Note: Part of the following documentation discusses using a local deduction code for setting up a direct deposit amount as a percentage. Using a local deduction code for this purpose is no longer the preferred method unless the deposit amount must be calculated pre-tax. Existing users of this older method may continue to do so if desired.

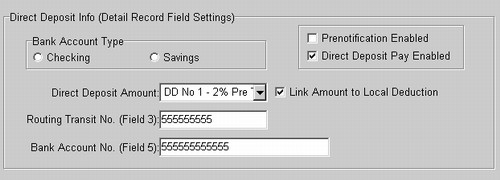

LINK TO LOCAL DEDUCTION CODE: If the direct deposit item needs to be calculated pre-tax or as a percentage, then it must be set up as a local deduction code. For example, if an employee elects to contribute $25 to an HSA plan which is a plan that reduces taxable wages, then the amount must be set up as a local deduction code.

| If using a local deduction code, then the deduction code must also be set up on the employee's Deduct Tab in order for the Nacha file to create this secondary deposit record. |

| Note: Any local deduction code that is created for purposes of direct deposit, should be linked to the payroll checking account and NOT to a liability or expense account because this amount will be deducted automatically out of your company's checking account. |

| The employee's net pay is distributed to the multiple accounts starting with account 2 working up to account 8. The remaining net pay balance, which is deposited into the primary account, is based on whether the secondary accounts are linked to a local deduction code. |

Example 1: Net Pay = $500.00 (Net pay already includes the local deduction)

DD Account 2 - Local Deduction = $55.00 (Net pay already includes this deduction)

DD Account 3 - Flat Amount = $75.00

Primary Account will get $425.00 (Net pay less all flat amount deposits)

If a secondary account is linked to a local deduction code, then the amount associated with the code will be deposited into the secondary account but it will NOT reduce the net pay balance that is deposited into the primary account. All local deduction amounts will have already been included as a deduction on the employee's check, therefore, they will not reduce the net pay balance that will be deposited into the primary account. Note: Any local deduction code that is created for purposes of direct deposit, should be linked to the payroll checking account and NOT to a liability or expense account because this amount will be physically deducted out of your company's checking account by the bank.

Example 2: Net Pay = $125.00 (Net pay already includes the local deduction)

DD Account 2 - Local Deduction = $55.00 (Net pay already includes this deduction)

DD Account 3 - Flat Amount = $50.00

DD Account 4 - Flat Amount = $87.00

DD Account 2 will deposit $55.00

DD Account 3 will deposit $50.00

DD Account 4 will deposit $75.00 (Balance of remaining net pay)

Primary Account will deposit $0.00 (Nothing left to deposit)