Pennsylvania Unemployment Tax - Employee Deduction [Version 10.1.0.5]

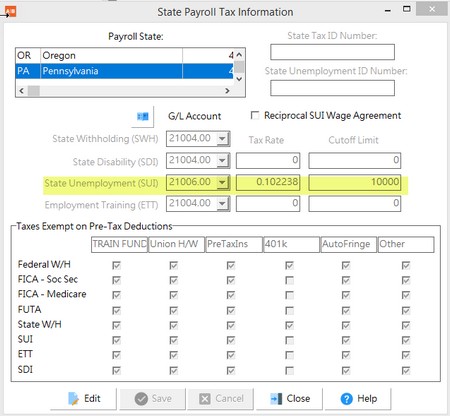

•Pennsylvania's unemployment insurance tax has an employer portion (burden) as well as an employee portion (deduction). The employer burden will be set up in the Payroll > Properties > State Tax Settings screen.

•The employee portion of the SUI tax will be set up using a Local Deduction Code.

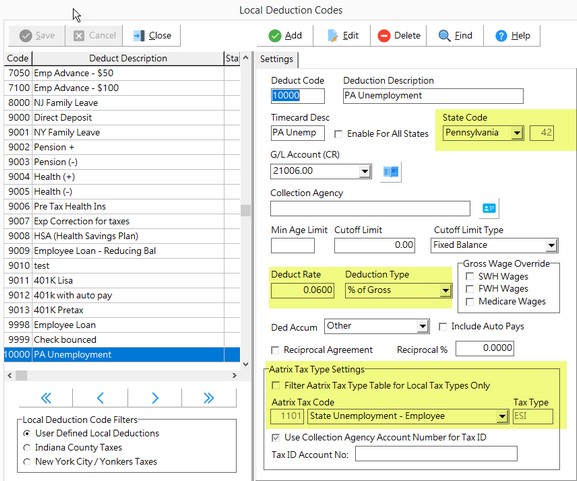

oGo to Payroll > Controls > Local Deduction Codes

oBEFORE clicking the Add button, go to the bottom of the screen and UNCHECK the ‘Filter Aatrix Tax Type Table for Local Tax Types Only’. You will get a message that both local tax and state tax codes will be displayed; click OK on the message.

oClick the Add button at the top of the screen and set up the local deduction code values. Below is an example of the set up.

oThe state code MUST be set to Pennsylvania.

oEnter the appropriate deduction rate for the current period. As of January 1, 2021, the deduction rate is .06% of gross earnings with no earnings limit. (Example: $10,000 of earnings x .0006 = $6.00)

oWith the 'Filter Aatrix Tax Type' box unchecked, you will be able to select the Pennsylvania tax code labeled ‘State Unemployment - Employee’ (code # 1101).

▪Note: This setting does NOT mean that any employee with this deduction will be automatically included on the Aatrix tax form PA UC-2A. Only employees that have earnings where the SUI State Code is equal to Pennsylvania will be included on this form. The employee portion of the tax is simply calculated on this form based on the reported wages. As the employer, you must determine which employees are subject to the deduction. Refer to the Pennsylvania Department of Labor & Industries documentation on unemployment compensation. https://www.uc.pa.gov/Documents/UCP%20Forms/ucp-7.pdf

•Once the local deduction code has been created, the deduction can be applied using ONE of the following options:

oLink to a Job. The Payroll State Code MUST be set up as Pennsylvania and the LDC must be linked. (Job Cost > Update Jobs > Payroll Tab).

▪Any employee that works on the designated job will be subject to the deduction.

oLink to an individual employee, as applicable

▪The deduction will be applied to the specific employee when the employee has Pennsylvania earnings.

oLink to the Payroll > Properties > Tax Rates Tab.

▪All employees with Pennsylvania earnings, including salaried employees that are not coded to a job, will be subject to the deduction.

•Use the Payroll > Tax Forms / EFile / W2s option to generate the quarterly Pennsylvania unemployment tax form PA UC-2A.

oBecause this is an unemployment tax form, only those employees that have earnings where the SUI State Code is equal to Pennsylvania will be included on this form. (The SWH State Code is where the wages are earned but the SUI State Code is where the unemployment wages are reported). The employee portion of the tax is simply calculated on this form based on the reported wages; it does not report the employee tax based on the local deduction code.