The state of Vermont has a new Child Care tax effective July 1, 2024. Employers are required to pay a 0.44% payroll tax on all employee wages earned in Vermont. An employer may choose to deduct and withhold a maximum of 25 percent of the required contribution (i.e. 0.11%) from employee wages. Please see the Vermont Government Website for more information: https://tax.vermont.gov/business/child-care-contribution

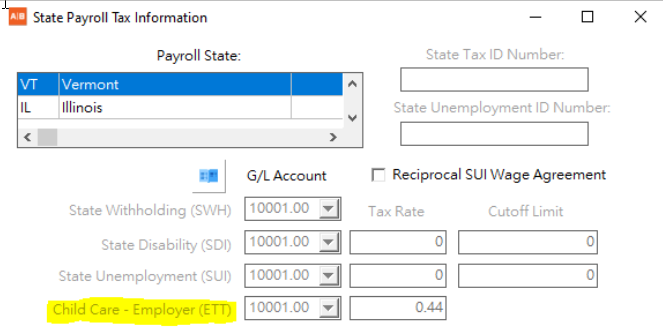

The employer tax for Child Care will be set up on the state tax settings screen for the state of Vermont as shown in the State Payroll Tax Information screenshot below. If you will be holding any child care amounts from individual employees, then you will need to set up a new local deduction code for the employee child care amount and then set up the local deduction on the employee screen for each employee that will have this deduction withheld from their paycheck:

Employer Setup: Set the tax rate up by selecting the state of Vermont in the Payroll State grid and updating the rate under the Child Care - Employer (ETT) Tax Rate setting. This tax is handled as the ETT Tax in the payroll check records which is considered an employer burden tax.

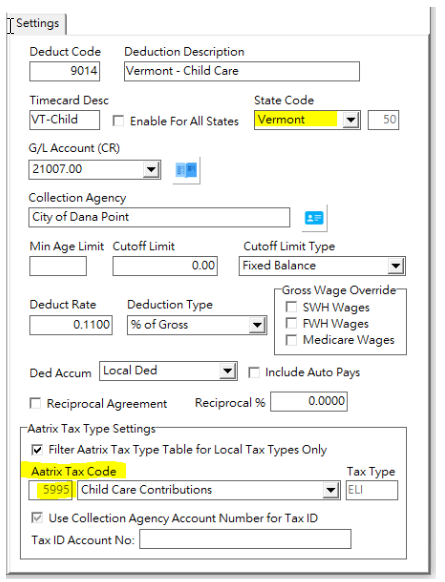

Local Deduction Setup: If you will be holding a deduction from the employee paychecks for the Child Care tax then you will need to set up a new local deduction code in the Local Deduction Codes screen as shown:

•Enable For All States: - Make sure this box is NOT checked.

•State Code: - Set the State Code to Vermont

•Aatrix Tax Code: - Link the local deduction to the Aatrix tax code 5995 which represents the employee's amount of child care tax.

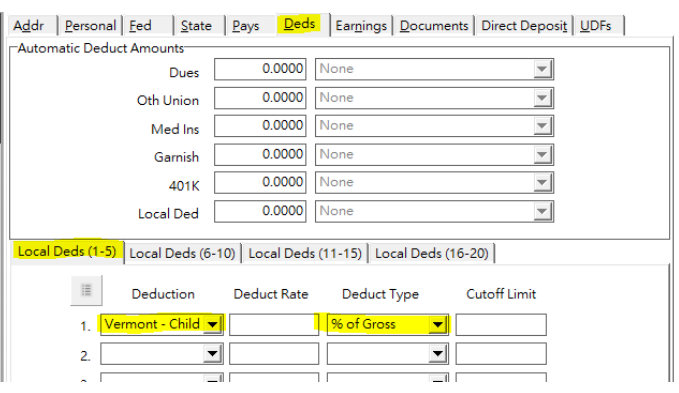

Employee Deduction Setup: If you will be holding a deduction from the employee paychecks for the Child Care tax then you will need to add the local deduction to each employee that will be paying the child care tax: