•Version 10.2.0.8 RED - Release Date 02/08/2024

•Version 10.2.0.8 BLUE - Release Date 04/08/2024

•Version 10.2.0.8 TEAL - Release Date 06/12/2024

•Version 10.2.0.8 PURPLE - Release Date 06/26/2024

•Version 10.2.0.8 NAVY - Release Date 07/22/2024

•Version 10.2.0.8 MAROON - Release Date 09/10/2024

•Version 10.2.0.8 AQUA - Release Date 09/23/2024

•Version 10.2.0.8 GREEN - Release Date 11/20/2024

•Version 10.2.0.9 - Year End Update 12/26/2024

2025 UPDATE FEES RELEASE

•Initial Software Release for 2025

| This update is the first software release for 2025 and will require that the 2025 Update Fees are current. AccuBuild Version 10.2.0.8 is the last update for the 2024 Update Fees renewal. Please contact AccuBuild Support for more information on update renewals. |

AATRIX

•ENHANCEMENT - Aatrix Installer Update 10.2.0.8 Maroon

•The installer program for the Aatrix Tax Form processing software (Setup.exe) has been updated to the latest version. The original installer has been renamed to Setup_Old.exe.

ACCUIMPORTER

•CORRECTION - Aatrix Installer Update 10.2.0.8 Maroon

•Payable invoices that were imported from Excel with the AccuImporter tool were allowed to post when an invoice was charged to an invalid Equipment Number where the Equipment Number did not exist on the Equipment Master List. The posting process for AP Invoices has been updated to cancel the posting process and notify the user of the invalid equipment number(s) so that the invoice entries can be corrected.

•ENHANCEMENT - Direct Payment Cash Receipts Import 10.2.0.8 Maroon

•The Accuimporter Utility has been updated to support importing of Direct Payment Cash Receipt records. A sample excel template for the cash receipt records (import_customerardirectpaymentreceipts.xls) can be found in the AccuBuild Samples\AccuImporter folder.

Technical Notes: This import requires custom script to be created for the individual customer needs and the new sequence numbers for the cash receipts include 11, 1011, 2011, & 3011 from the AccuBuild Library Script Class 117000. Commented sample script is provided in the Script Library for these sequence numbers.

The Accuimporter Utility now supports warning messages to be displayed during the import when there are no errors found in case the user wishes to cancel the import when warnings messages exist. See sample script in Sequence 2011 for details on handling warning messages.

DOCUMENT MANAGEMENT

•ENHANCEMENT - Document Management Integrity Tests 10.2.0.8 BLUE

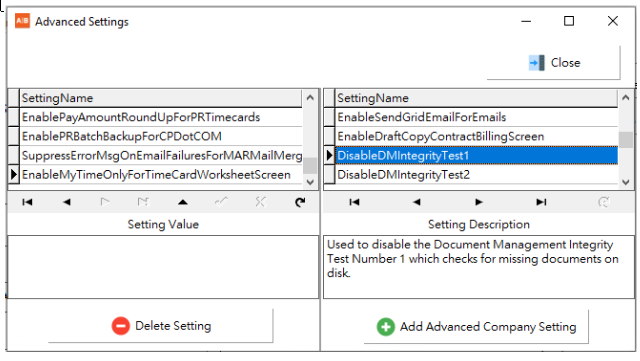

•The new Advanced Settings have been added in order to speed up the document management integrity tests process:

oDisableDMIntegrityTest1 - This option is used to disable the Document Management Integrity Test Number 1 which checks for missing documents on disk.

This test is used to make sure that a document listed in the AccuBuild Document Management System (ADMS) actually exists on disk and has not been removed. Normally the documents that are missing are related to temporary document copies that the user has worked on and they were never refiled back into the system due to an abnormal exit from the AccuBuild Program.

This testing process can take quite a while when there are hundreds of thousands of documents in the system, so by disabling this step, the testing process will be done much faster.

oDisableDMIntegrityTest2 - This option is used to disable the Document Management Integrity Test Number 2 which checks for documents with missing indexes.

This test checks for documents that do not have any key fields (indexes) associated with the document such as an employee number, vendor number, job number etc. These key index fields control when a document is included in one of the document folder lists in the ADMS. For example, if a document has an employee number index assigned to it, that document will be listed in the employee documents folder on the employee list.

Since these key fields can be removed by updating the properties screen of a selected document, it is possible for a user to clear all the indexes associated with a document. If you are not concerned about listing these documents, then you can use this setting to disable this step.

Both of these settings are now available on the Advanced Settings Screen which can be opened from the Accounting Tab of the Configuration Properties Screen using the Advanced Property Settings Button. Use the File > System Administrator > Configuration menu option to access these settings:

•ENHANCEMENT - Document Routing Changes for PO AP Invoice Amounts 10.2.0.8 GREEN

•Several Changes were made to the Document Routing process that relate specifically to payable invoices for purchase orders which will provide more information when approving these types of invoices. Please review the following documentation which outlines the changes that were made and how to implement these for your company

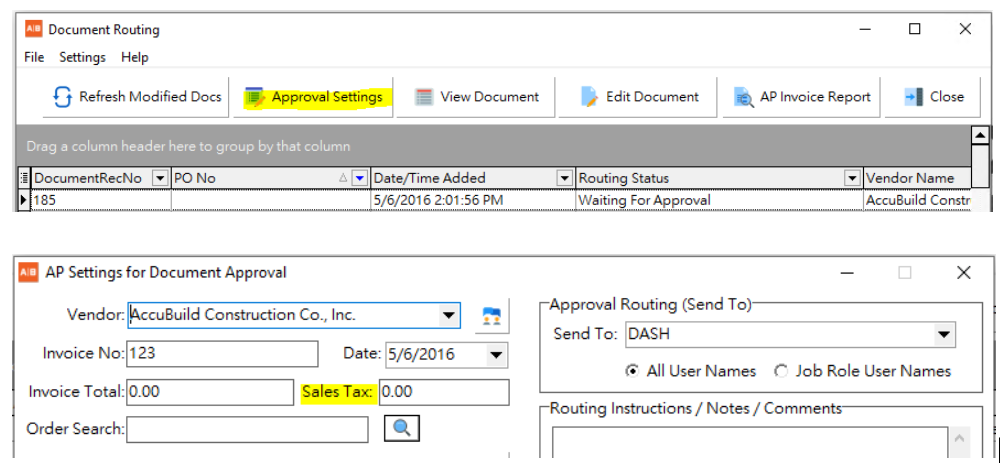

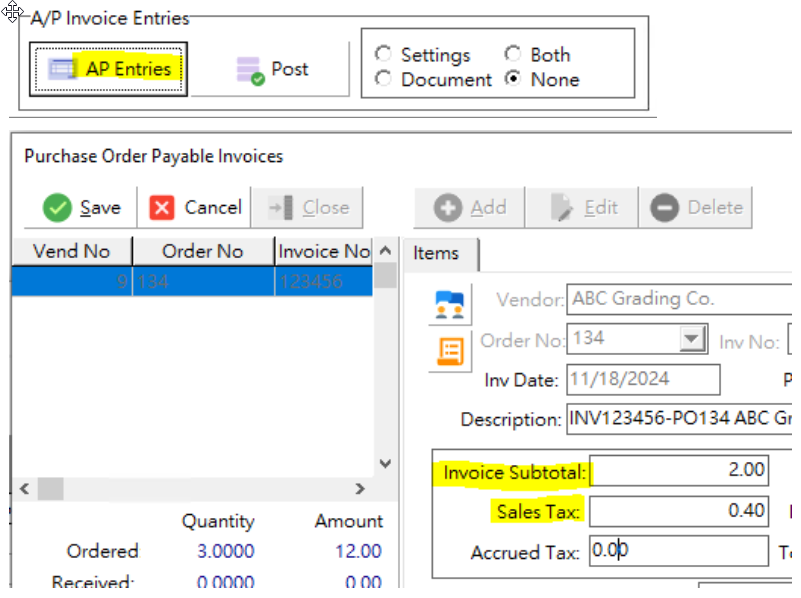

Approval Settings Screen: The AP Settings for Document Approval screen has been updated to include a new Sales Tax field so that sales tax amounts which are included on PO AP Invoices can be tracked in the routing grid and included in the PO AP Invoice entry screen:

The Invoice Total represents the Gross PO Invoice Amount including any Sales Tax. With the addition of the Sales Tax field, both of these amounts can now be tracked in the Document Routing screen and copied to the Purchase Order Payable Invoices entry screen when using the AP Entries button.

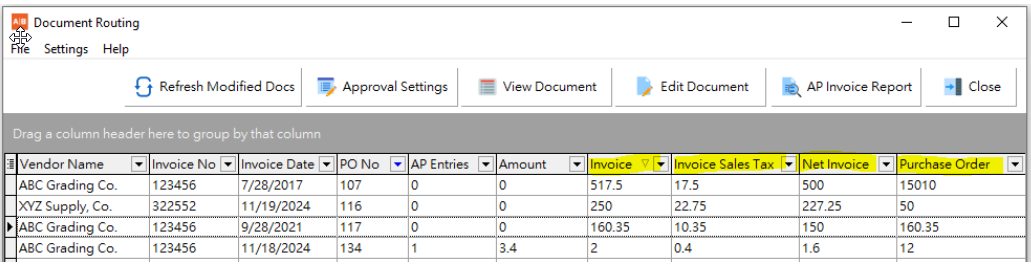

Document Routing Screen: The Document Routing screen has been updated with new fields in the document grid in order to provide more information when routing purchase order invoices:

The following is a partial list of fields in the Document Routing grid that relate to payable invoice amounts and are provided to help understand the new PO calculated fields. The fields in black are the original fields that existed prior to this feature update and the fields in blue represent the new PO field amounts:

•AP Entries - This column shows the count of AP Invoice entries that have been entered into the AP Invoice Entry screen or the PO AP Invoice Entry screen

•Amount - This column shows the total amount of the payable invoice entries that have been entered into the AP Invoice Entry screen or the PO AP Invoice Entry screen including any Sales Tax amounts on PO AP Invoices.

•Invoice - This is the gross invoice amount and includes any sales tax. This amount comes from the Invoice Total field on the AP Settings for Document Approval screen.

•Invoice Sales Tax - This is the sales tax amount on the invoice. The amount comes from the Sales Tax field on the AP Settings for Document Approval screen.

•Net Invoice - This amount represents the net invoice amount. This amount is computed using the Invoice Total field minus the Sales Tax field on the AP Settings for Document Approval screen.

•Purchase Order - This amount represents the extended net amount total of the purchase order. It is calculated by summing all of the line items on the purchase order (quantity * unit price).

Advanced Settings Screen: A new Advanced Setting is required in order to implement the new calculations for the PO AP Invoice related fields (blue fields) to be populated. If you DO NOT enable the new Advanced Setting, then all of these blue fields will be set to zero by default.

•EnableSalesTaxAmountForRoutedPOInvoices - Enable this advanced setting in order to activate the calculations for the PO AP Invoice related fields (blue fields).

Routing Screen Grid Adjustments: The Routing Screen grid can be adjusted by each AccuBuild user in order to change the field order in the grid OR to hide any field from being shown in the grid. Each time a grid adjustment is made, it will be saved and remembered for that user the next time the screen is opened.

•Moving Columns: When you first open the grid, the new fields (blue fields) will be located to the far right side of the grid. You can simply click (left click) on the column heading and drag the field to the left in order to move it to where you want it located and then release the mouse.

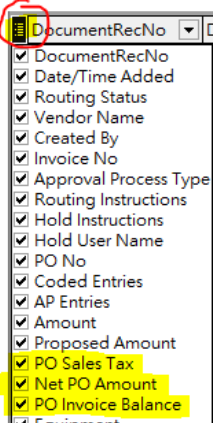

•Hiding Columns: Use the small icon next to the first column on the grid to select the fields for viewing or hiding. Check the fields you want to be included in the grid and uncheck the fields you want to hide.

•

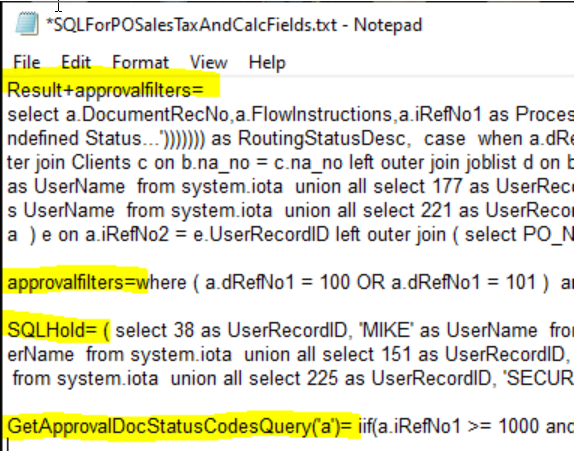

Technical Notes: When the new Advanced Setting is enabled for this feature, the SQL Script for the routing grid is different from the original SQL that is used when this feature is NOT enabled. These script changes were necessary in order to handle the new fields and compute the PO Total Amounts. Each time the routing screen is opened and the Advanced Setting is enabled, then new SQL Script will be recorded in the accubuild user directory in a text file called SQLForPOSalesTaxandCalcFields.txt. If any issues are encountered due to a SQL, the first set of SQL Script (Result+approvalfilters=) can be copied to a company connection for testing and troubleshooting. There are actually 4 sets of script in this text file, however the first set is what creates the data for the routing grid:

Resetting Grid Defaults: If you would like to reset the grid to the original default settings, you can remove the apScanForApprovalGrid.INI configuration file located in the user settings under the ACCUTEMP folder. Right click on the main AccuBuild menu screen and select Browse user settings folder:

EQUIPMENT

•ENHANCEMENT - Equipment Depreciation Update Process 10.2.0.8 BLUE

•The Update Depreciation Totals process in the Equipment Integrity Tests menu can fail when other users are in the AccuBuild System and have the equipment files open. Previously, when the failure occurred, there was no clear explanation for the failure. The system will now display a message indicating that other users need to be out of the system in order to run this process.

•ENHANCEMENT - Equipment Hours Accumulator Update Process 10.2.0.8 BLUE

•The Update Hours Accumulator process in the Equipment Integrity Tests menu can fail when other users are in the AccuBuild System and have the equipment files open. Previously, when the failure occurred, there was no clear explanation for the failure. The system will now display a message indicating that other users need to be out of the system in order to run this process.

GENERAL LEDGER

•ENHANCEMENT - General Ledger Report - Traditional Version 10.2.0.8 BLUE

The Traditional Version (Crystal Reports) of the General Ledger report (GLREP07A.RPT) has been modified to handle displaying numbers larger than 999 million without clipping the left side of the amounts.

•ENHANCEMENT - General Ledger Financial Statements - Traditional Version 10.2.0.8 BLUE

The Traditional Version (Crystal Reports) of the General Ledger Financial Statements can have clipping issues on large dollar amounts over $100 million. Previously a substitute report format (GLFINAN1.RPT) was documented as a report substitution option that would correct the clipping on larger dollar amounts. However there have been instances reported where this format still does not correct the clipping of the amounts and therefore a new report format (GLFINAN3.RPT) has been published with this release which can be used as a report substitution in place of the previous format (GLFINAN1.RPT):

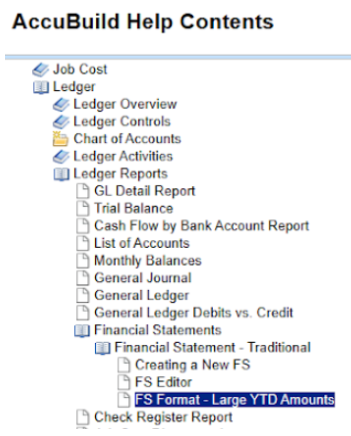

•Use the File > System Administrator > Report Substitution option to replace GLFINANC.RPT with the format GLFINAN3.RPT. Refer to the help link for more information: FS Format - Large YTD Amounts (accubuildcloud.com)

MY ACCUBUILD REPORTS

•CORRECTION - MAR Puchase Order Report 10.2.0.8 TEAL

The MAR Purchase Order Report entitled Sub / Purchase Order Payment Status Report was updated to fix an issue with the Invoice Drill Down option and the Payment Drill Down option where the drill down reports were not showing the void check amounts properly. This issue has been corrected in this release with an update to the Library Report Class 696

•ENHANCEMENT - Automatic Payroll Checks - Custom Framework 10.2.0.8 TEAL

The Custom Framework Class 101700 for Automatic Payroll Check Batches has been updated to make sure the Payroll Menu is always refreshed when this framework is enabled. This was necessary in case the framework script introduces new records into the PRTCBat table (time card record batch) that would require the Calculate Taxes menu to be enabled. This new change will guarantee that the Calculate Taxes menu will be refreshed AFTER any new timecard records are created and BEFORE the Auto Time Cards form is closed.

•ENHANCEMENT -MAR Report Tracking 10.2.0.8 Maroon

A new Advanced Setting has been added in order to enable MAR Report Activity in the user activity log:

•EnableMARReportRunsInUserActivityLog - This option is used to enable the new MAR Report Activity logging process. Once this setting has been enabled, the AccuBuild system will start tracking audit details of the MAR Reports that are run by each user.

This setting has an optional parameter (Setting Value) that can be enabled as needed to capture more advanced report information, however the default setting will track the basic report information that was run and the user that ran the report.

•Setting Values: The default setting is recommended:

oBlank or 0 = basic report information (default)

o1 = advanced report information - this setting will require much more data to be recorded in the user activity log and may cause the activity log file to grow and become bloated. It is recommended to use this setting sparingly for specific testing needs over short periods of time.

Note: This advanced setting MUST be set up for each company in the AccuBuild System.

•ENHANCEMENT -MAR User Settings and Activity Report 10.2.0.8 Maroon

A new MAR Report entitled User Settings and Activity Report has been added to the Employee P/R Reports folder of the MAR Reports screen.

This report lists all of the security settings for both the AccuBuild Program menu restrictions as well as the MAR Report Access list for all users within an AccuBuild Company. In addition to the security settings, the report will also include the user menu access activity and the MAR report activity for the period defined by the report cutoff dates.

You will need to secure this report in order to use it and it should only be used by company administrators who have access for maintaining security settings in the AccuBuild System.

Once the report has been secured, you will need to set up the new Advanced Setting that will enable the audit trail logging for MAR Reports. Refer to the notes in this release regarding the new Advanced Setting entitled EnableMARReportRunsInUserActivityLog for more information. Once this setting has been enabled, the AccuBuild system will start tracking audit details of the MAR Reports that are run by each user.

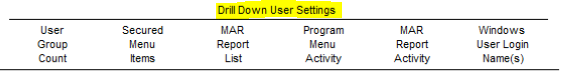

The report will list all users in the company with drill down reports for each section of the Accubuild System. The number of security entries for each section will be listed next to the user name and when there are one or more entries under a section, the drill down details for that section can be accessed by clicking on the number under the section heading:

•User Group Count - This number represents the number of groups that the user belongs to. If there are one or more groups, you can drill down to see the group names.

•Secured Menu Items - This number represents the number of menu items that are secured (blocked) from the user. The blocking of menus can be the result of menu restriction settings or menu security level settings which are identified under the Restriction Type column.

•MAR Report List - This number represents the number of MAR Reports that the user has access to based on the MAR user access settings or the MAR user group access settings for user groups that the user belongs to.

•Program Menu Activity - This number represents the number of user records that have been recorded in the user activity log during the period represented by the report cutoff dates. The log entries are listed in order by date and time of the activity.

•MAR Report Activity - This number represents the number of MAR Reports that have been run by the user and recorded in the user activity log during the period represented by the report cutoff dates. The log entries are listed in order by date and time of the activity.

•Windows User Login Name(s) - This number represents the number of Windows User Names that the AccuBuild User has used to log into the AccuBuild Program during the period represented by the report cutoff dates. Normally there will only be one user name listed, however if a change is made to a Windows User name or if the user has multiple Windows User names, there could be multiple entries.

ORDERS

•CORRECTION - MAR Puchase Order Report 10.2.0.8 TEAL

The MAR Purchase Order Report entitled Sub / Purchase Order Payment Status Report was updated to fix an issue with the Invoice Drill Down option and the Payment Drill Down option where the drill down reports were not showing the void check amounts properly. This issue has been corrected in this release with an update to the Library Report Class 696

•CORRECTION - Purchase Order Copy Options for Buyout List Items 10.2.0.8 PURPLE

The Copy functions on the Purchase Order screen have been updated to exclude the Buyout Item link from being copied to the new line item(s). The Buyout Item link is used to link a PO Line Item to a buyout list for the job that is included on the Order. These links are created when new items are added to the Order using the Job Inventory PickList button. When an Order is Copied with all related line items, or when a single line item is copied, these Buyout Item links will no longer be included on the new items.

PAYROLL

•ENHANCEMENT - Payroll Tax Tables for 2024

•Federal Tax Tables - new tables for 2025 10.2.0.9

•Arkansas - new tax tables effective July 1, 2024 10.2.0.8 NAVY July 22, 2024

•Arkansas - new tables for 2025 10.2.0.9

•California - new tables for 2025 10.2.0.9

•Georgia - new tax calculations for 2024 10.2.0.8 TEAL June 12, 2024

•Hawaii - new tables for 2025 10.2.0.9

•Idaho - new tables for 2024 10.2.0.8 TEAL June 12, 2024

•Illinois - new tables for 2024 10.2.0.8 RED Feb 8, 2024

•Indiana - new tables for 2025 10.2.0.9

•Iowa - new tables for 2025 10.2.0.9

•Kansas - new tax tables effective July 1, 2024 10.2.0.8 NAVY July 22, 2024

•Kentucky - new tables for 2025 10.2.0.9

•Maine - new tables for 2025 10.2.0.9

•Maryland - new tables for 2024 10.2.0.8 RED Feb 8, 2024

•Massachusetts - new tables for 2024 10.2.0.8 RED Feb 8, 2024

•Michigan - new tables for 2025 10.2.0.9

•Minnesota - new tables for 2025 10.2.0.9

•Missouri - new tables for 2025 10.2.0.9

•Montana - new tables for 2025 10.2.0.9

•Nebraska - new tables for 2025 10.2.0.9

•New Mexico - new tables for 2025 10.2.0.9

•North Carolina - new tables for 2025 10.2.0.9

•North Dakota - new tables for 2024 10.2.0.8 RED Feb 8, 2024

•Ohio - new tables for 2025 10.2.0.9

•Rhode Island - new tables for 2025 10.2.0.9

•South Carolina - new tables for 2025 10.2.0.9

•Utah - new tables effective June 1, 2024 10.2.0.8 PURPLE June 26, 2024

•Virginia - new tables for 2024 10.2.0.8 BLUE April 8, 2024

•West Virginia - new tables for 2025 10.2.0.9

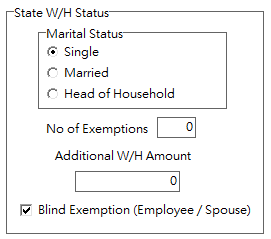

•ENHANCEMENT - Massachusetts Employee Exemption Settings 10.2.0.8 RED

The Employee Center Screen has been updated with some new state withholding exemption settings that will be used for the new 2024 payroll tax calculations. The marital status setting now includes an option for Head of Household and a new checkbox entitled Blind Exemption (Employee / Spouse) has been added for the employee and / or their spouse who are blind.

•CORRECTION - ConstructionPayroll.com Posting Process 10.2.0.8 RED

A correction was made to the check posting process for payroll checks that are posted to AccuBuild from ConstructionPayroll.com via the API Process.

•ENHANCEMENT - Aatrix 1099 Second Mailing Address Added 10.2.0.8 BLUE

The 1099 records that are generated for the Aatrix tax forms processing software have been updated to include the second part of the mailing address. This field is typically used to enter a suite number or apartment number as part of the mailing address for the 1099s.

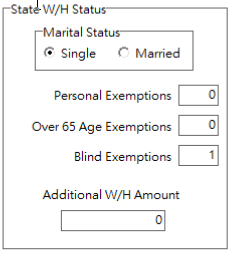

•ENHANCEMENT - Virginia Employee Exemption Settings 10.2.0.8 BLUE

The Employee Center Screen has been updated with new state withholding exemption settings for the state of Virginia that will be used for the new payroll tax calculations that are effective for April 2024. These new exemptions include the Over 65 Age Exemptions and the Blind Exemptions.

