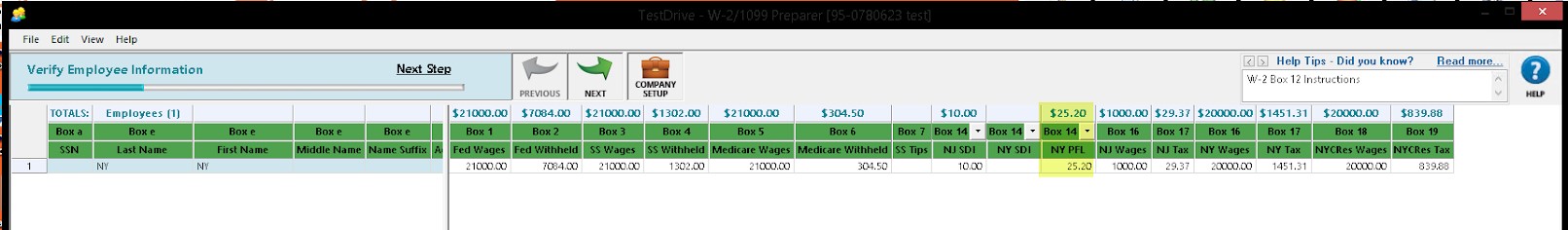

New York - The Family Leave tax is handed through a local deduction code that needs to be implemented and the amount is reported annually on the employee W-2. A|B will automatically print this amount in Box 14 of the W-2; no Box 14 setup is necessary.

PMID 8111 - New York State Disability Tax- Paid Family Leave

As of January 1, 2018, New York introduced the Paid Family Leave Act.

Paid family leave basics. Paid Family Leave provides coverage for:

●Parents during the first 12 months following the birth, adoption, or fostering of a child;

●Employees caring for a spouse, domestic partner, child, parent, parent-in-law, grandparent, or grandchild with a serious health condition; and

●Employees assisting loved ones when a spouse, child, domestic partner, or parent is deployed abroad on active military duty.

Employee eligibility:

●Employees with a regular work schedule of 20 or more hours per week are eligible after 26 weeks of employment.

●Employees with a regular work schedule of less than 20 hours per week are eligible after 175 days worked.

