If your company is located in California or if your employees work in California, then be sure to review these items when setting up the Payroll system.

California - Paid Family Leave Act |

|

California - State Disability Cutoff Limit |

|

California - State Withholding |

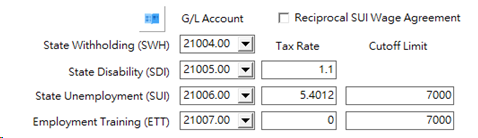

•ENHANCEMENT - California State Disability (SDI) Cutoff Limit (VERSION 10.2.0.8)

The cutoff limit for SDI in California has been eliminated for 2024. AccuBuild will no longer consider a cutoff limit when computing the SDI tax amount.

NOTE: If you need to run any additional payroll checks for 2023 AFTER the year end update has been installed (Version 10.2.0.8), you will want to set the Override Automatic Tax Calculations checkbox on the Fed Tab of the employee list for any employees that have reached the SDI Limit for 2023 so that you can adjust the SDI subject wages and related tax amounts.

The state settings for California will no longer display a Cutoff Limit field for SDI as shown below:

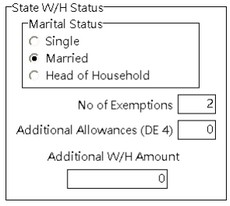

[Version 10.2] - The state withholding settings have been updated for the 2020 California State Withholding controls in order to support the additional allowances setting from the California Form DE 4 - 'Additional Allowances (DE 4)' for payroll tax calculations: