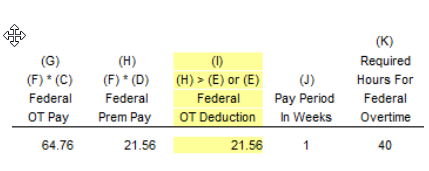

Beginning in 2025, the Federal Amount of Overtime pay will now be reported on the employee's W2 statement. These overtime calculations will be handled automatically by the AccuBuild Software based on the new MAR Report entitled Federal Report of Exempt Overtime Pay. There is no employee setup required for these amounts as they are required under federal law. The amount to be reported is highlighted in yellow under column I as shown:

Please refer to the document titled Federal Report of Exempt Overtime Pay for more information.

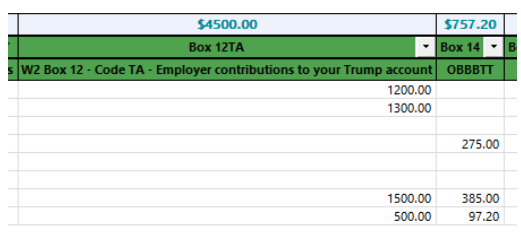

Federal Overtime Pay Exempt Amounts (Code TT)

•For 2025 W2s, these overtime amounts will be reported in Box 14 under the heading Box 14 - OBBBTT (One Big Beautiful Bill - Code TT). Although the amount is automatically populated, you may adjust it as necessary in the Aatrix screen.

•Starting with 2026 W2s, these overtime amounts will be reported in Box 12.