Follow these steps to set up a job that requires sales tax to be billed on a contract billing. Please note that the following business rules are assumed in this setup:

•Remodel projects in Texas require sales tax on ALL billing items.

•The WIP Contract amount should NOT include the sales tax amount

•Sales tax is always computed on Net Amount after Retention

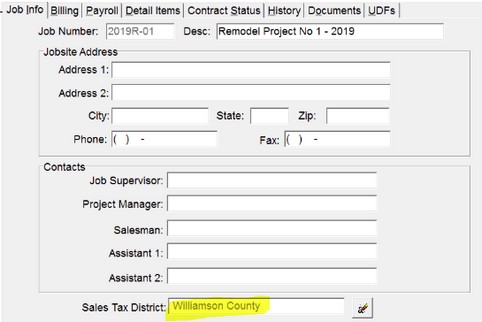

Job Setup Requirements for any new Remodel Projects in Texas

•Set up the Sales Tax District on the Job Info Tab as shown below.

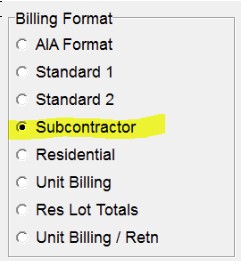

•Click on the Billing Tab and set the job Billing Format to Subcontractor.

Create a Custom AIA Invoice with Sales Tax:

•Make a copy of the AIA Format and rename to AIA Billing with Computed Sales Tax.

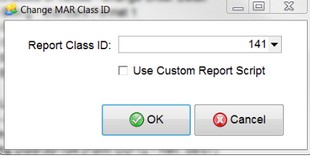

oChange the Report Class to 141 (right click on the new form) - This will flag the invoice type as a Subcontractor Billing Format so that the system will automatically use this format on any project that is flagged for Subcontractor Billing Format.

▪Do NOT Check the Report Class option to Use Custom Report Script:

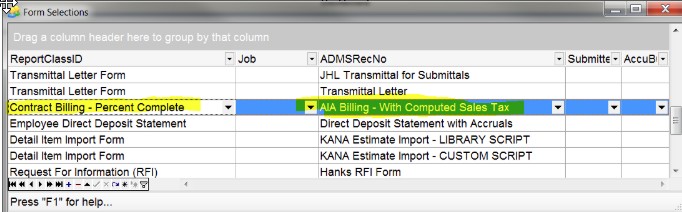

•Use the MAR Custom Form Assignments option to assign the new billing format to the Contract Billing - Percent Complete form option.

oRemember, you can also use this screen to assign the form to be used on a specific project, customer or AB user.

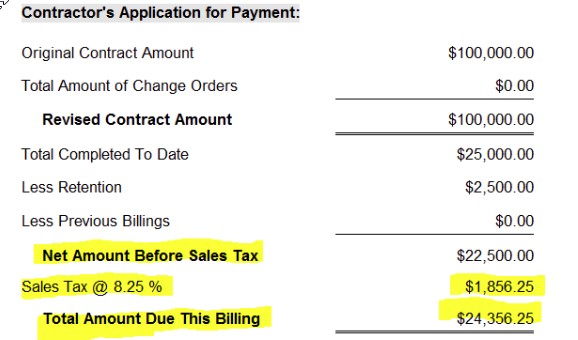

•Modify the new form to include the sales tax fields

▪SalesTaxRate

▪SalesTaxAmount

▪JobTotalAmountDueIncludingTax

Billing Process for Projects that require sales tax:

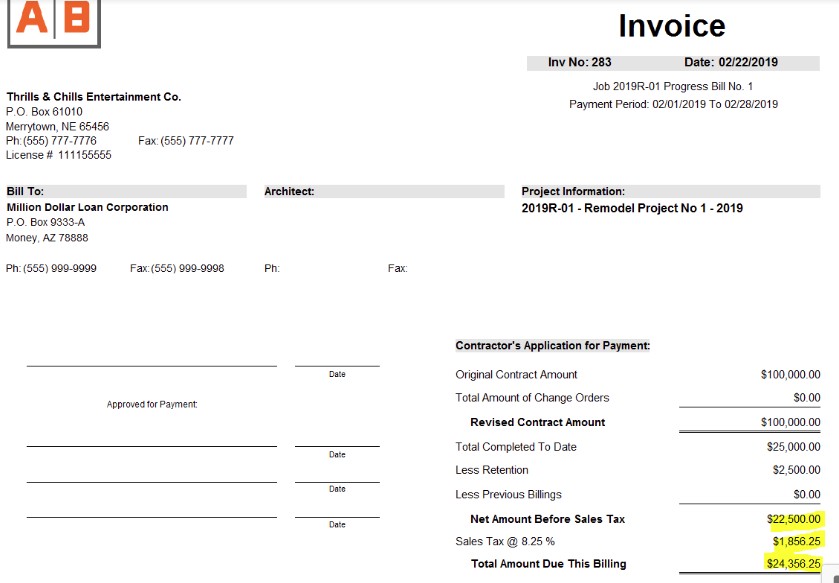

1.Invoice the Job using the Contract Billings and submit the form with the sales tax to the owner. Note: Only the Invoice for the owner includes the sales tax amount. When the billing is posted, the sales tax will NOT be posted in order to preserve the business rules for excluding sales tax from all job cost WIP reporting and contract totals (GAAP and Bonding Industry requirements).

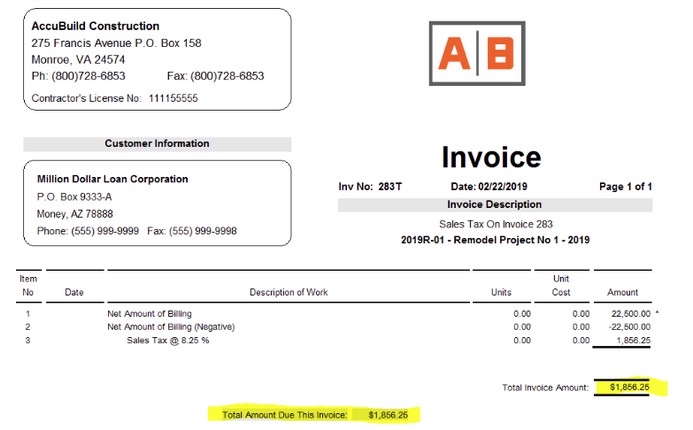

2.Create a Misc AR Invoice in the Receivables module to book the Sales Tax portion of the invoice as follows:

a.Do NOT Send this invoice to the Owner - This is for booking purposes for sales tax portion only.

b.Include the job number but do NOT Check the box to include in contract totals.

c.You can use the same invoice number from the contract billing followed by the letter ‘T’ for tax if you like for easier reference.

d.Use the same bill to customer as the AIA invoice and the same sales tax district as the job.

e.Enter 1st line item for the Net Amount Before Sales tax from the contract billing and mark this line as taxable.

f.Enter 2nd link item for the same amount as as line 1 except make the amount a negative amount and make sure this line is NOT marked as taxable.

g.Preview Invoice and make sure the total amount matches the Sales Tax Amount from the Contract Billing, then post the invoice if it matches.

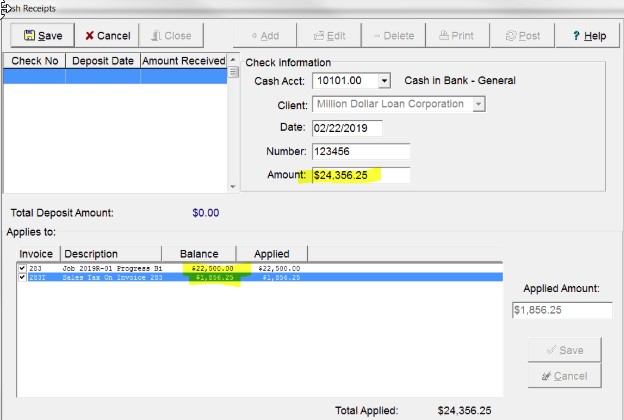

Cash Receipt Process for the payments from the owner:

•The project owner will pay the full amount and you will apply the payment to both the contract billing and the sales tax invoice:

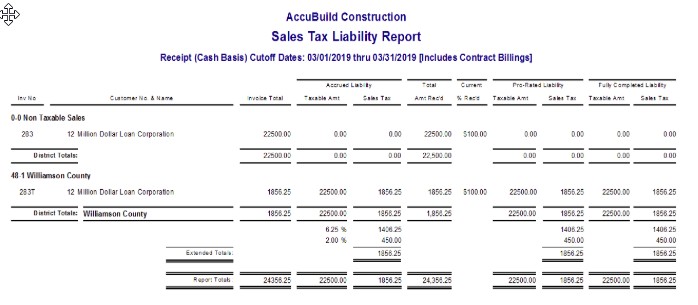

•Sales Tax Reporting

•Print the Reports > Receivables > Sales Tax Report when you are ready to pay sales tax to the state.

•This report has several options, including cutoff dates, and displays both the amount invoiced and the amount received.