DATABASE STRUCTURE UPDATE

•ENHANCEMENT - This update requires database structure changes to your company database files. You will be prompted to update the database when the program is first opened after installing the 10.1 Release. There are at least three databases that will be updated with this update and possible more if you have multiple companies and / or multiple users within each company. Database restructure processing is outlined below:

oBASEGLOB - AccuBuild Global Database - Updated when the AccuBuild Program is opened for the first time by any user. This process is only done ONE time per AccuBuild Program Installation.

oBASECOMP - AccuBuild Company Database - Updated the first time a company is opened by any user. This process is done ONE time per Company.

oBASEUSER - AccuBuild User Database - Updated the first time a user logs into a company. This process is done ONE time per User per Company.

Example 1: User Joe is the first user to log into the AccuBuild Program for Company "A" after the update is installed:

▪BASEGLOB is updated for new structure changes (one time for global database)

▪BASECOMP is updated for new structure changes (one time for Company "A" database)

▪BASEUSER is updated for Joe (one time for User Joe in Company "A")

Example 2: User Sally is the second user to log into the AccuBuild Program for Company "A"

o BASEUSER is updated for Sally (one time for User Sally in Company "A")

Note: At this point, Joe and Sally will never be prompted for restructure going forward when they log into Company "A". However, if Joe or Sally are have user access to another company in AccuBuild, they will be prompted again for that company.

IMPORTANT - Before any database restructures are done, a backup of the company databases are made to a zip file in the company folder.

AATRIX

•ENHANCEMENT - Tax Form System Tables Updated [PMID Ref No 14947]

The system tables in the AccuBuild DATA Folder were updated to correspond with the latest changes from Aatrix for tax form processing which mainly involves revised changes to support the Family Leave Act Forms and new support fields for the Federal EEO-1 FormIn order.

oRBScript.ADT

oAatrixTaxTypes.ADT

oAatrixTaxTypes_Ver10005.ADT - Backup copy of previous version of AatrixTaxTypes

AB MOBILE / AB TIME CLOCK

•ENHANCEMENT - Time Clock App - Version 4 Changes [PMID Ref No 14887]

oThe following set of stored procedures have been added in this release which enhance the upload routines for the 'close the day' process. These new procedures insure that data uploads are handled correctly without any missing or duplicate data should the 'close the day' process be interrupted or terminated due tot bad internet connectivity.

•abm_az_DailyReportADMSEmployeePicture_Upload2

•abm_az_DailyReportADMSEmployeeSinglePicture_Upload

•abm_az_DailyReportTimeCardRecord_WithCount_Write

•abm_az_DailyReportTimeCardRecord_Write

•abm_az_MobileUploadRecord_DuplicateCheck

•abm_az_MobileUploadRecord_Write

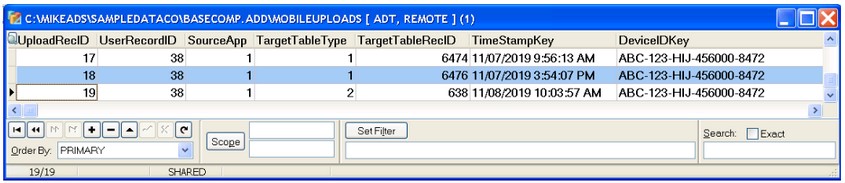

oA new table entitled 'MobileUploads' has been added to the company database which is used to track uploaded records and files between the AccuBuild Mobile products and the AccuBuild Main Program. This table will be used to track each uploaded record or file and is used as part of the solution to ensure that all data is uploaded successfully should internet connectivity be lost during the upload process. Additional audit trail fields will also be maintained in this table to keep track of user IDs and Device IDs (Phones, Tablets, etc.) where the records and / or files originated from:

ACCOUNTS RECEIVABLE

•ENHANCEMENT - New Advanced Setting for Misc AR Invoice Sales Tax Rounding Calculation [PMID Ref No 14941]

The Miscellaneous A/R Invoice Screen has been updated with new functionality to change the calculation method used to compute sales tax for customer invoices. The default setting for sales tax calculations is currently based on the 'Bankers Rounding Rule' method where the half cent is rounded up or down based on odd or even amounts. This new setting (when enabled) will force the system to round the half cent up to the next penny and override the default method.

•Default Calculation Example: An invoice with a taxable amount of $298.00 and a sales tax rate of 7.75% will compute the sales tax at $23.09 (rounding down from 23.095).

•Sales Tax Round Up Example: When the new advanced setting is enabled, an invoice with a taxable amount of $298.00 and a sales tax rate of 7.75% will compute the sales tax at $23.10 (rounding up from 23.095).

This new feature is enabled under the Advanced Settings Screen:

•Go to File > System Administrator > Configuration > Advanced Property Settings Button

•Select the new setting 'EnableSalesTaxRoundUpForARInvoices' and click the Add Advanced Company Setting Button

ACCUIMPORTER

•CORRECTION - Changes for Importing A/P Invoices [PMID Ref No 14010]

The AccuImporter Utility has been updated to change the method for saving the next available invoice reference number (inv_ref_no) in the accounts payable properties settings. This correction should help to correct situations where an imported batch of invoices could contain a duplicate reference number that needed to be corrected before the batch could be posted.

CLIENTS

•CORRECTION - Client Center - Updated Formatting Templates for Phone Numbers, Account Numbers, etc [PMID Ref No 15073]

The formatting field masks for the Client Center Screen have been added for phone numbers, default account numbers etc. in order to keep these fields formatted in a uniform display layout:

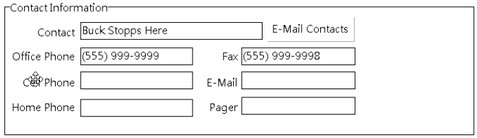

Previous Display Fields:

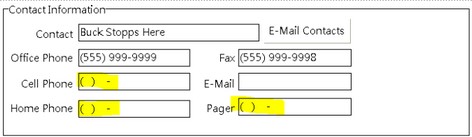

New Formatted Display Fields:

GENERAL LEDGER

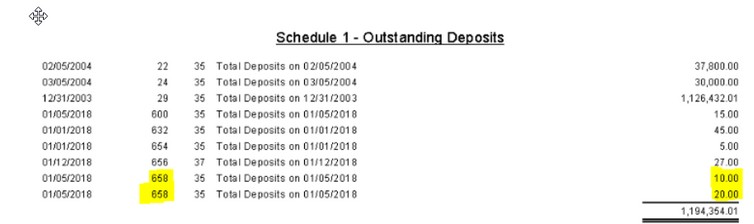

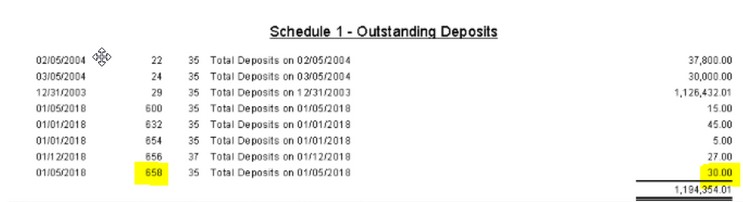

•CORRECTION - Bank Reconciliation Screen - Deposit Grouping [PMID Ref No 14995]

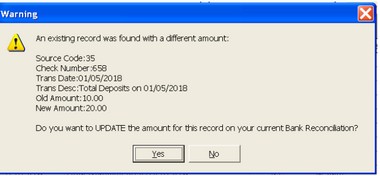

The Bank Reconciliation process for listing all of the outstanding bank deposits was updated to make sure all deposits are grouped in order by deposit date and batch number. This new grouping will eliminate the unnecessary message that would prompt the user to change the deposit amounts under certain situations when the bank reconciliation was closed and then re-opened for editing:

This message was being displayed even though no amounts were changed after the bank reconciliation was initially created. The previous work around solution was to answer 'No' to this prompt and just allow the amounts to be cleared as two separate amounts for the same date as shown:

This issue has been corrected to eliminate the unnecessary prompt and to show the deposit amount as a single amount for the same deposit date and batch number as shown:

JOB COST

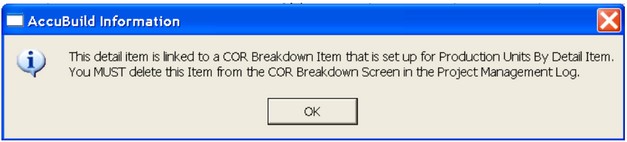

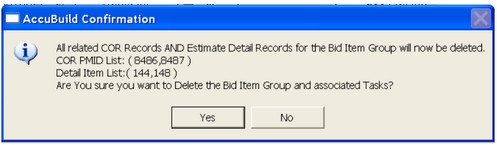

•CORRECTION - Job Center Screen - Prevent deletion of COR Bid Items related to Production Units [PMID Ref No 13822]

In order to prevent orphaned task records for Bid Item Groups, the Job Center Screen will no longer allow detail items that are linked to the COR Log (change order items) to be deleted if they are set up for production units by detail items. If a record deletion is attempted, the user will be directed to the COR Breakdown Screen in order to delete these records to prevent any orphaned records for the Bid Item Group.

PAYROLL

•2020 Tax Table Updates - New Tax Tables and Software Changes for 2020 [PMID Ref No 15314}

•The federal payroll withholding tables for the 2020 Calendar Year have been updated with two sets of withholding tables based on the new employee W-4 settings for “2019 or earlier” and “2020 or later”.

•The payroll withholding tables for the 2020 Calendar Year have been updated for the following states:

▪California

▪Colorado

▪Idaho

▪Illinois

▪Iowa

▪Indiana - County Tax rate changes

▪Kentucky

▪Maine

▪Maryland

▪Massachusetts

▪Michigan

▪Minnesota

▪Missouri

▪New Mexico

▪New York - State

▪New York - Yonkers City Taxes

▪North Carolina

▪North Dakota

▪Oregon

▪Rhode Island

▪South Carolina

▪Ohio

▪Oklahoma

▪Vermont

▪Virginia

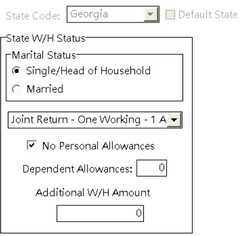

•ENHANCEMENT - State Withholding settings for Georgia [PMID Ref No 15314]

New state withholding settings have been added for several states on the Employee Center > State Tab:

•California - The state withholding settings have been updated for the California State Withholding controls in order to support the additional allowances setting from the California Form DE 4 - 'Additional Allowances (DE 4)' for payroll tax calculations

•Georgia - Changes were made to the Married Status Settings and the Personal Allowance Settings on this screen.

Refer to the Payroll FAQs - Georgia documentation in the Help System for complete details on the changes.

•Illinois - The state withholding settings have been updated for the Illinois State Withholding controls in order to support the additional allowances from Line 2 of the Illinois Form IL-W-4

•Missouri - The state withholding settings have been updated for the Missouri State Withholding controls in order to support the 'Head of Household' Status for payroll tax calculations.

•North Carolina - Added 'Head of Household' filing status

•North Dakota - Added 'Head of Household' filing status. North Dakota state withholding tax calculations for the 2020 tax year will now support two withholding methods based on the new Federal W-4 Settings for '2019 W-4 or earlier' or '1010 W-5 or later'.

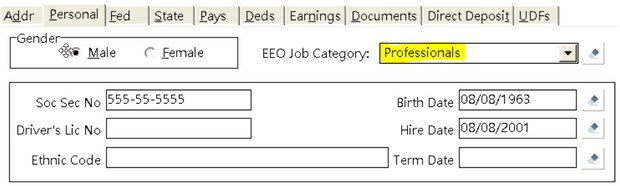

•ENHANCEMENT - Employee Center - EEO Job Category [PMID Ref No 14947]

The Employee Center Screen contains a new field on the Personal Tab for the EEO Job Category. This field in conjunction with the existing Ethnic Code field is used to feed the new Aatrix Federal EEO Form which is now supported in this update.