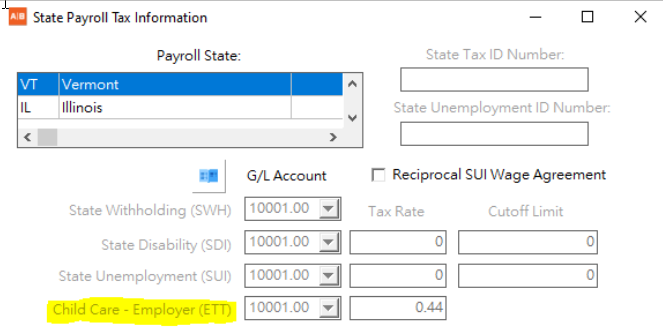

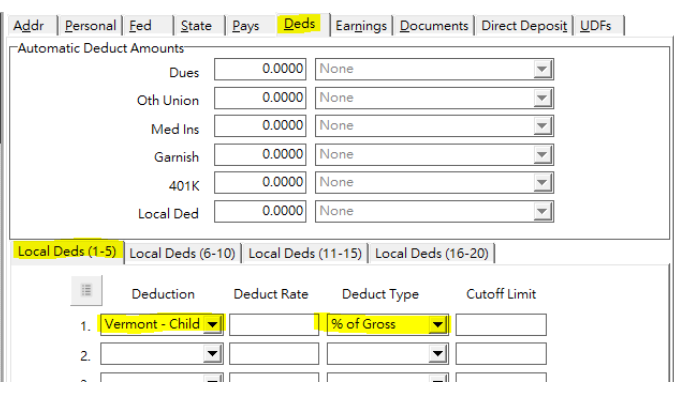

•ENHANCEMENT - Vermont Child Care Payroll Tax 10.2.0.8 TEAL

The state of Vermont has a new Child Care tax effective July 1, 2024. Employers are required to pay a 0.44% payroll tax on all employee wages earned in Vermont. An employer may choose to deduct and withhold a maximum of 25 percent of the required contribution (i.e. 0.11%) from employee wages. Please see the Vermont Government Website for more information: https://tax.vermont.gov/business/child-care-contribution

The employer tax for Child Care will be set up on the state tax settings screen for the state of Vermont as shown in the State Payroll Tax Information screenshot below. If you will be holding any child care amounts from individual employees, then you will need to set up a new local deduction code for the employee child care amount and then set up the local deduction on the employee screen for each employee that will have this deduction withheld from their paycheck:

Employer Setup: Set the tax rate up by selecting the state of Vermont in the Payroll State grid and updating the rate under the Child Care - Employer (ETT) Tax Rate setting. This tax is handled as the ETT Tax in the payroll check records which is considered an employer burden tax.

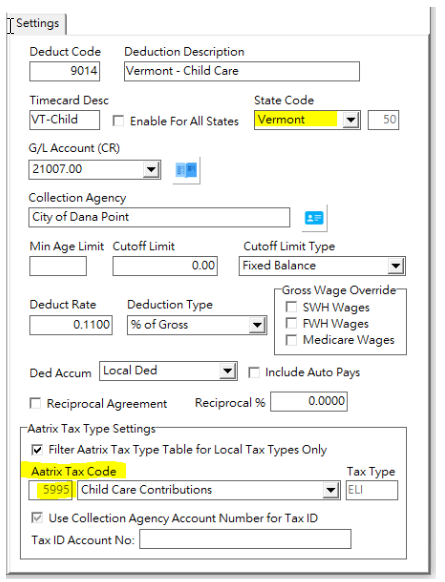

Local Deduction Setup: If you will be holding a deduction from the employee paychecks for the Child Care tax then you will need to set up a new local deduction code in the Local Deduction Codes screen as shown:

•Enable For All States: - Make sure this box is NOT checked.

•State Code: - Set the State Code to Vermont

•Aatrix Tax Code: - Link the local deduction to the Aatrix tax code 5995 which represents the employee's amount of child care tax.

Employee Deduction Setup: If you will be holding a deduction from the employee paychecks for the Child Care tax then you will need to add the local deduction to each employee that will be paying the child care tax:

•ENHANCEMENT - Automatic Payroll Checks - Custom Framework 10.2.0.8 TEAL

The Custom Framework Class 101700 for Automatic Payroll Check Batches has been updated to make sure the Payroll Menu is always refreshed when this framework is enabled. This was necessary in case the framework script introduces new records into the PRTCBat table (time card record batch) that would require the Calculate Taxes menu to be enabled. This new change will guarantee that the Calculate Taxes menu will be refreshed AFTER any new timecard records are created and BEFORE the Auto Time Cards form is closed.

•ENHANCEMENT - Certified Payroll XML File Specification Update for California Version 10.2.0.8 AQUA

The XML File Specification for Certified Payroll Reporting has been updated to the California Payroll Records Version 1.3. This specification requires two new fields to be included in the XML file as well as new formatting for the employee name field. Please refer to this link to review all the XML file changes made in this release.

•ENHANCEMENT - Employee Notes Update for XML "notes" Element 10.2.0.8 AQUA

The Employee Notes field in the Employee List now supports a method to include the employee’s descriptive information for the California XML notes element which is located on the payrollInfo_employees_payroll_deductionsContribPay group. This is an optional field for the XML file, however, if you are required to supply any information on this element, you can enter the descriptive information anywhere in the Employee Notes field enclosed in square brackets [] as shown:

[CAXML_notes:Employee notes for XML export go here between tag and ending bracket].

