Version 10.2.0.4 BLUE - 10/10/2022

Version 10.2.0.5 - 12/27/2022

2023 UPDATE FEES RELEASE

•Initial Software Release for 2023

| This update is the first software release for 2023 and will require that the 2023 Update Fees are current. AccuBuild Version 10.2.0.4 is the last update for the 2022 Update Fees renewal. Please contact AccuBuild Support for more information on update renewals. |

ACCUIMPORTER

•CORRECTION - Record creation for Sales Tax Record [PMID Ref No 9549] 10.2.0.4 Blue

The auto generated sales tax records for misc AR Invoices did not include the Sales Tax Description and the Sales Tax Liability account. This issue has been corrected in the Library Scrip

ACCOUNTS PAYABLE

•ENHANCEMENT - 1099 Processing for 2022 1099s

The Aatrix Integration has been updated for processing the 2022 1099 MISC and 1099 NEC Forms.

JOB COST

•ENHANCEMENT - Contract Billings - Job List Selection [PMNID Ref No 30489]

The job selection list for Contract Billings has been updated to only show open jobs. Closed jobs will no longer be included in the selection list. If you need to generate a contract billing on a closed job, you will need to set the job back to “open” status.

PAYROLL

•ENHANCEMENT - Payroll Tax Tables for 2022 [PMID Ref No 26289] Version 10.2.0.4

•Arkansas - The 2022 tax tables for Arksansas have been updated again for new rates and tax tables effective for October 2022. 10.2.0.4 Blue

•Indiana - The 2022 tax tables for Indiana have been updated for new tax tables effective for October 2022.

•Virginia - The 2022 tax tables for Virginia have been updated for new tax tables effective for October 2022.

•ENHANCEMENT - Payroll Tax Tables for 2023

•Arizona - new tax rates (percentages) for 2023

•California - new tax rates for 2023

•District of Columbia - new tax rates for 2023

•Indiana - Rate Changes

•County Tax Changes: Boone, Johnson, Knox, LaPorte, & Monroe

•State Tax Rate reduced to 3.15% for 2023

•Iowa - new tax rates for 2023

•Kentucky - new tax rates for 2023

•Maine - new tax rates for 2023

•Minnesota - new tax rates for 2023

•Mississippi - new tax rates for 2023

•Missouri - new tax rates for 2023

•Montana - new tax rates for 2023

•Nebraska - new tax rates for 2023

•New Mexico - new tax rates for 2023

•New York State - new tax rates for 2023

•New York - Yonkers City - new tax rates for 2023

•North Carolina - new tax rates for 2023

•North Dakota - new tax rates for 2023

•Oregon - new tax rates for 2023

•Rhode Island - new tax rates for 2023

•South Carolina - new tax rates for 2023

•Vermont - new tax rates for 2023

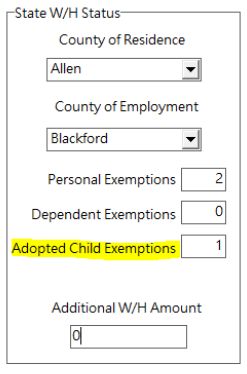

•ENHANCEMENT - Payroll Employee Center Screen Change for Indiana [PMID Ref No 26289] 10.2.0.4 Blue

The Employee State Exemptions settings have been updated for the state of Indiana. A new Adopted Child Exemptions field has been added and will now be used in the state withholding tax calculations for Indiana:

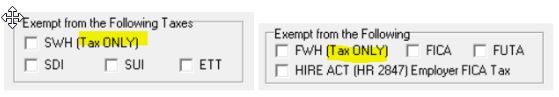

•ENHANCEMENT - Tax Exempt Settings for State and Federal Withholding [PMID Ref No 11731]

The tax exempt settings for Federal and State withholding taxes have been updated to change the calculation process in which these settings are now handled. If the SWH (Tax Only) or FWH (Tax Only) checkboxes are enabled (checked), only the tax amount will be set to zero but the subject wages will no longer be set to zero. Previously these settings would clear both the tax amount and the subject wages.

NOTE: This new change only affects these two taxes, all of the other tax exempt checkboxes will clear both the tax amount and the subject wages and these taxes include SDI, SUI, ETT, FICA, & FUTA.

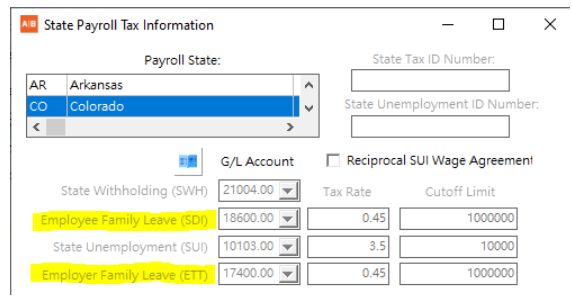

•ENHANCEMENT - Paid Family Leave Tax for Colorado for 2023

Colorado will now have a paid family leave tax for 2023. This tax is paid by both the employee and the employer and will be handled under the SDI Tax for the employee portion and the ETT tax for the employer portion. Please be sure to verify with your CPA or tax advisor for setting these tax amounts up if they apply to your company

IMPORTANT NOTE: Colorado has not issued any cutoff limit for the new Paid Family Leave Tax so you will want to set the limit high enough to exceed the highest wage earner in your company. For example, if all of your employees earn less than $1 Million per year, then you can set the cutoff limit to $1 Million. Please adjust as needed for your situation. These tax settings are set up in the State Payroll Tax Information Screen:

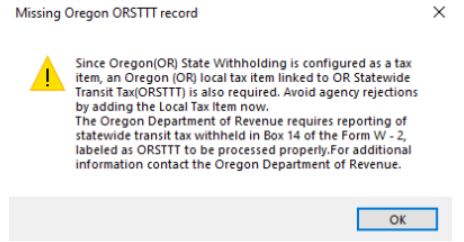

•ENHANCEMENT - Oregon Transit Tax

The state of Oregon has a Transit Tax that should be handled in AccuBuild as a local tax. The Aatrix tax forms system is now checking for these tax records when running payroll forms for Oregon. If you have employees working in Oregon who are subject to Oregon withholding taxes, then be sure to set up a local deduction as outlined below. If you have not set up this local deduction, then you may get the following error message when processing Aatrix Tax forms for Oregon:

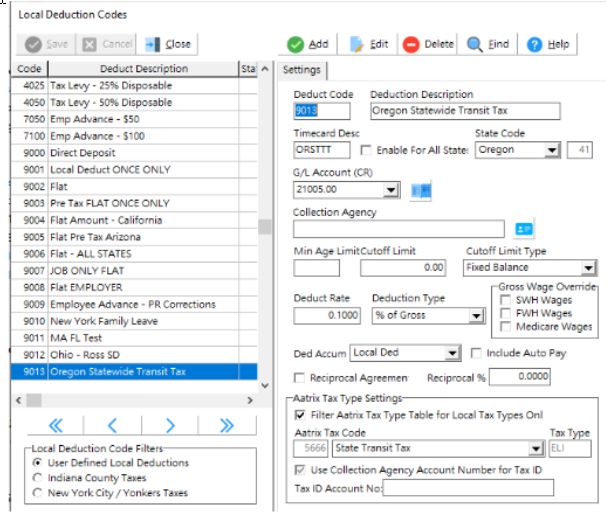

Oregon Transit Tax Local Deduction: Set up the local tax deduction as shown in the screenshot below (The Deduct Code will be assigned automatically). Be sure to set the local deduction for the state of Oregon ONLY and be sure to connect the local deduction to the Aatrix Tax Type (5666 - State Transit Tax) at the bottom of the screen under the Aatrix Tax Type Settings:

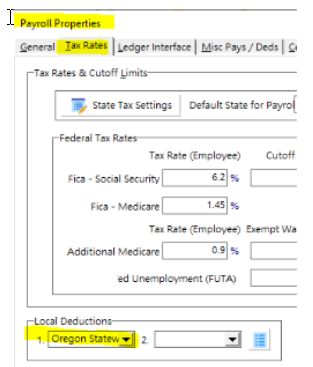

Once you have the local deduction set up, you will want to add the local deductions to any employees that will be working in Oregon on the employee list. If ALL of your employees work in Oregon, then you may want to consider adding the Local Deduction code under the Payroll Properties instead of on each employee. If the local deduction is set up under the Payroll Properties Screen (Tax Rates tab), it will be applied to ALL employees automatically:

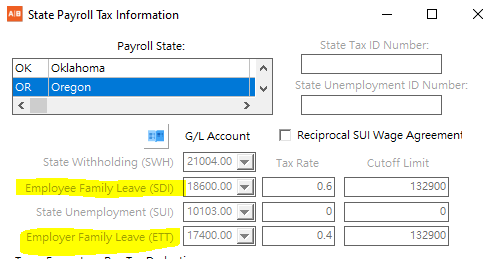

•ENHANCEMENT - Paid Family Leave Tax for Oregon for 2023

Oregon will now have a paid family leave tax for 2023. This tax is paid by both the employee and the employer and will be handled under the SDI Tax for the employee portion and the ETT tax for the employer portion. Please be sure to verify with your CPA or tax advisor for setting these tax amounts up if they apply to your company.

•CORRECTION - Payroll Employee Center Screen - Adding Employees [PMID Ref No 30754] 10.2.0.4 Blue

The Employee State Exemptions table was causing an exception error when adding a new employee if a blank record was found in the table. This issue was traced to a situation where the AccuBuild Program was terminated abnormally while a new employee was being added. The issue has been resolved by removing any blank records from the table when the employee screen is first opened.

•ENHANCEMENT - W2 Processing for 2022 W2s

oThe Aatrix Integration has been updated for processing the 2022 W2 forms.