Some unions may require a % of gross deduction that would need to also include the vacation pay or another miscellaneous pay. The % of gross deduction will NOT include miscellaneous pays therefore the % of gross deduction needs to be computed as an hourly rate.

The following is an example of the calculation and setup of the union code in order to include the vacation pay in the deduction.

Scenario: The Check Off Dues deduction is 3.6 % of gross and must also be calculated on the Vacation Pay.

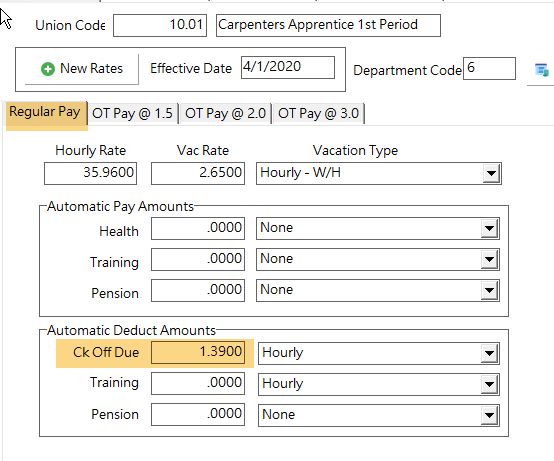

Base Rate = 35.96 x 3.6% = 1.29

Vacation Rate = 2.65 x 3.6% = 0.095

Total Hourly Rate = 38.61 x 3.6% = 1.39 = Hourly Rate at Regular Rate

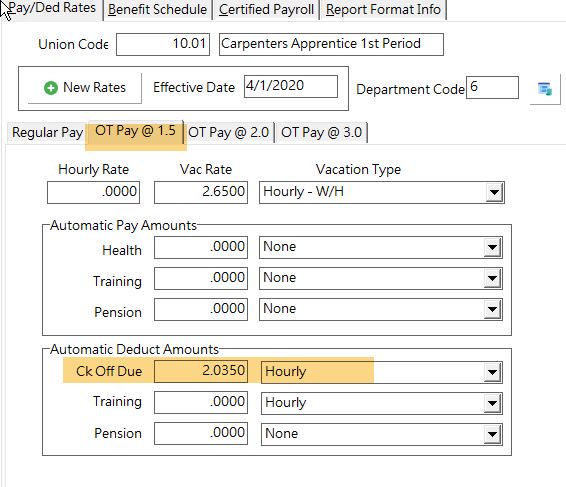

Overtime @ 1.5

Base Rate = 35.96 x 1.5 OT = 53.94 x 3.6% = 1.94

Vacation Rate = 2.65 x 3.6% = 0.095 (not applicable to the OT factor)

Total Hourly Rate = 53.94 + 2.65 = 56.60 x 3.6% = 2.035 = Hourly Rate at O.T. @ 1.5

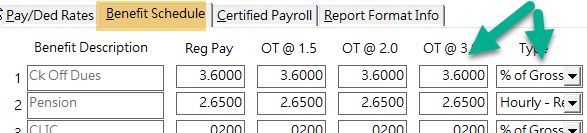

On the benefit schedule, the dues deduction rate can be listed as 3.6 % of Gross - Report Purposes Only

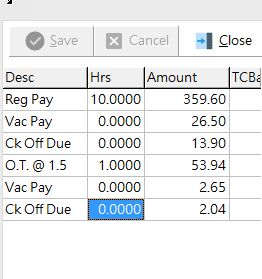

Below is a test of the time card calculations of the dues for 10 hours of regular pay and 1 hour of overtime.