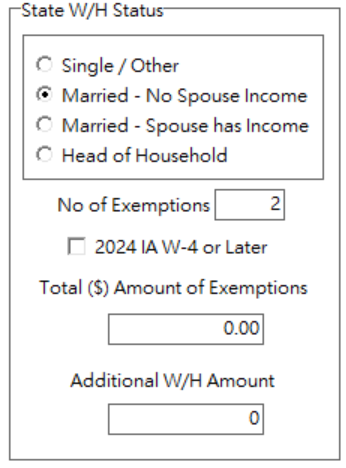

The Employee Center Screen has been updated with new withholding exemption settings for the state of Iowa that will be used for the new 2025 payroll tax calculations. These settings reflect recent changes in the Iowa W-4 form (IA W-4):

Marital Status: This setting now includes two options for the Married Status and a new option for Head of Household. In addition, there is a new Other option on the 2024 IA W-4 which will be used for the Single Status.