County Taxes

•Oregon requires the employer to pay county taxes based on a percentage of wages. The workers comp codes can be used to represent each county and then linked to each job on the Update Jobs > Payroll Controls Tab. This way, the county taxes can be accrued with each time card entry. Keep in mind that the workers comp rate is based on $100 of gross wages so the rate must be entered accordingly. Be sure to note that the Workers Comp Accrual account field on the Payroll Properties Screen must be set up to represent the county tax accrual account.

If you do not wish to accrue the county taxes in the manner listed above, then the Detail Report by Job report in the Payroll system could be used on a partial run basis for jobs that fall within a selected county in order to get the gross wage exposure and to calculate the total tax amount. A general journal entry or an accounts payable invoice can be entered to create the accrual and to expense the appropriate jobs.

Workers Compensation Insurance

•Oregon's workers compensation insurance is currently based on $ 0.015 per hour and for the employer and employee. The employee's portion can be set up as a local deduction based on an hourly rate with the local deduction report being used to recap the withheld amounts. The employer portion cannot be accrued as burden through normal workers comp insurance codes as these calculations are based on a percentage of gross.

The union codes may be used to accrue the employer portion for workers comp, however the burden amount will be accrued to union benefits payable instead of workers comp payable and the amount will be included on the union reports. The accrual is not substantial and will not hurt job costing totals if it is missing. For example, 100 employees at 40 hours per week would only amount to $60.00 of employer burden so it is not extremely critical to accrue this amount.

Oregon Transit Tax

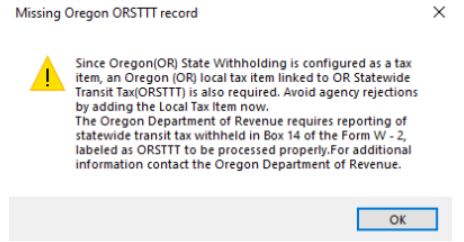

•The state of Oregon has a Transit Tax that must be handled in AccuBuild as a local tax. The Aatrix tax forms system is checking for these tax records when running payroll forms for Oregon. If you have employees working in Oregon who are subject to Oregon withholding taxes, then be sure to set up a local deduction as outlined below. If you have not set up this local deduction, then you may get the following error message when processing Aatrix Tax forms for Oregon:

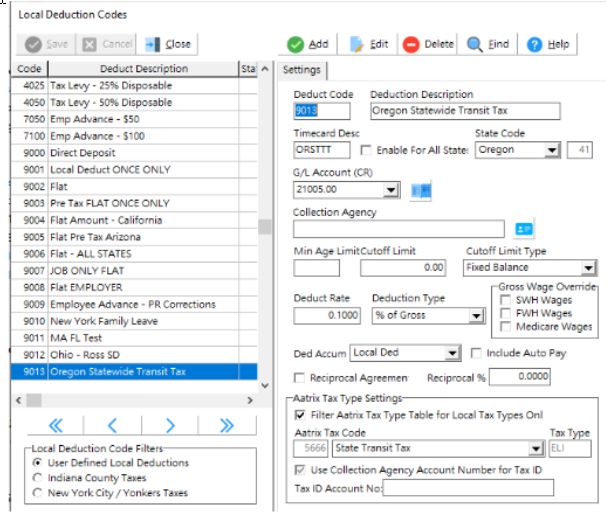

Oregon Transit Tax Local Deduction: Set up the local tax deduction as shown in the image below. (The Deduct Code will be assigned automatically). Be sure to set the local deduction for the state of Oregon ONLY and be sure to connect the local deduction to the Aatrix Tax Type (5666 - State Transit Tax) at the bottom of the screen under the Aatrix Tax Type Settings:

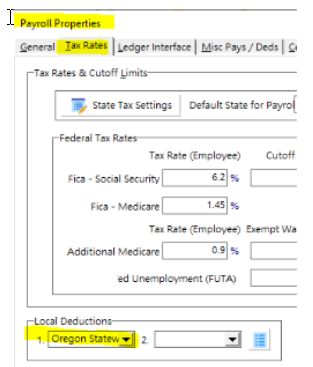

Once you have the local deduction set up, you will want to add the local deductions to any employees that will be working in Oregon on the employee list. If ALL of your employees work in Oregon, then you may want to consider adding the Local Deduction code under the Payroll Properties instead of on each employee. If the local deduction is set up under the Payroll Properties Screen (Tax Rates tab), it will be applied to ALL employees automatically: