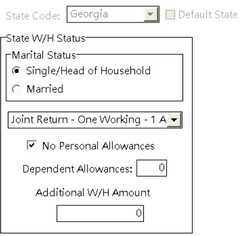

[Version 10.2] - New state withholding settings have been added to the Georgia State Withholding controls on the Employee Center Screen which are used to adjust the personal allowance settings for both single and married employees:

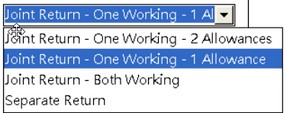

•Married Status Settings: The drop down option for 'Joint Return - One Working' has been expanded to support options for either 1 or 2 personal allowances under this setting:

•No Personal Allowances: A new checkbox has been added entitled 'No Personal Allowances' which will apply to both married and single employees for setting the personal allowances to zero. When this box is checked, the tax calculations will not include any wage reductions for personal allowances. The standard deduction and dependent allowance deduction amounts will still be used for wage reduction calculations when this box is checked.

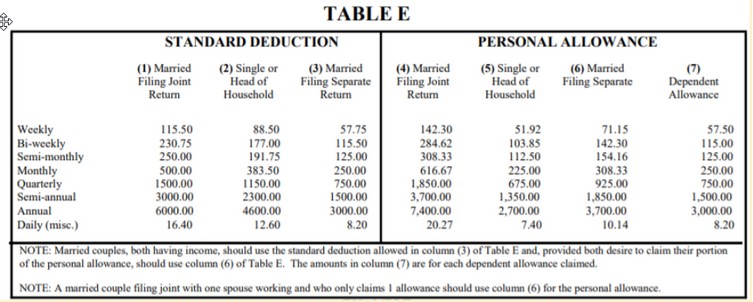

| AccuBuild uses the Percentage Method for Georgia State Withholding calculations where the Standard Deduction, Personal Allowances, and Dependent Allowances are pulled from Table E as shown below: |

Standard Deduction Annual Amounts: Table E - Columns (1) through (3)

•Single / Head of household - $4,600.00

•Married - Joint Return (all 3 drop down options) - $6,000.00

•Married - Separate Return - $3,000.00

Personal Allowances: Table E - Columns (4) through (6)

•Single / Head of household - $2,700.00

•Married - Joint Return - 1 Working - 2 Allowances - $7,400.00

•Married - Joint Return - 1 Working - 1 Allowance - $3,700.00

•Married - Joint Return - Both Working - $3,700.00

•Married - Separate Return - $3,700.00

NOTE: If the No Personal Allowances Checkbox is checked then Personal Allowances will be set to $0.00 for Single or Married (all options).

Dependent Allowances: Table E - Column (7)

•Single or Married (all options) - $3,000 per dependent