The EEO Job Category defines the employees job description using a list of 10 options from the drop down list as shown:

1 - Executive/Senior Level Officials and Managers

2 - First/Mid-Level Officials and Managers

3 - Professionals

4 - Technicians

5 - Sales Workers

6 - Administrative Support Workers

7 - Craft Workers

8 - Operatives

9 - Laborers and Helpers

10 - Service Workers

Note: Use the Erase Button to the right of this drop down control if you want to clear this field.

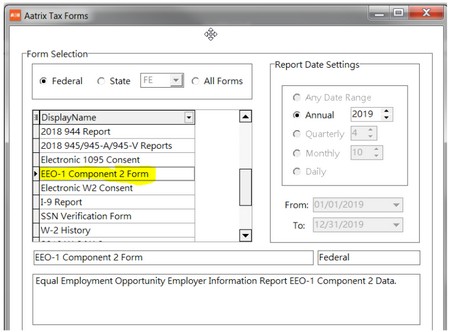

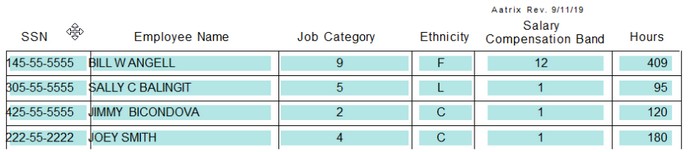

•ENHANCEMENT - New EEO-1 Federal Form added to the Aatrix Forms Library [PMID Ref No 14947]

A new Form has been added by Aatrix for the Equal Employment Opportunity Employer Information Report EEO-1 Component 2 data

While some of the form fields will require manual entries during processing, the employee detail information (page 2 and subsequent pages) regarding ethnic code, work category, wage bracket and hours will be fed by AccuBuild data provided the ethnic code and labor categories are set up correctly in the Employee Center Screen:

•ENHANCEMENT - New Employee W-4 Setting for 2020 Payroll Tax Year [PMID Ref No 15314]

A new W-4 Setting has been added to the Employee Center Screen which will be used to determine how the Federal Withholding tax amounts are calculated for the 2020 Payroll Tax Year. This setting allows for the new 2020 W-4 format or the previous W-4 formats from 2019 or earlier. The 2020 W-4 format is designed to help employees more accurately calculate their federal withholding tax amounts using several new entries as explained below.

IMPORTANT NOTE: You do NOT have to use the new W-4 settings for 2020 and may continue to use the current employee settings from 2019 or previous years. In other words, if you do nothing to change an employee’s W-4 setting, AccuBuild will continue to compute the federal withholding taxes as normal for 2020. However, if an employee fills out the new 2020 W-4, you can make the change for the employee on an individual basis and Accubuild will calculate the federal withholding taxes using the new 2020 W-4 Settings. The latest update from the IRS regarding this form is that employees will be required to fill out the new 2020 W-4 by October 1, 2020.:he

PROJECT MANAGEMENT

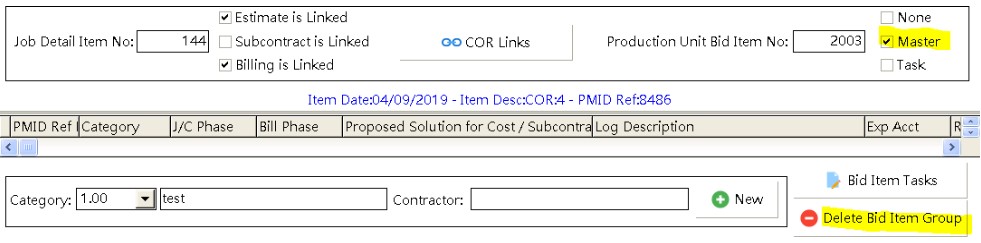

•ENHANCEMENT - New Changes for COR Breakdown Items related to Production Units by Detail Item [PMID Ref No 13822]

The COR Breakdown Screen has been updated with new control features that are specific to breakdown items related to production unit by detail items. These new changes will make it easier to remove production unit line items without causing orphaned task records in the detail items file (ESTDETL).

