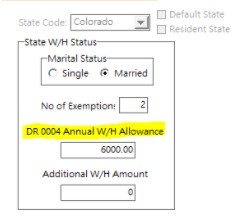

The State of Colorado has changed the state withholding calculation method for 2022. A new optional state filing certificate Form DR 0004 can now be used to set up an annual withholding allowance. If the new form is NOT used, then the annual withholding allowance amount will be based on the new 2021 Federal W-4 which is currently set to $8,000 for married employees and $4,000 for all other employees. If you will be using the new form, then be sure to enter the annual withholding allowance amount in the new field as provided: