If a payroll check has been posted through the system with an incorrect job or phase or general ledger account number, then there are several options available to correct the error.

| 1. | The first and best option would be to void the payroll check and then to re-issue the check using the same check number and check date. By voiding the check, AccuBuild will automatically generate entries that will reverse all postings of the invoice from all systems. Be sure to void and re-issue the check with the same dates so that the net affect is zero for the day. Note: Voiding the entry will NOT affect Daily Field Reports. Please see the section below titled Correcting a check that utilizes Daily Field Reports. |

| 2. | The second option would be to make a general journal entry to reclassify the expense. Keep in mind that a general journal does not reference the employee number or check number except in the description field. Therefore, the reports generated for the payroll system will NOT reflect the change. |

| 3. | The third option would be to enter a handwritten check to reclassify the expense amount from one set of cost codes to another. This option will provide a better record of all transactions related to the specific check, however, this option will NOT remove all related payroll burden associated with the check. Payroll burden is calculated on the total gross wage of the check and then pro-rated out to the individual time card entries. Therefore, if the gross wage netst to zero, then the burden calculation will also be zero and the original burden will not be removed from the job/phase/expense account. |

The handwritten check entry should reference the same check number, check date, pay period and employee information as the original check, however, the net amount of the check and the tax deductions will be zero. In the timecard entry screen, enter the complete transaction with the job, phase and general ledger account that the original entry should have been charged to. Enter a second timecard transaction with the same hours as a negative number (for example: -8) with the expense information that the original entry was charged to. Once posted, these entries will leave an audit trail of both the original entries and the reclassification of the cost.

Correcting a check that utilizes Daily Field Reports

Please note, if you are using advanced options that integrate with the Payroll system, such as Daily Field Reports (DFR) and Production Unit Tracking by Detail Item, then we suggest the following steps be followed in order to keep all systems in sync when correcting payroll check coding.

Voiding a check does not reinstate the original time card worksheet records as 'unprocessed' nor does it affect the Daily Field Reports in any way.

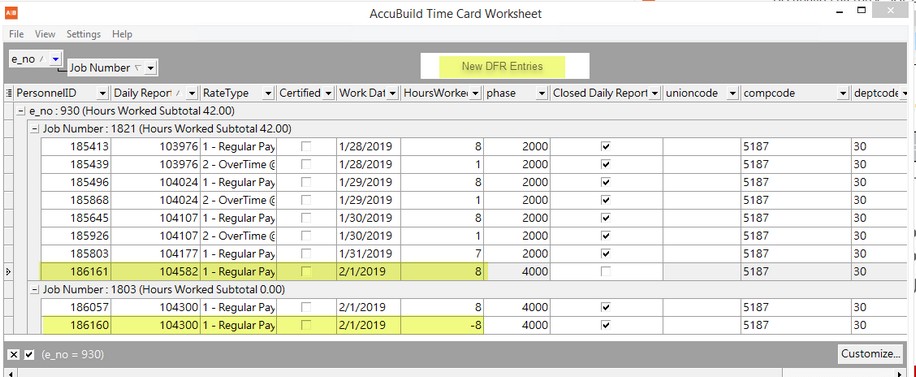

The following example illustrates moving one employee's hours from job 1803 to 1821.

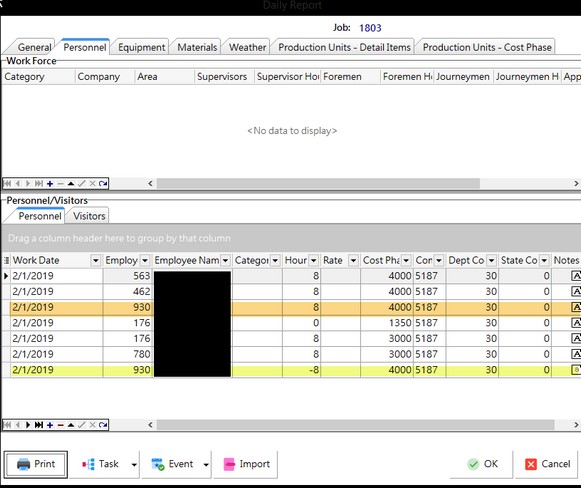

| 1. | Create a new DFR for the correct job using the same original date and enters the hours. This new DFR should match the original DFR with the exception of the job number. |

•If you track production units by detail item, you will also need to update the DFR Task Hours as well.

| 2. | Edit the original DFR but do NOT edit the original entry. We want to create an audit trail of the changes as well as allow the system to create new time card entries. The user should add a new entry to show negative hours for the employee. |

•If you track production units by detail item, you will also need to update the DFR Task Hours to reflect the negative hours as well.