The location inside the Employee Notes field does NOT matter as long as the descriptive information is formatted with the opening and closing square brackets and includes the CALXML_notes: text following the opening bracket. The XML notes are limited to 250 characters.

•ENHANCEMENT - Employee Notes Update for XML "notes" Element 10.2.0.9

The Employee Center Screen (employee list) has been updated on the Fed Tab with a new Letter option for Box 12 of the W2. All four letter options (A - D) in the W-2 Box 12 Info section will now include the letter II for representing medicare waiver payments excluded from gross income.

•ENHANCEMENT - Paid Family Leave Tax for Delaware for 2025 10.2.0.9

Delaware will now have a paid family leave tax for 2025. Employers are responsible for 100% of the contributions under the plan, but the Act allows the employer to require their employees to pay up to (but no more than) half of their contributions as per the Delaware website link (below). The Employer Portion of the Paid Family Leave will be tracked accrued under the ETT tax field in the PRCHECKS Table and the Employee withheld portion (if any), will be withheld using the SDI Tax field in the PRCHECKS Table

Employee Family Leave (SDI)

G/L Account - A new G/L Account will need to be set up to track the paid family leave amounts that are deducted from the employee's paycheck. Be sure to set up this account even if you will NOT be withholding any portion of the Paid Family Leave tax from the employee.

Tax Rate - Enter the rate that you will be using for the employee's portion of the Paid Family Leave tax. NOTE: If your employees will NOT be contributing to the plan, then leave the rate set to zero.

Cutoff Limit - It appears from the Delaware Website Link that the cutoff limit for the Paid Family Leave tax will be based on the social security cutoff limit. Please confirm with your CPA or company controller for setting up the proper cutoff limit. This cutoff limit will need to be updated as necessary at the start of each new calendar year.

Employer Family Leave (ETT)

G/L Account - A new G/L Account will need to be set up to track the family leave amounts that are accrued for the employer's portion of the Paid Family Leave tax.

Tax Rate - Enter the rate that you will be using for the employer's portion of the Paid Family Leave tax.

Cutoff Limit - It appears from the Delaware Website Link that the cutoff limit for the Paid Family Leave tax will be based on the social security cutoff limit. Please confirm with your CPA or company controller for setting up the proper cutoff limit. This cutoff limit will need to be updated as necessary at the start of each new calendar year.

Please refer to the Delaware Website Link (below) for more details on the plan and check with your CPA or company controller for more guidance on how the plan rates should be set up for your company’s implementation of the new Family Leave Tax. https://laborfiles.delaware.gov/main/pfl/Employer_and_TPAs_Guide_to_DPL.pdf.

•ENHANCEMENT - Paid Family Leave Tax for Maine for 2025 10.2.0.9

Maine will now have a paid family leave tax for 2025. Employers are responsible for the contributions under the plan, but the plan allows the employer to require their employees to pay a portion of the paid family leave tax amount (refer to the website links below for more information). The Employer Portion of the Paid Family Leave will be tracked accrued under the ETT tax field in the PRCHECKS Table and the Employee withheld portion will be withheld using the SDI Tax field in the PRCHECKS Table.

Employee Family Leave (SDI)

G/L Account - A new G/L Account will need to be set up to track the paid family leave amounts that are deducted from the employee's paycheck. Be sure to set up this account even if you will NOT be withholding any portion of the Paid Family Leave tax from the employee.

Tax Rate - Enter the rate that you will be using for the employee's portion of the Paid Family Leave tax. NOTE: If your employees will NOT be contributing to the plan, then leave the rate set to zero.

Cutoff Limit - It appears from the Maine Website Link that the cutoff limit for the Paid Family Leave tax will be based on the social security cutoff limit. Please confirm with your CPA or company controller for setting up the proper cutoff limit. This cutoff limit will need to be updated as necessary at the start of each new calendar year.

Employer Family Leave (ETT)

G/L Account - A new G/L Account will need to be set up to track the family leave amounts that are accrued for the employer's portion of the Paid Family Leave tax.

Tax Rate - Enter the rate that you will be using for the employer's portion of the Paid Family Leave tax.

Cutoff Limit - It appears from the Maine Website Link for FAQs that the cutoff limit for the Paid Family Leave tax will be based on the social security cutoff limit. Please confirm with your CPA or company controller for setting up the proper cutoff limit. This cutoff limit will need to be updated as necessary at the start of each new calendar year.

Please refer to the Maine Website Links (below) for more details on the plan and check with your CPA or company controller for more guidance on how the plan rates should be set up for your company’s implementation of the new Family Leave Tax.