When a Bid Item Master breakdown record is selected in the grid, a new button will be visible entitled Delete Bid Item Group which will allow the Master Detail Item and all related tasks items to be deleted together as a group so that all related records are deleted both on the COR Breakdown Screen as well as all of the related Job Detail Items on the Job Center Screen (accounting estimate records).

Delete Bid Item Group - When you click this button, the system will run a series of validation tests on all related records BEFORE allowing the records to be deleted:

•The COR Breakdown Items MUST be linked to the accounting system.

•All related Job Detail Items will be checked for prior period date violations.

•All related Job Detail Items will be checked to make sure there are no contract billing totals.

•The production unit tasks items will be checked to make sure no production unit transaction entries exist for units completed and related hours. A warning will be displayed if transactions exist, and if the transactions are tied to a Daily Field Report, the process will be canceled.

If there are no validation errors, then the user will be prompted with a list of COR PMID Items and related Job Detail Items that will be deleted for the selected Bid Item Group. At this point, the user can continue or cancel the operation:

Once the group of records have been deleted, a message will be displayed showing the original count and deleted count for both the COR PMID records and the Job Detail Records.

When a Bid Item Task Record is selected in the grid, the Copy and Delete Buttons will now be hidden in order to avoid confusion as Task Records cannot be deleted from this screen. In order to Edit or Delete a task record from a Bid Item group, you MUST select the Master Bid item that the task belongs to and then use the Bid Item Tasks Button to open the Bid Item Tasks Screen.

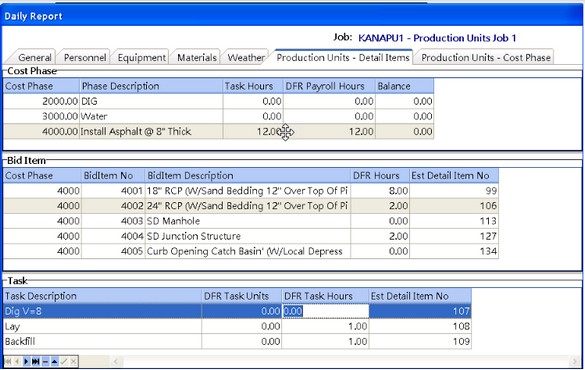

•CORRECTION - Daily Report Screen changes related to the Production Units by Detail Item [PMID Ref No 14999]

Several changes were made to the Production Units - Detail Items Tab for the Daily Report Screen:

oWhen multiple sets of Bid Items and Tasks exist for the same Bid Item Number, The Bid Item Grid and the Task Grid did not display the totals properly even though the underlying data was correct. Two new stored procedures were added to the system library to make sure the data is displayed properly under this situation:

▪abm_Get_DPU_DailyReportTaskTotals_PMIDNo_ParentItemNo_1019

▪abm_Get_DPU_DailyReportTaskTotals_PMIDNo_ParentTaskItemNo

oThe Stored Procedure Library version was updated in this release so that the new stored procedures will be added automatically when the version 10.1 update is installed and the program is opened for the first time.

oThe screen was not always synchronizing the three grids properly when the Cost Phase or Bid Item selections were changed and also whenever any new task units or hours were entered. This issue was causing the screen to display bid items that were not part of the selected phase group. In addition, the underlying tasks were appearing with zero hours and zero units. This issue has been corrected.

oAn hourglass cursor will now be displayed whenever the system is recomputing the totals for each of the three grids (Cost Phase, Bid Item, & Task).

oThe Phase Descriptions on the Phase Grid and the Task Descriptions on the Task Grid were both expanded from 20 characters to 35 characters in order to show the full descriptions.

SYSTEM ADMINISTRATOR

•CORRECTION - User Group Screen - test for duplicate user names

The File > System Admin > User Groups screen was not filtering the user list based on the company number for each user which in some cases would display the same username more than once on the screen. This was a display issue only on the user interface and the underlying users table contained correct data with no duplicates. This issue has been corrected.