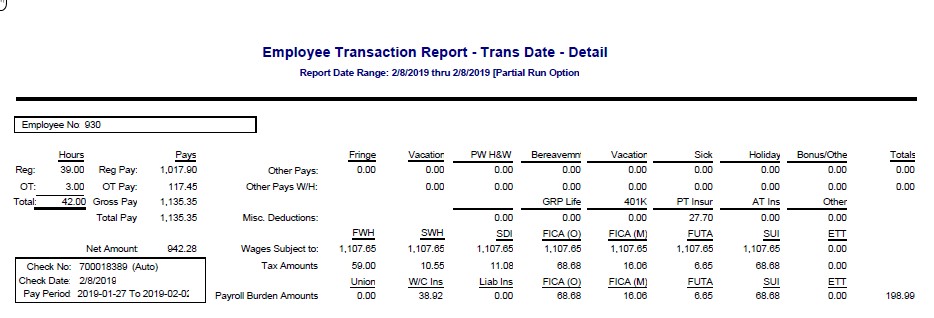

| 3. | Print the Employee Transaction Report - Trans Date - Detail report using the original check date; use the partial run to select the employee. |

4. Void the original check, using the original check date if the accounting period is still open. This entry will ensure that all of the original entries, including the burden calculations, are reversed

•If your company has a tailored solution that auto creates journal entries after the posting of a payroll check, including a void check, then be sure to post the journal entry at this point.

| 5. | Set the Time Card Worksheet date filter to the original pay period for the check. Unprocessed records should display the new DFR entries to the corrected job and well as the negative hours on the original job; the hours should net to zero. |

| 6. | Recall the processed records for the original pay period for the employee; this will include ALL jobs that the employee worked on. |

| 7. | Import all records for the employee for the selected period into the batch. |

| 8. | Review time card records; total hours and gross amount should equal the original check totals. (Refer to the Employee Transaction Report printed earlier) |

| 9. | Process the new check using the override auto tax; you may need to force the tax calculations to match the original check so that the net pay is the same as the original check. (Refer to the Employee Transaction Report printed earlier) |

10. Print the check to plain paper using the same original check number and check date (if possible), otherwise the check date should be the same as the void date.

•If the employee uses direct deposit, enter any number (such as '1') as the check number. You will not be able to assign the original direct deposit number. AB will assign a new direct deposit number for you.

11. Post the batch.

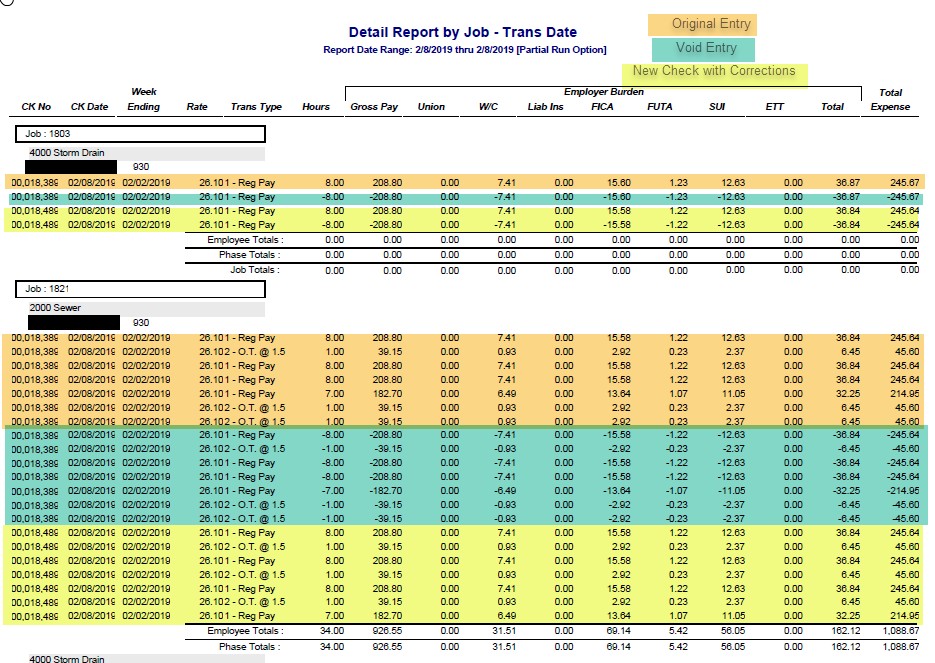

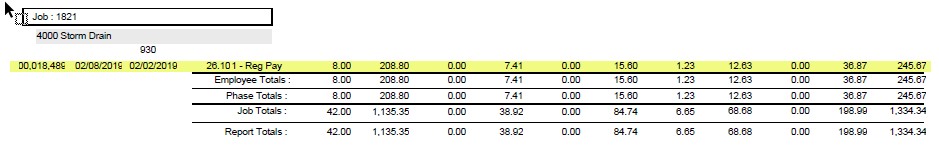

12. Print the Detail Report by Job - Trans Date report for the check/void date used in the above entries. The report will show that the gross hours/amount are moved as well as the burden amounts. Notice that the original job will show the hours corrected twice; once with the void check and then once again with the new check. Again, this is necessary so that all parts of the system, including the DFRs, can reflect the corrections.