Paid Family and Medical Leave: MDOL: Paid Family and Medical Leave - https://www.maine.gov/paidleave/

Paid Family Leave FAQs: faqenglish.pdf - https://www.maine.gov/paidleave/docs/2024/faq/faqenglish.pdf

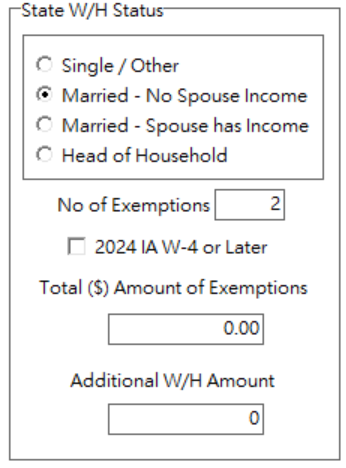

•ENHANCEMENT - Iowa Employee Exemption Settings 10.2.0.9

The Employee Center Screen has been updated with new withholding exemption settings for the state of Iowa that will be used for the new 2025 payroll tax calculations. These settings reflect recent changes in the Iowa W-4 form (IA W-4):

Marital Status: This setting now includes two options for the Married Status and a new option for Head of Household. In addition, there is a new Other option on the 2024 IA W-4 which will be used for the Single Status.

Import Note: Prior to this software release, the only options available were for Single or Married. If the employee was set to Single prior to this release, they will now be set to Single / Other. If the employee was set to Married prior to this release, they will now be set to Married - No Spouse Income. Be sure to review the new employee settings for Iowa before running the payroll for 2025 to make sure the proper tax calculations are done.

2024 IA W-4 or Later: This checkbox should be checked when the employee has filled out a new IA W-4 Form for 2024 or later. When this box is checked, the 2025 tax calculations will use the new Total ($) Amount of Exemptions for the employee deductions when computing the State Withholding tax amount. If this box is NOT checked, then the No of Exemptions entry times $40 will be used for the employee deductions for the State tax amount.

Total ($) Amount of Exemptions: If the employee has filled out a new IA W-4 Form for 2024 or later, then enter the amount from line 6 (Total allowances) of the IA W-4 Form.

SYSTEM ADMINISTRATOR

•ENHANCEMENT - New Advanced Settings

Use the File | System Administrator | Configuration menu option to access these settings:

•DisableDMIntegrityTest1 - 10.2.0.8 BLUE - This option is used to disable the Document Management Integrity Test Number 1 which checks for missing documents on disk.

•DisableDMIntegrityTest2 - 10.2.0.8 BLUE - This option is used to disable the Document Management Integrity Test Number 2 which checks for documents with missing indexes.

•EnableMARReportRunsInUserActivityLog - 10.2.0.8 Maroon - This option is used to enable the new MAR Report Activity logging process. Once this setting has been enabled, the AccuBuild system will start tracking audit details of the MAR Reports that are run by each user.

•EnableSQLBasedIntegrityTests - 10.2.0.8 AQUA - A new Advanced Setting has been added in order to enable SQL Based integrity tests which can be tailored for speed performance optimization on customers with large database tables containing millions of records. Currently these optimizations can be done for the Job Cost and the Accounts Payable Integrity Tests. Please contact AccuBuild Support for more information on implementing this feature.

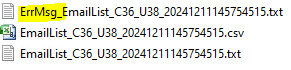

•EnableSendGridDirectDepositEmailAddressVerify - 10.2.0.9 - A new advanced setting is now available for companies that are using the SendGrid email feature for emailing Employee Direct Deposit Statements. The new setting will be used to enforce new business rules for employee emails on direct deposit statements. When this setting is enabled, the direct deposit statement will not be mailed if the employee email address in the employee file does match up with the employee number assigned to the direct deposit document. Important Note: It is strongly recommended that this Advanced Setting is enabled whenever the SendGrid email process is being used.

If an email is skipped during this process due to an invalid email, it will be logged in a new file located in the SendGrid folder under the AccuBuild Program Folder. The name for the new file will be the same name as the EmailList_file name but will be preceded with the ErrMsg_ letters as shown below:

If there are any skipped files due to invalid email addresses or blank email addresses, then the ErrMsg_EmailList file will be displayed to alert the user of any errors. If there are no errors, then this file will NOT be displayed.

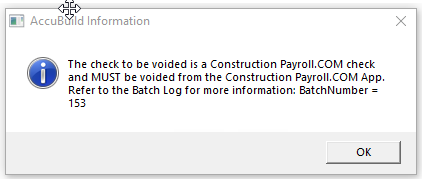

•Correction - Voiding Construction Payroll.COM AP Checks - 10.2.0.9

The AccuBuild System was allowing AP Checks created by the Construction Payroll.COM App to be voided with the Void AP check screen (Payables | Void Checks menu option). The system will now block these checks from being voided in AccuBuild provided the Advanced Setting entitled EnablePRBatchBackupForCPDotCOM is enabled.

All checks that are created in Construction Payroll.COM must be voided in the Construction Payroll.COM App and the voided check information will be posted to the AccuBuild System automatically. These checks are identified by the description in the Batch Log where the letters [CP] appear at the beginning of the batch description.

WARNING - If the EnablePRBatchBackupForCPDotCOM Advanced Setting is NOT enabled, the system will allow the check to be voided.

The following message will be displayed when a Construction Payroll.COM check is rejected by the void check option:

•Correction - Release Notes fix on AccuBuild Help Menu - 10.2.0.9

The Release Notes item on the AccuBuild Help menu was not working. This issue has been corrected.