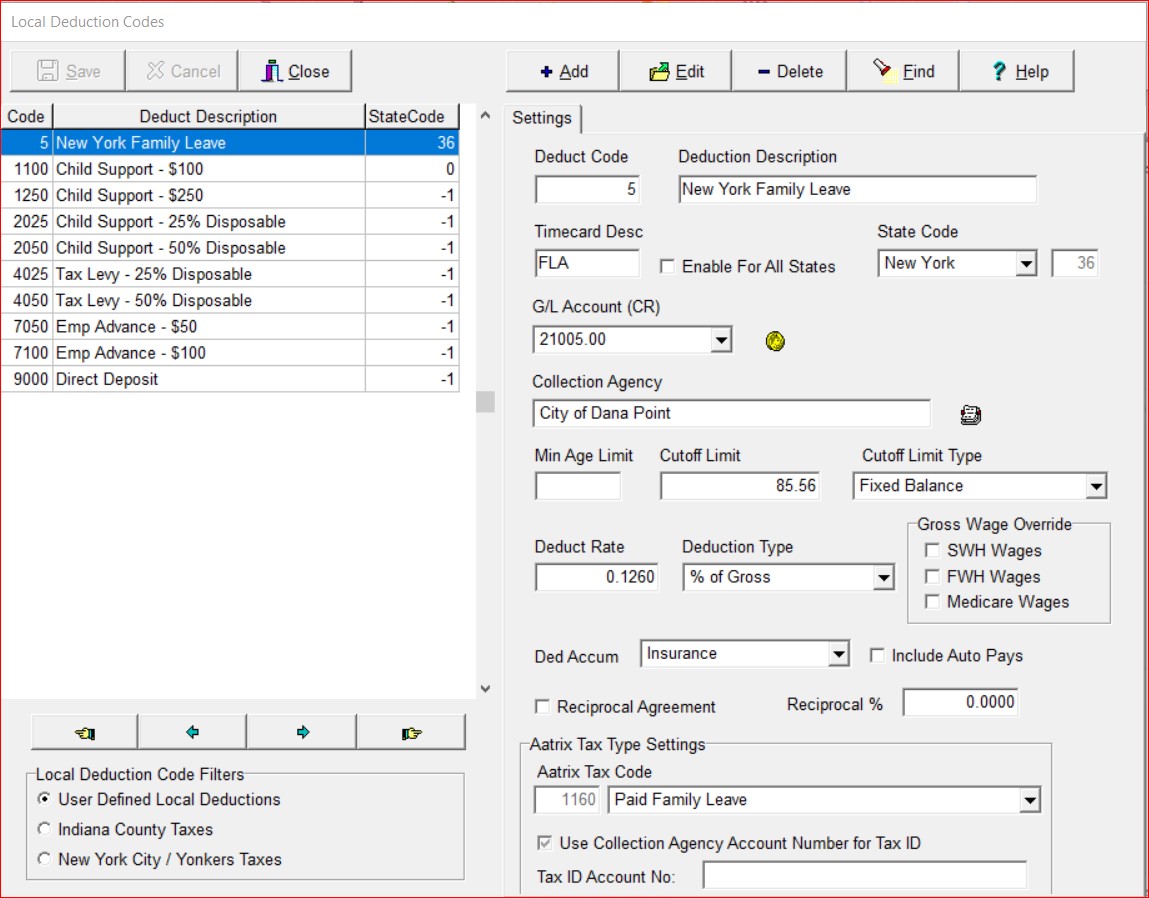

Insurance coverage. Paid Family Leave coverage will typically be included as a rider to an employer's existing disability insurance policy, and will be fully funded by employees through payroll deductions. In 2018, the maximum employee contribution is 0.126% of an employee's weekly wage up to 0.126% of the annualized New York State Average Weekly Wage. The program is mandatory for nearly all private employers. Public employers may opt into the program.

Phase-in schedule. Paid Family Leave will be phased in over four years, beginning January 1, 2018. In 2018, employees may take up to eight weeks of paid leave at 50% of an employee's average weekly wage up to 50% of the New York State average weekly wage. That increases to 12 weeks of paid leave in 2021 paid at 67% of an employee's average weekly wage up to 67% of the New York State average weekly wage. (New York State Office of the Governor, Press Release, July 19, 2017, http://www.governor.ny.gov/news/governor-cuomo-announces-regulations-implementing-new-yorks-nation-leading-paid-family-leave.)

Accubuild can help you handle this contribution in the following manner:

•Set up a Local Deduction as follows, and hook to Aatrix in the section called Aatrix Tax code:

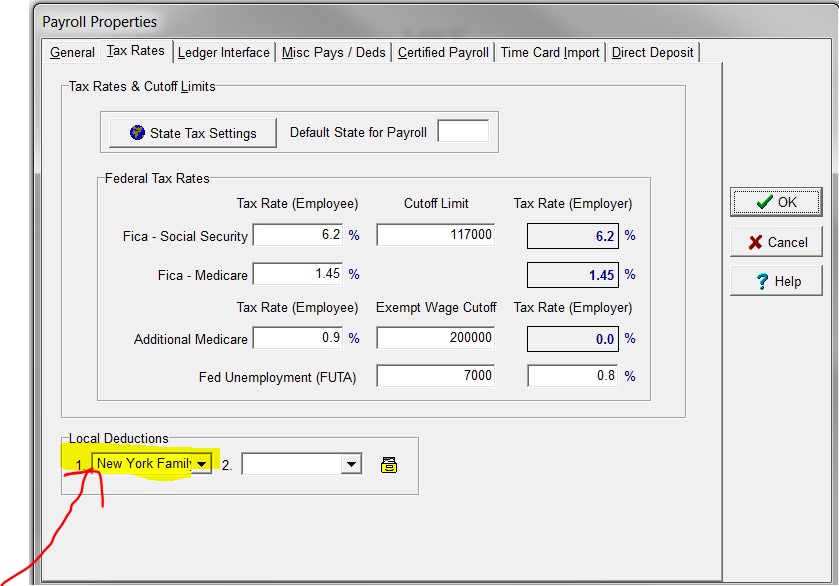

•If the company is located in the state of New York, set up the local tax in the payroll properties which will work for all New York entries. Set the local tax for Family Leave in the Payroll Properties>Tax Rates>NY

•Pursuant to the Department of Tax Notice No. N-17-12, employers should report employee contributions on Form W-2 using Box 14 – State disability insurance taxes withheld. Benefits should be reported by the State Insurance Fund on Form 1099-G and by all other payers on Form 1099-MISC. If the local deduction code has been correctly set up, Aatrix will handle this for you as shown in the following screen shot: