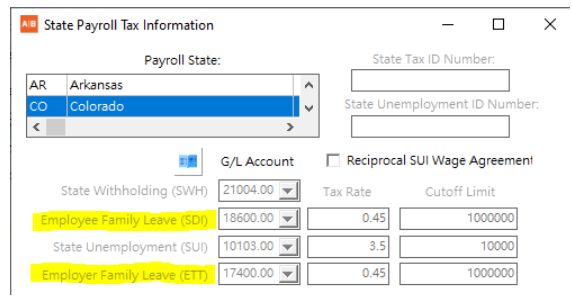

Colorado introduced the paid family leave tax in 2023. This tax is paid by both the employee and the employer and will be handled under the SDI Tax for the employee portion and the ETT tax for the employer portion. Please be sure to verify with your CPA or tax adviser for setting up these tax amounts if they apply to your company.

IMPORTANT NOTE: Colorado has not issued any cutoff limit for the new Paid Family Leave Tax so you will want to set the limit high enough to exceed the highest wage earner in your company. For example, if all of your employees earn less than $1 Million per year, then you can set the cutoff limit to $1 Million. Please adjust as needed for your situation. These tax settings are set up in the State Payroll Tax Information Screen: