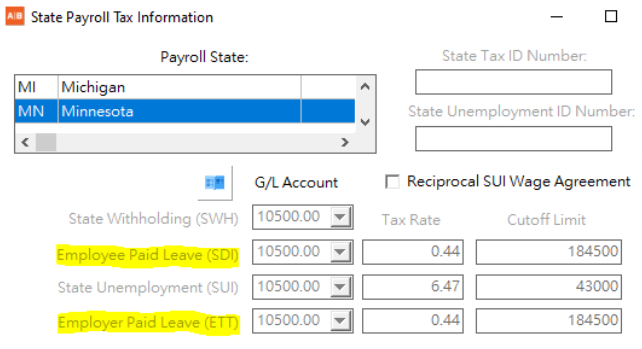

Minnesota - Effective January 1, 2026, Minnesota will now have a paid leave tax for 2026. The premium rate for 2026 will be 0.88% which can be split between the employer and the employee. Employers are responsible for 50% of the contributions under the plan, but the Act allows the employer to require their employees to pay up to (but no more than) half of their contributions as per the Minnesota website links below. The Employer Portion of the Paid Leave will be tracked accrued under the ETT tax field in the PRCHECKS Table and the Employee portion will be withheld using the SDI Tax field in the PRCHECKS Table.

Employee Family Leave (SDI)

G/L Account - A new G/L Account will need to be set up to track the paid leave amounts that are deducted from the employee's paycheck. Be sure to set up this account even if you will NOT be withholding any portion of the Paid Leave tax from the employee.

Tax Rate - Enter the rate that you will be using for the employee's portion of the Paid Leave tax. NOTE: If your employees will NOT be contributing to the plan, then leave the rate set to zero.

Cutoff Limit - It appears from the Minnesota Website Link that the cutoff limit for the Paid Leave tax will be based on the social security cutoff limit. Please confirm with your CPA or company controller for setting up the proper cutoff limit. This cutoff limit will need to be updated as necessary at the start of each new calendar year.

Employer Family Leave (ETT)

G/L Account - A new G/L Account will need to be set up to track the family leave amounts that are accrued for the employer's portion of the Paid Leave tax.

Tax Rate - Enter the rate that you will be using for the employer's portion of the Paid Leave tax.

Cutoff Limit - It appears from the Minnesota Website Link that the cutoff limit for the Paid Leave tax will be based on the social security cutoff limit. Please confirm with your CPA or company controller for setting up the proper cutoff limit. This cutoff limit will need to be updated as necessary atht estart of each new calendar year.

Minnesota Website Link:

Please refer to this link https://paidleave.mn.gov/ for more details on the plan and check with your CPA or company controller for more guidance on how the plan rates should be set up for your company's implementation of the new Paid Leave Tax.