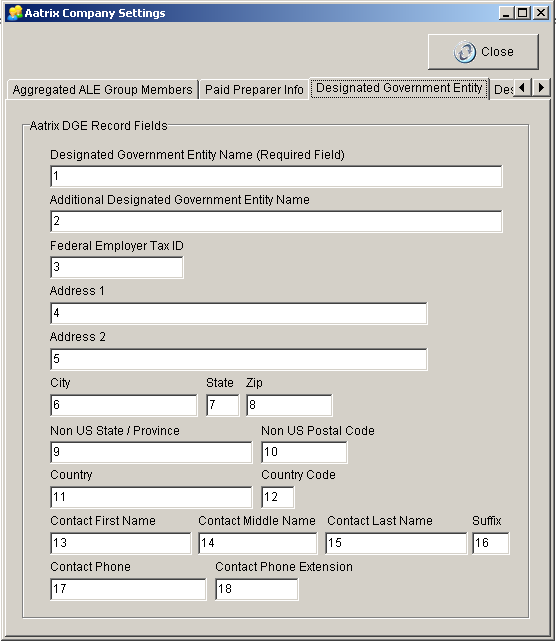

•Designated Government Entity Tab – These fields are used for Form 1094-C – Part I – Boxes 9-16 if your company is a Designated Government Entity:

•Paid Preparer Info Tab – This tab is disabled and is reserved for future use. The information on this tab is NOT required for the new ACA reporting requirements with Aatrix.

•Designee Info Tab – This tab is disabled and is reserved for future use. The information on this tab is NOT required for the new ACA reporting requirements with Aatrix.